The question of retaining profits on quality dividend companies through the selling of a position seems to counter the whole point of dividend investing. After all, aren’t you supposed to allow the dividends to compound? In a small way, we described one approach and our rational for selling quality companies after small gains in yesterday’s article (Our Primary Concern: Retaining Profits).

However, there is another way to view the rationale behind selling a dividend stock after a “fair profit.” In the early years of the Dow Theory Letters, Richard Russell would often cite a Robert Rhea quote about the impact of a stock decline. Rhea said:

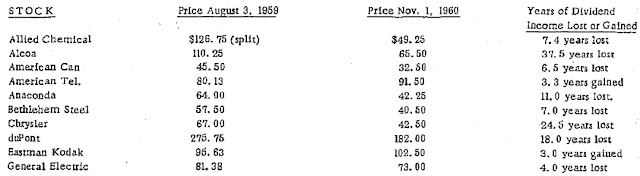

“’Buying in bear markets is merely gambling and not very good gambling at that. Why not have cash instead of investments in bear markets? Why insist that one cannot afford to forego investment income when one day’s price shrinkage may cancel several years’ dividends?’”

|

| Source: Richard Russell, Dow Theory Letters, http://www.dowtheoryletters.com/ |

Because stocks are not required to return principal with a stated yield as with many bonds, there is no assurance that the price will recover to the level that a purchase was initiated. Therefore, receiving short-term income on a dividend stock, although a necessary source of income for retired individuals, the prospect exists that an investor could end up with only a portion of the principal instead of the intended income plus principal.

The lack of assurance of principal and income with dividend stocks is why we believe people have become disenfranchised with technology stocks like Microsoft (MSFT) and Cisco Systems (CSCO). If they’ve invested in the stocks with the belief that they’re in it forever, when the decline comes, absent any dividend, there is little recourse or hope of recovering lost funds or keeping up with inflation.

Even new investors to Microsoft and Cisco Systems, aware of their bold promises in 1999 and subsequent failure to deliver in 2011, are asking themselves, “is it really worth facing the prospect of no return?” These questions are being asked when in some instances, especially with Microsoft, the timing probably couldn’t be better (especially now that they’re paying a dividend). Our supplementary comments on Microsoft can be found here.

While we subscribe to the Graham/Buffett principles of investing (buying for the long-term, you’re buying a business, concentrate on values, etc.) we assume that since there are only a handful of billionaires hewn strictly from investing in stocks, we might do well to hedge our thinking and strategy.

Finally, further analysis of Robert Rhea’s claim on not being invested at all during bear markets is something that is at odds with Charles Dow and we’ve decided is not appropriate or necessary. From our experience, bear markets are no guarantee of losses in your portfolio. Charles H. Dow, founder of the Wall Street Journal, has said that:

"Even in a bear market, this method of trading will usually be found safe, although the profits taken should be less because of the liability of weak spots breaking out and checking the general rise."

Schultz, Harry D., A Treasury of Wall Street Wisdom, Investors' Press, (New Jersey, 1966). p. 12. Additional commentary here.

Evidence of the fact that bear markets don’t always equal destruction of wealth, while going long stocks, is demonstrated in our 2007, 2008 and 2009 performance review. Naturally, 2008 is not expected to be replicated (having gains, while going long only, during a market decline of 40% or more). However, we do know that being all in or timing the market to be all out during bear markets shouldn’t be the goal. The goal, from our perspective, should be the preservation of gains whenever possible.