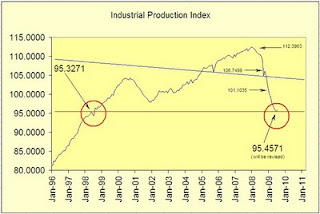

In looking at the movement of the index, I dismissed the peak of 95.3271 on May 1998 and the trough of July 1998 as a significant technical support/resistance level for the index. This appears to be a critical oversight since the June 2009 low in the IPI at 95.4571 appears to have created a temporary support level. Even though the difference between 97.8399 and 95.4571 is only 2.32%, I feel it is necessary to identify this issue in my analysis as a potential learning opportunity.

Now for the shameless self-promotion, in my January 27, 2009 analysis of the IPI index, I said, "Based on this most recent move the IPI is expected to decline at least to the December 2001 level of 97.8399." This observation was about as accurate as you could get. Additionally, I said, “…we're in for at least another six months of declines in the IPI.” This assessment was off by 1 month which isn't bad. As mentioned before, the IPI hit a temporary bottom in June 2009. Some folks who snicker at the thought of technical analysis being applied to an economic indicator that isn’t even a critical component of the U.S. economy have every right to question the method. However, the fruitless effort, in this instance, “seems” to have been useful.

Finally, let’s look at where I think the IPI index is possibly going from here. In the 90-year history of the reporting of the IPI, there has been only one declining period in which the index had temporarily gone up and then down more than once (fake out.) We’ve already had one fake out of the index when it sharply rose in October of 2008 and then continued downward. I don’t see (revealing my limitations) this index falling below the current trough of 95.4571 until it does a Dow Theory retrace of at least one, and possibly all three, of the following upside targets:

-

101.1035

-

106.7499

-

112.3963

Implicit in my discussion of the IPI is that we are at a turning point for the economy. Based on the combination of the Dow Theory confirmation of July 23, 2009 and the IPI turning up from the June low, I will have to guess that the National Bureau of Economic Research (NBER) is going to proclaim June 2009 as the official end to the recession. The end to this recession will be lackluster and questioned from all corners. Additionally, the stock market will only follow the pattern of a cyclical bull market (bear market rally) within a secular (long term) bear market. I doubt that the general public will agree that the recession is over since jobs will not be as plentiful as the past. However, from the standpoint of an economist the recession is over provided the IPI June low is sustained over an extended period of time.

Again, the IPI index generally lags the stock market by 6 to 9 months. Therefore, the index could continue to rise while the stock market has reversed to the downside. We’ll have to see just how much the most recent trough remains in place.Touc.

Monday's Article:

Dow Theory

One response to “Industrial Production Index”