The first after-hour profile is Applied Material (AMAT). In the screen shot below we see that AMAT has a market capitalization of $18.3 billion. During market hours on August 5th, we see that the stock traded down by 1.51% or $0.21. Over the last 3 months, AMAT has had average daily volume of 21 million shares.

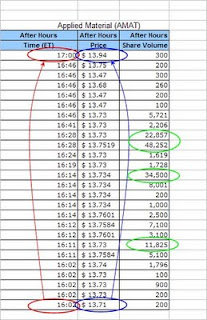

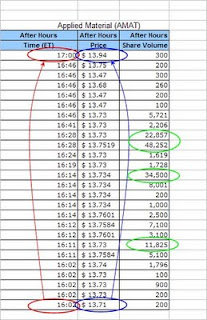

In the screen shot below, we see that in after-hour trading AMAT traded up by exactly $0.21 bringing the price right back to where it started in the beginning of the day. Notice that during the after-hour trading it took only 160,000 shares to offset 12,303,994 shares traded during regular hours. Also notice that four trades equaled 73% of the total after-hour volume.

What I'd like to know is this, who is holding 48,252 worth of AMAT shares valued at $663,465? Why does anyone who owns so many shares try to sell them at a time when they wouldn't likely get the best price available? Who is matching up these trades?

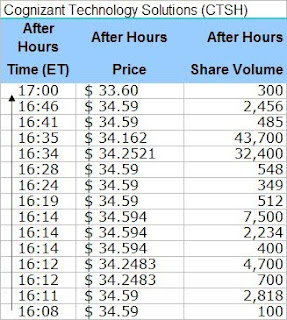

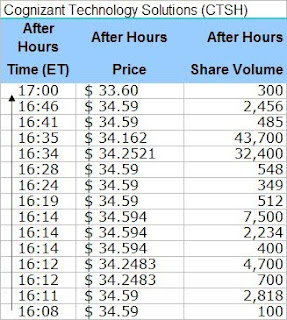

Next up is Cognizant Technology Solutions (CTSH). Below we see that CTSH traded up by $0.99 on trading volume of 9,503,064.

However, during after-hour session we can see that CTSH trades back down by $0.99. It only took 99,202 shares to get the price exactly back to where it started earlier in the day.

Again, notice that someone with 43,700 shares worth $1,468,966 decided that after-hours was the best time to unload the shares. Not to be outdone, someone else with 32,400 shares valued at $1,109,768 feels like getting rid of their shares.

Conclusion

From my experience routing trades to the floor of the NYSE in the mid-90's, these transactions are suspect. After all, who would try to unload so many shares without disrupting the market price. In the case of Cognizant Solutions, the 43,700 shares sold was 44% of all after-hour trading. such a large proportion of trading volume would normally spike the price up or down dramatically. Strangely, there was someone willing to obtain the odd number of shares after-hours. This is a highly unusual transaction for so many shares at a time when the market is so illiquid. In fact, most of the

After Hours Activity that I have posted show similar patterns.

My suspicion is that institution(s) are accumulating short/long positions as the price of the stock rises during the regular hours. Once the market closes, the same institution sell/buy the shares to/from themselves or a related party. Additionally, options for the stock could have been purchased, sold or written in anticipation of the expected change in price after-hours. This is definitely something that is worth investigating further to determine how these transactions are being carried out. Not to mention the fact that the shares are rising and falling by exactly the opposite amount that took place during regular market hours.

Sources:

However, during after-hour session we can see that CTSH trades back down by $0.99. It only took 99,202 shares to get the price exactly back to where it started earlier in the day.

However, during after-hour session we can see that CTSH trades back down by $0.99. It only took 99,202 shares to get the price exactly back to where it started earlier in the day.  Again, notice that someone with 43,700 shares worth $1,468,966 decided that after-hours was the best time to unload the shares. Not to be outdone, someone else with 32,400 shares valued at $1,109,768 feels like getting rid of their shares.

Again, notice that someone with 43,700 shares worth $1,468,966 decided that after-hours was the best time to unload the shares. Not to be outdone, someone else with 32,400 shares valued at $1,109,768 feels like getting rid of their shares.