Back on 8/24/09, I wrote about Warren Buffett and his view on equity investment during inflationary time. Today write up offers an extended commentary and example of the situation.

Why Moderate Inflation is Beneficial

Let's assume you are an owner of a basketball team. You've just picked up a great young player and decided to sign him for a 5 years contract for $5 million per year (cost). You have a fixed cost of $25 million. It's now time to sell tickets (revenue). You do not fixed your ticket price. Every year, you raise them by inflation rate. As a result, your revenue increase at a faster pace than your cost which is fixed!

I understand that not all business is set up like a sports team, but most business operate using fixed cost model and thus the Fed try to target a moderate inflation rate.

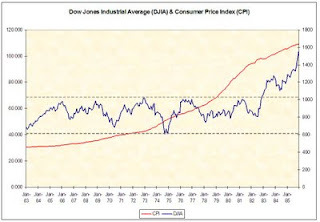

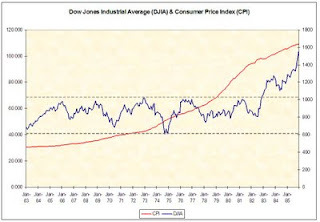

What happen when stock price stay stagnant or trade in a range for years while economy slowly improve? Value are being created! Price stagnant while earning begin slowly improve. Market now become cheaper every year as earning slowly begin to improve because of moderate inflation. At some point, earning exceed a certain threshold creating an undervalued market which attracts buyers. This creates the beginning of bull market. The chart below shows the Dow plot against CPI.

You can see that the Dow did nothing until it broke to the upside in 1982.

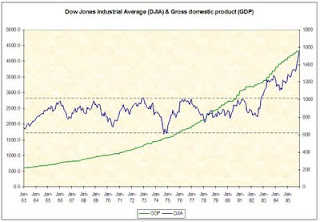

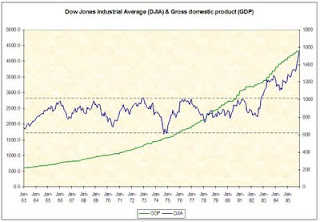

Another illustration is when I compare the Dow to the GDP. Think of the Dow as the Price (P) then using GDP as the earning (E) of our entire economy. What you have is a P/E of our entire economy. The chart below shows that the Dow fluctuated while GDP rose slowly.

As are result, this is why our government wants inflation. However, the government cannot control the stock market. The market will move up with the right value is established. Most notable range is from 4%-6% dividend yield on the Dow. During the Great Depression, yield reached 10%. The Dow reached 4% yield during the March low and is now sitting around 3% yield.

2 responses to “Inflation and Equity Investors”