An article titled “Apple-less Dow faces changes to make-up,” found in the Financial Times, suggests that the current owners responsible for the composition of the Dow Industrials are considering ways to make it possible to add Apple (AAPL) to the 116-year old index. The myopic view of changing the Dow Industrials simply for the purpose of adding AAPL will haunt the index managers and investors alike.

In the past, the changes in the composition of the Dow have been ill-timed to begin with. In our article titled "Dow Jones' Decline Largely Impacted by Index Changes," we highlight the fact that composition changes routinely negatively impacted the Dow Industrials. Additionally, we have demonstrated that the changes to the Dow Industrials from 1929 to 1932 was the sole contributor to the decline of the index by -89%, when compared to the Barron's 50 Index in the same time frame.

In a follow-up article titled “After the Crash, Recovery was Faster Than Most People Think” we show how the irresponsible changes to the Dow Industrials from 1929 to 1932 was the reason for the index to take 25 years to get back to the 1929 high.

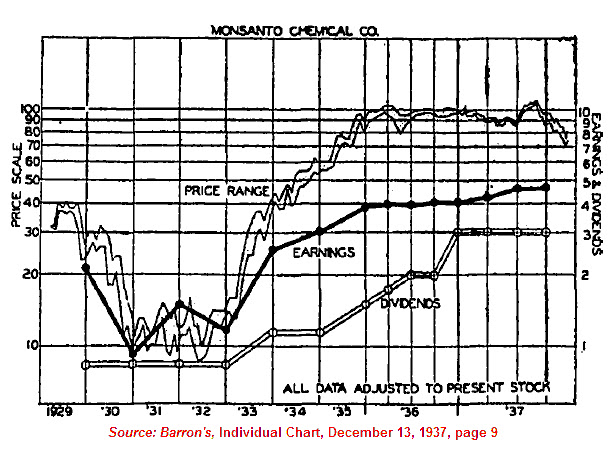

We’ve shown that many high quality stocks (the purpose of the Dow Industrials is to represent “high quality” stocks) were able to reach their 1929 high in 8-9 years instead of 25 years like with the Dow Industrials (as reflected in the Monsanto Chart below). The extended delay in getting back to the prior high was due solely to a losing trader's mentality of buying high and selling low applied to addition and subtractions to the Dow Industrials.

The recent addition of Unitedhealth Group (UNH) to the Dow Industrial Average, replacing Kraft Foods (KFT) exemplifies the "buy" high mentality of those who manage the index. United Health is being added after nearly 215% gains in the stock since the March 2009 low. This compares to "only" a 100% gain in Kraft Foods since the same starting point, see chart below.

To emphasize our point, since the March 9, 2009 low, the following are the major index returns:

-

NYSE Composite: +98.22%

-

Dow Industrials: +107.41%

-

S&P 500: +115.98%

-

Dow Tranports: +128.74% (does not contain AAPL)

-

Russell 2000: +149.23% (does not contain AAPL)

-

Nasdaq Composite: +150.66%

As the theory goes, the performance of a well diversified index should achieve moderate gains and moderate declines. The Dow Industrials have performed as though it was a well diversified index, rather than one composed of only 30 companies. On the flip side of the diversification theory, a highly concentrated portfolio should have higher volatility both up and down. For a sense of perspective, the Russell 2000 does not contain Apple while the Nasdaq Composite does. The absence of Apple in the Russell index did not inhibit its ability to effectively match the performance of the Nasdaq Composite.

As we’ve pointed out in our article titled “Broader Market And Dow Theory Suggest Proceeding With Caution,” if the Value Line Geometric Index is any indication, broad participation of the rise from 2009 is faltering (see chart below).

This is a warning that the narrow focus on a few companies at the top (based strictly on market cap) is going to collapse upon itself or more focus on values not related to the largest cap stocks is necessary. Market history suggests that broad based equal-weighted indexes that don't make new highs is the canary in the coal mine. Anyone seeking Apple’s (AAPL) inclusion to the Dow Industrials are fated to repeat the mistakes of the past with unsurprising outcomes to follow.