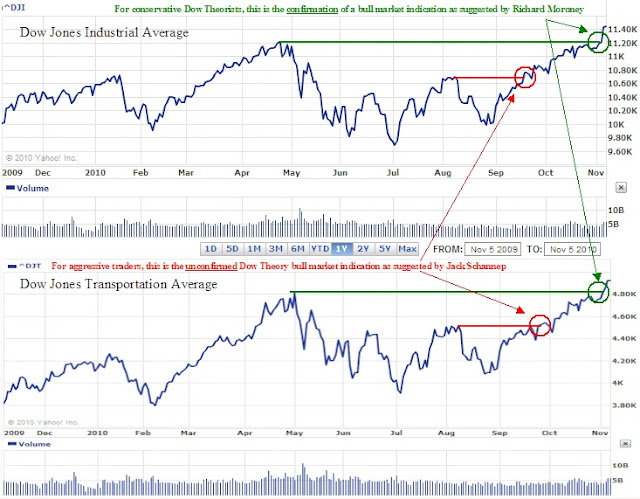

1. Part of the confusion might be that Mr. Schannep gave a SELL signal on 30 Jun 10 -- that articlle of yours seems to have been published that very day, while the 2nd sentence implies that it was written the previous day. Therefore, the next signal would have to be BUY, which came 27 Sep 10.

Is it possible you missed the 30 Jun 10 signal?

Also, your 7 Nov 10 article implies a "bull market indication" on 24 Jun 09 -- I'm not sure what that means, but as a historical note, Schannep gave a BUY signal on 9 Apr 09.

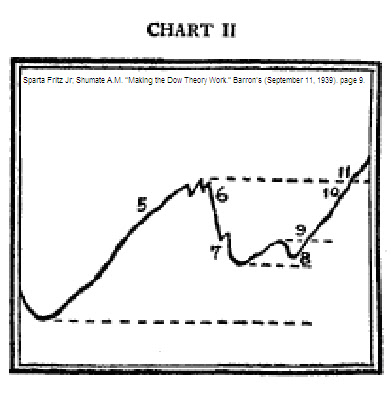

2. Regarding Dow Theory analysis: At its simplest, my understanding is that a market move must meet rather basic criteria for time and distance, as noted on page 18 (examples follow) of the book, with caveats.

A secondary reaction move, after a primary market high or low must be about 3% -- enough to allow ONE index to recover at least 3%; ONE index -- but not both -- may exceed the previous high or low. It must take at least two weeks to reach that point, which sets a "mark" (peak or trough). After which, when BOTH indicies exceeds their "mark", there is a Dow Theory Signal -- a change in trend, turn of the tide, etc.

So, the market picture for 2010 was:

DJI: High on 26 Apr, reaction mark on 7 Jun, bounce on 18 Jun, SELL signal on 30 Jun.

DJT: High on 3 May, reaction mark on 7 Jun, bounce on 15 Jun, SELL signal 30 Jun.

I've omitted SPX, since you folks seem to be somewhat "purist". However, I might suggest a review of the Dow Theory section of "Technical Analysis of Stock Trends (9th Edition)", page 24 in particular. As the basis for Dow's Theory is market movement, it should be reflected in -- or at least agree with -- movement in such a large index. In addition, merely because it did not exist when Dow, Nelson, Hamilton or Rhea were alive does not merit exclusion from consideration. Deliberately ignoring it, as Russell and Moroney do, may be akin to using Ptolemy to critique Copernicus.

The previous caveats mentioned are threefold:

1. Schannep rigorously defines Bull and Bear markets as a 19% rise/16% drop from low/high (those are reciprocal) on page 86. Therefore, they serve as a "trailing stop", should Dow Theory not give a signal.

2. Schannep also defines "capitulation" on page 90 (10% drop below 10 week average) as a drop significant enough to warrant shortening the two-week timeframe to one week, for a BUY signal.

3. The bounce after a reaction must occur over more than one day; thus the 27 May 10 bounce was not valid.

Hope that is helpful.

Our Response:

It is definitely possible that we could have missed the June 30 sell signal. However, Let us try to prove that our understanding of Dow Theory is correct.

First, there is the issue of the primary trend. No primary trend stops and then re-starts only two months apart. This goes back to the issue that you’ve mentioned about the timing of a call. Such a short period of time between bull or bear market calls is a tip-off that a false signal had to have been triggered on June 30, 2010. A review of the primary trend from Rhea, Hamilton, Nelson, Russell and Schaefer is in order on that point.

Second, Dow Theory is all about confirmations. No matter which source that is used, there was not a confirmation of the decline to the same supports levels in the Transportation and Industrial Averages for the Feb. 5th and Feb. 7th. This is very significant because the exact same confirmation of both the Industrials and Transports was used to re-issue a buy indication on November 3 by Mr. Schannep. Although it should be said that Mr. Schannep used the S&P and the Industrials which gave a “buy” only a couple days ahead of the standard Transports and Industrials signal. Was it worth the extra days advance notice? Absolutely, if you’re already out of the market. However, Hamilton, Rhea and Russell are very clear on the risk of jumping the gun on bull and bear market signals without accurate confirmation.

In our November 4th “analysis” we were specific in indicating that we chose to opt for the sure fire call instead of the earlier call on September 27th when the markets broke above the line. Again, if the call for a “buy” signal can wait 4.73% for the sure-fire confirmation of the bull market or “buy” signal then we’ll opt for the most conservative route.

The whole premise of Dow Theory is about following the steps as outlined by Nelson and further elaborated on by Hamilton and Rhea. When E. George Schaefer proposed the 50% principal, he didn’t create something that wasn’t already a part of Dow Theory. Schaefer only highlighted an aspect that others may have taken for granted or overlooked. Adding elements that didn’t exist may seem to bring the concept of Dow Theory out of the dark ages. However, there are specific aspects that Schannep has introduced that are not consistent with Dow Theory.

Third, the introduction of the S&P 500 as a valid index to track is erroneous in that it assumes that there is an advantage by introducing the index. Since the S&P 500 was created in 1957, all data prior to 1957 is modeled on a 100% correlation to the Dow Jones Industrial Average. This means that movement in the index would have mirrored the Dow industrials which is impossible now and therefore could not possibly happen before 1957. This means that all insightful examination of price movements of the S&P 500 before 1957 is useless.

There is evidence to suggest that in the period from 1929-1932, data from the Barron’s 50 index actually declined by only 78% instead of the Dow Industrials’ 89% reflecting that human judgment related to changed in the index impacted the outcome of the decline. Without the S&P 500 being in existence at the time there is no way to test this theory. We covered the topic of changes Dow Industrial Average and their impact from 1929 to 1932 in our article titled “Dow Jones’ Decline Largely Impacted by Index Changes” and “After the Crash of 1929, Recovery was Quick.”

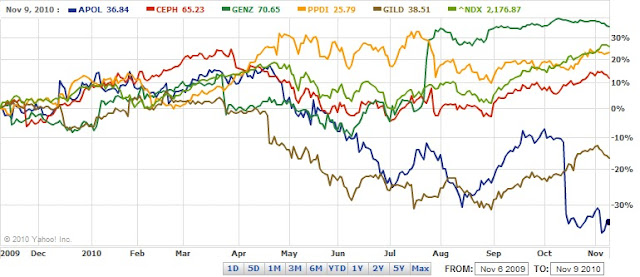

In addition, the current beta on the movement between the Dow Industrials and S&P 500 is only occasionally at 1 or 99.9% correlated. In any instance that there isn’t a correlation it is in the favor of the Industrials. This defies logic since any index of stocks with only 30 companies should fall by a greater magnitude and rise by a greater magnitude than an index of 500 companies. If you use the Yahoo!Finance interactive charting, you will find that during almost any period since 1970, the Dow Industrials fell less than, and rose more than, the S&P 500. Although this isn’t true for every period it is true for the majority (80/20) of periods selected especially if you pick periods further out in time to the present. This means that signals gained by one index will not be the same with another index.

We’ve already shown that there is a problem with the belief that a broader index provides more accuracy and stability in the markets in our article titled “Diversification Doesn’t Matter.” In fact, we’ve done a recent update on this data and have found that the Dow Industrials have exceed the performance of the S&P 500 in the 5-year, 3-year, 1-year, and YTD categories. In addition, the 2008 performance of the Dow Industrials fell less than the S&P 500 which defies the point of having a diversified index.

The net result of sticking to an index that existed over an extended period of time is that people of today can test the validity of the claims made by Dow Theorists in the past. If we cannot test the theory on a continuous index then we would not be able to prove or disprove the accuracy of the claims. Being able to prove the claims of people in far flung eras allow for us to give credence to the facts.

Our next issue is the introduction of Edwards and McGee’s classic book Technical Analysis of Stock Trends (9th edition). The use of such a source is unfortunate since it is not the source. The source for Dow Theory is from books published by Russell, Schaefer, Greiner, Shumate, Fritz, Dow, Nelson, Hamilton, Rhea, Olmerod, Collins and Raeder. All of the aforementioned are Dow Theorists first. Although a great book, Technical Analysis of Stock Trends is not an authoritative source for considered understanding on Dow Theory even though they correctly say that "...Dow Theory is the granddaddy of all technical market studies."

Schannep’s definitions of a bull and bear market and the parameters that are set around such definitions are probably useful and profitable. However, it is probable that we’re talking about Schannep’s theory instead of Dow’s theory. I don’t mind that Schannep has his own way of accounting for bull and bear markets. However, Dow Theory is usually much more simplified than what has been proposed by Schannep.

As mentioned before, your understanding of Schannep’s work is far greater than ours. This gives you the benefit of knowing, in our opinion, one more approach on the topic than we have. We couldn’t claim to be Dow purists since we’ve only opted for the method that seems the simplest.

We hope our response has added food for thought and thank you for your contribution to Schannep’s work. As a subscriber to Schannep’s service, you are a credit to his efforts and thank you for your time spent explaining his philosophy.