On Friday April 9, 2010, the Dow Jones Industrials and the Dow Jones Transportation Averages both moved to new highs at the same time. According to Dow Theory, this confirmation by both averages would indicate that the market has more room to go on the upside before a change of direction is to take place.

The path to this bull market confirmation (within a secular bear market) has been a battle with many casualties. The last week had many examples to demonstrate this point. On April 5th, the Industrials broke to a new closing high however the Transports did not confirm. On April 6th, the Transports broke to a new high but the Industrials did not confirm. On April 8th, the Transports broke above the high that was established on April 6th however the Industrials could not exceed the previous high of 10,973.55 set on April 5th. April 9th finally cleared the air on the much needed confirmation of the market's trend.

The factors that are in favor of the continuation of the bull market are that the Industrials and Transports are 50% above their respective 2007 to 2009 declines. Additionally, prior declines within secular bear markets like 1906 to 1924 or 1966 to 1982 have had many retrenchments of 80% to 100% before falling back to the old lows. So far, the Industrials have recouped 58.42% of the previous decline. If the Industrials were to retrace a classic Dow Theory 2/3 of the previous decline, the index could go to 11,574.59 with no problem.

However, the tepid nature of the gains that led to the new highs along with the lackluster volume that has accompanied the move up from the March 9, 2009 low doesn’t seem to encourage confidence in the direction. More alarming is the fact that we are not near historical levels of under-valuation in the market in general. The Dow Industrials currently has a dividend yield of 2.48% when the long-term average high yield is around 6%. Also of concern is that the Dow Fair Value is at 6.92 times the dividend yield. This is contrasted with the 1.52x that is normally associated with great buying opportunities.

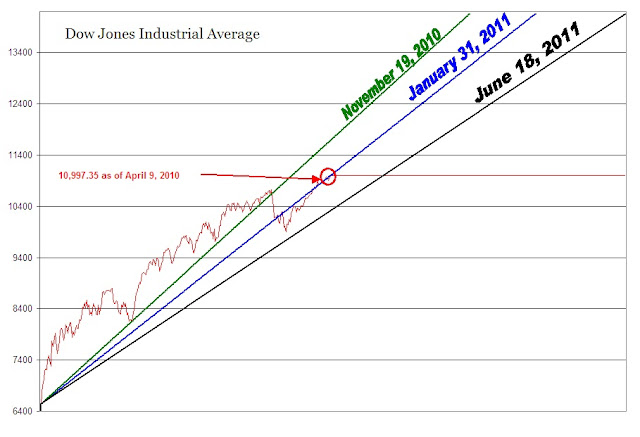

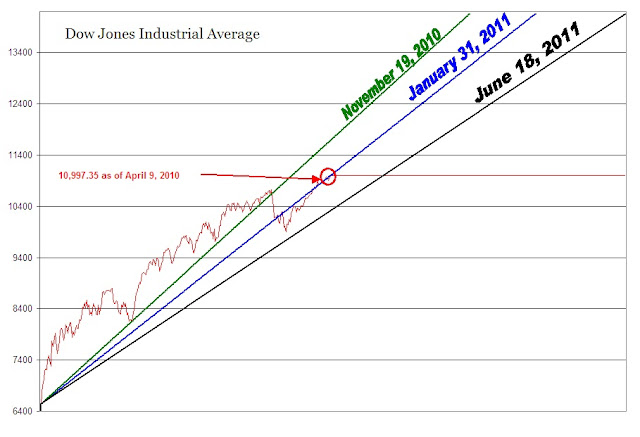

The former editor of the Wall Street Journal and Dow Theorist William Peter Hamilton once said, “the wish must never be allowed to father the thought.” For this reason, we will take a wait and see approach to the market going forward. However, until proven otherwise, we are on a march back to Dow 14,164.53, which was set on October 9, 2007. In anticipation of the rise to the old market high, we have illustrated, in the chart below, three upside scenarios for the Dow Industrials.

The first projection (green line) assumes that the Industrials will continue the torrid pace set from March 9, 2009 to January 19, 2010. The likelihood of the index continuing at such a pace is not expected. However, in the book Charles H. Dow: Economist by George W. Bishop, Jr., it is noted that, according to Charles Dow, there are two stages to a bull market in stocks and that the second stage is more bullish than the first stage. This contrasts sharply with Robert Rhea and William Peter Hamilton’s assertion that there are three stages to every bull and bear market. If we are in the transition to the “second and final” stage of this bull run then it is possible for the market to continue on, and possibly exceed, the first trajectory that was previously set. The projected date that the Dow would reach 14,164.53 is November 19, 2010.

The second projection (blue line) is based on the March 9, 2009 to April 9, 2010 action on the Dow Jones Industrials. This pace seems more realistic than the first projection since it assumes a less dramatic increase in the index. To think that the market could continue moving higher as it had in the past would be quite unrealistic. Based on the current trajectory the Dow would reach the old high by January 31, 2011.

Finally, the third projection (black line) is based on the current trend being the mean and the first projection being the high end of the range. The third projection is a mirror of the first. The third trajectory would reach the old high by June 18, 2011.

Although we have a clear bull market confirmation (within the context of a secular bear market) it is necessary to determine where the downside targets should be. According to Dow’s Theory the following are the targets for a subsequent decline:

In addition to the normal downside targets, there is the prospect that if the Dow falls below the imaginary third projection level (black line), then all bets are off. From the current Dow Theory confirmation, if the index cannot retains the level of 10,997.53 beyond July 15, 2010, then the market should have a major correction shortly thereafter.

Reaching the old high is all within the context of a normal secular bear market. The tendency is for the market to get to the old high and then quickly wipe out the notion that a new secular bull market is about to begin. This is the nature of a secular bear market.

Useful References:

- "Will the Market Continue Beyond January's Highs" on SeekingAlpha.com

- "Stock Market Projections" on SeekingAlpha.com

- "The Importance of Market Perspective" on SeekingAlpha.com

- Bishop, George W., Charles H. Dow: Economist, Dow Jones Books (New Jersey, 1967), p. 20.

- Rhea, Robert, The Dow Theory, Barron's (New York, 1932), p. 26.