| Symbol | Name | Price | % Yr Low | P/E | EPS (ttm) | Dividend | Yield | Payout Ratio |

| MDP | Meredith Corp. | 29.36 | -0.05% | 10.30 | 2.85 | 1.02 | 3.47% | 36% |

| ANAT | American National Insurance | 76.58 | 0.37% | 12.96 | 5.91 | 3.08 | 4.02% | 52% |

| WABC | Westamerica BanCorp. | 48.57 | 0.39% | 15.52 | 3.13 | 1.44 | 2.96% | 46% |

| MCY | Mercury General Corp. | 38.7 | 1.45% | 14.23 | 2.72 | 2.40 | 6.20% | 88% |

| GBCI | Glacier BanCorp., Inc. | 13.12 | 2.22% | 22.24 | 0.59 | 0.52 | 3.96% | 88% |

| TCB | TCF Financial Corp. | 13.05 | 2.55% | 13.18 | 0.99 | 0.20 | 1.53% | 20% |

| HGIC | Harleysville Group Inc. | 30.72 | 2.71% | 11.01 | 2.79 | 1.44 | 4.69% | 52% |

| SFNC | Simmons First National Corp. | 25.15 | 2.72% | 11.70 | 2.15 | 0.76 | 3.02% | 35% |

| TDS | Telephone and Data Systems | 30.18 | 2.84% | 23.22 | 1.30 | 0.47 | 1.56% | 36% |

| AFL | AFLAC Inc. | 46.21 | 3.08% | 10.41 | 4.44 | 1.20 | 2.60% | 27% |

| UVV | Universal Corp. | 37.14 | 3.16% | 6.85 | 5.42 | 1.92 | 5.17% | 35% |

| BRK-A | Berkshire Hathaway Inc. CL 'A' | 115,750 | 3.37% | 17.59 | 6580.82 | N/A | N/A | N/A |

| SYBT | S.Y. BanCorp., Inc. | 23.35 | 3.62% | 13.65 | 1.71 | 0.72 | 3.08% | 42% |

| STBA | S&T BanCorp., Inc. | 17.61 | 5.04% | 15.18 | 1.16 | 0.60 | 3.41% | 52% |

| CMA | Comerica, Inc. | 33.78 | 5.31% | 18.56 | 1.82 | 0.40 | 1.18% | 22% |

| PEP | PepsiCo Inc. | 65.76 | 5.50% | 17.58 | 3.74 | 2.06 | 3.13% | 55% |

| AVY | Avery Dennison Corp. | 33.69 | 5.66% | 11.70 | 2.88 | 1.00 | 2.97% | 35% |

| ALL | Allstate Corp. | 28.69 | 5.73% | 11.71 | 2.45 | 0.84 | 2.93% | 34% |

| NTRS | Northern Trust Corp. | 45.92 | 5.81% | 16.94 | 2.71 | 1.12 | 2.44% | 41% |

| NWN | Northwest Natural Gas Co. | 46.62 | 5.96% | 17.79 | 2.62 | 1.74 | 3.73% | 66% |

| CHFC | Chemical Financial Corp. | 19.1 | 6.30% | 17.36 | 1.10 | 0.80 | 4.19% | 73% |

| SUSQ | Susquehanna Bancshares, Inc. | 7.9 | 6.95% | 46.47 | 0.17 | 0.08 | 1.01% | 47% |

| SCG | SCANA Corporation | 40.54 | 7.06% | 13.65 | 2.97 | 1.94 | 4.79% | 65% |

| CINF | Cincinnati Financial Corp. | 28.4 | 7.14% | 12.51 | 2.27 | 1.60 | 5.63% | 70% |

| BOH | Bank of Hawaii Corp. | 46.35 | 7.33% | 12.91 | 3.59 | 1.80 | 3.88% | 50% |

| BXS | BanCorp.South Inc. | 12.49 | 7.62% | 78.06 | 0.16 | 0.04 | 0.32% | 25% |

| GS | Goldman Sachs Group, Inc. | 135.49 | 7.66% | 14.84 | 9.13 | 1.40 | 1.03% | 15% |

| PRK | Park National Corp. | 63.95 | 7.76% | 14.18 | 4.51 | 3.76 | 5.88% | 83% |

| SON | Sonoco Products Co. | 32.94 | 8.36% | 16.15 | 2.04 | 1.16 | 3.52% | 57% |

| PG | Procter & Gamble Co. | 64.25 | 8.62% | 16.91 | 3.80 | 2.10 | 3.27% | 55% |

| WMT | Wal-Mart Stores, Inc. | 54.52 | 8.74% | 11.90 | 4.58 | 1.46 | 2.68% | 32% |

| BKH | Black Hills Corp. | 30.84 | 8.90% | 18.80 | 1.64 | 1.46 | 4.73% | 89% |

| AVP | Avon Products, Inc. | 28.69 | 9.16% | 17.71 | 1.62 | 0.92 | 3.21% | 57% |

| LLTC | Linear Technology Corp. | 31.27 | 9.25% | 13.25 | 2.36 | 0.96 | 3.07% | 41% |

| CTL | CenturyTel, Inc. | 38.66 | 9.57% | 12.97 | 2.98 | 2.90 | 7.50% | 97% |

| CFR | Cullen/Frost Bankers, Inc. | 55.77 | 9.72% | 15.93 | 3.50 | 1.84 | 3.30% | 53% |

| MLM | Martin Marietta Materials, Inc. | 79.16 | 9.77% | 35.18 | 2.25 | 1.60 | 2.02% | 71% |

| FII | Federated Investors Inc | 22.18 | 9.89% | 13.28 | 1.67 | 0.96 | 4.33% | 57% |

| C | Citigroup Inc | 40.26 | 10.42% | 13.16 | 3.06 | 0.04 | 0.10% | 1% |

| 39 Companies | ||||||||

Watch List Summary

There is a noticeably large number of insurance and financial companies on our list. This may be because of the foreign debt situation in Greece or the possibility of a debt ceiling impass. Further analysis would have to be done but it appears that this sector is out of favor and worth investigating.

On the top of our list is Meredith (MDP), a major player in the media sector. While the Murdoch scandal seems to casts a pall over the sector, Meredith has emerged to be in good shape financially. The company earned $2.85 in the last 12 months and is paying $1.02 in dividends. Next year earnings are expected to come in at $2.68 which would not jeopardize the dividend payment in our view. Historically, MDP is considered undervalued with a dividend yield of 1.3% thus the current yield of 3.47% suggests that the stock could double in due time. The company will report its quarterly earning on July 28th.

American National Insurance (ANAT) is no stranger to the NLO team. This life insurer trades at a 55% discount to its book value and offers a hefty 4% dividend yield. With the payout ratio at 50%, earnings will need to drop substantially for the company to consider cutting, halting or borrowing to pay the dividend. Anyone interested in this stock should be aware that it is a highly illiquid stock. The average volume based on the last three months is merely 21,000. Friday's volume for ANAT was 12,150. American National Insurance has been trading in a line formation or consolidation for a year and any move, up or down, could set the trend for the stock.

Another stock hitting our radar is Pepsico (PEP). Pepsi reported higher profits but scaled back on their guidance which took down the stock. Pepsi's yield is slightly above 3% making the stock worth looking into. Historically, Pepsi trades between 2.2% and 1.2% so a 3% yield would imply that this company is undervalued by as much as 40%.

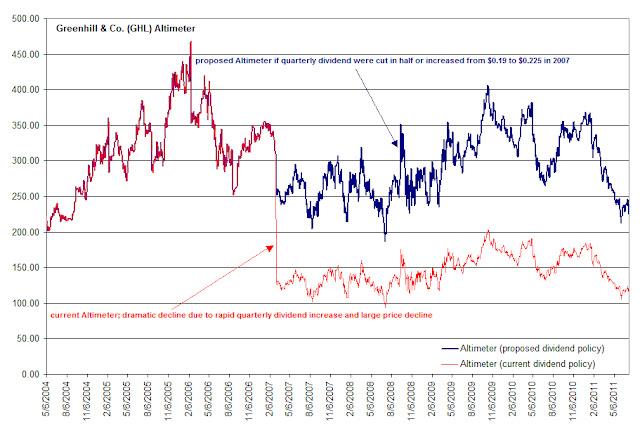

Stock Highlight: Greenhill & Co. (GHL)

Top Five Performance Review

| Symbol | Name | 2010 Price | 2011 Price | % change |

| BEC | Beckman Coulter, Inc. | 47.26 | 83.5 | 76.68% |

| JNJ | Johnson & Johnson | 57.63 | 66.72 | 15.77% |

| FRS | Frisch's Restaurants, Inc | 19.99 | 22.4 | 12.06% |

| XRAY | DENTSPLY International | 29.26 | 39.54 | 35.13% |

| WST | West Pharmaceutical | 35.41 | 46.45 | 31.18% |

| Average | 34.16% | |||

| DJI | Dow Jones Industrial | 10,424.62 | 12,681.16 | 21.65% |

| SPX | S&P 500 | 1,102.66 | 1,345.02 | 21.98% |

Disclaimer: