A reader writes:

In a recent Time Magazine article dated July 27, 2010, David Rosenberg said the following:

"…But the market gets it wrong as often as it gets it right – it was wrong to forecast a recession in the fall of 1987, again in the summer of 1998 and again in the winter of 2003. It was wrong to forecast sustained growth in the summer of 2000, a recovery in the winter of 2002, an avoidance of recession in the fall of 2007 and the end of the downturn in the spring of 2008. It may be a discounting mechanism, but the stock market has a spotty record – let's remind ourselves of that."

Does this mean that the Dow Theory was not giving the right signals for the stock market during all the periods Rosenberg mentions above? Can you tell me what was Russell saying with regards to the stock market's and the economy's trend as forecasted by the Dow Theory during those periods?

To put it another way, there are two separate issues involved here:

-

First, does the Dow Theory correctly forecast the bull/bear trend reversals in the stock market? (Answer seems yes, though with a considerable lag.)

-

Second, does the stock market correctly forecast recoveries/recessions in the economy? (Some say No!)

Our Response:

To address the preceding questions, we’ll first cover the role of Dow Theory from our perspective. Then we’ll address the aspect of modern usage of Dow Theory from the leading proponents with the widest following. Then we’ll circle round to address Dow Theory and how to make it useful regardless of its obvious shortcomings. We’ll address Richard Russell’s take on Dow Theory and what he was saying about the market using Dow Theory. We’ll make comments on David Rosenberg’s assessment that the stock market “…gets it wrong as often as it gets it right” by comparing the periods of recession with the Dow Jones Industrial Average.

When thinking in terms of Dow Theory, the New Low Observer team doesn’t take the conventional view on how it should be used. To us, Dow Theory isn’t a market forecasting tool as much as it is an allocation indicator. When there is a bull market indication then we have a target allocation of 33% or more for a single stock. When there is a bear market indication then we have a target allocation of 25% or less for an individual stock.

Some take Dow Theory too seriously and extrapolate far beyond even the most rudimentary use and allow it to become a make or break approach for buying or selling stocks. The most useful, but least understood, element of Dow Theory is Charles Dow’s discussion of values. Subsequent writing on the topic of values, in the context of Dow Theory, by Nelson, Hamilton, Rhea, Collins, Shumate, Schaefer, Russell and Schennep are worth heaps more than any successful market call of a top or bottom. In fact, the Dow Theory understanding of values trumps all market signals since great values can exist in both bull and bear markets.

Aside from ignoring the emphasis on values, the two most common mistakes that are made when thinking about Dow Theory are misinterpretation and misapplication. Accurate interpretation is the primary goal of every Dow Theorist. However, it becomes easy to get overwhelmed with current market conditions. This makes the acceptance of what the indicator is saying very challenging. Front load a few personal experiences from the “Great” Depression and WWII and it become impossible to see the market from the trees. Renowned Dow Theorist Robert Rhea once cautioned those trying to interpret the markets (especially Dow Theory) that, “the wish must not father the thought.” In many cases, it becomes too easy for the wish to supercede the judgment of markets.

The linked article written on June 16, 2010 on MarketWatch.com titled “

Avoiding a Death Sentence” by Mark Hulbert provides a perfect example of misinterpretation and misapplication when trying to use Dow Theory. We get misapplication by trying to recommend selling stocks based on the misinterpretation of a potential bear market indication.

In the article, Hulbert highlights opinions on Dow Theory from the most prominent Dow Theorists today starting with Richard Russell, Jack Schannep and Richard Moroney. The basic view in the article was that the stock market was grasping at the last straws of a bull market and it was only a matter of time before a sell signal would to be given.

Richard Russell was the only one of the three Dow Theorists who was unwavering in his view that a sell signal had already been registered. The article quotes Russell as saying that, “the curse is cast. …[The breaking of the May lows] means that the primary bear market is resuming. The monster is creeping towards Bethlehem.”

Schannep and Moroney seemed to be in agreement that a violation of the June 7th low would be what they needed to see in order for them to officially declare that a sell signal had been indicated, according to Dow Theory. As it happens, the June 7th lows were violated for both the Dow Industrials and Dow Transports (on a closing basis) which means that both Dow Theorists would have given sell recommendations to their newsletter subscribers.

The misinterpretation of Dow Theory that was executed by these three theorists was a function of two distinct issues. First, there wasn’t a focus on prior action as suggest by Charles H. Dow. Our May 13th article on Dow Theory outlined the specific action that should be watched for prior to the occurrence based on the Dow Industrials movement from January 19th to February 5th. The next item that was misinterpreted was the May 6th “flash crash.” The fact that the Dow Industrials and Dow Transports had similar closing lows of May 6th made the otherwise technically significant closing price unimportant in comparison to the intra-day low. The intra-day low reflected either the psychological influence needed to fall as much as it did or the psychological influence needed to recover from such a low.

These are the factors that I think contributed to the misinterpretation of the signals given. Some Dow Theorists have said that because they take an arms length approach to the market (i.e. not invested personally in stocks) that their interpretation is not clouded by the desires for financial gain. However, those same Dow Theorists manage to get it wrong just as often as anybody else.

Next is the issue of the misapplication of Dow Theory. William Peter Hamilton was correct in titling his book on Dow Theory

The Stock Market Barometer. Like a weather barometer, Dow Theory was intended to be a guide to the direction of the market on a short-term basis. The readings from a weather barometer tell you to either bring an umbrella or leave it at home. The barometer never tells you to stay at home if it is going to rain. Telling investors that a bear market has been signaled and therefore you need to sell all or some of your stocks is the equivalent of saying, “its going to rain today, you’d better stay home.”

Again, Dow Theory wasn’t intended to generate a buy or sell indication. Instead, it was created to tell investors what the current conditions of the market are with a 3-month, 6-month, or 9-month peek at what might lay ahead. If the indication is that we’re in a bear market then we could expect that the market will decline further. If the indication is that we’re in a bull market then we could expect that the market will rise. What an investor does with this information is something else altogether. In many respects, buy and sell reactions based on Dow Theory bull and bear market indications are misapplications of the theory.

Throughout the writings by Rhea and Hamilton, it has been noted that Dow Theory is not a “get rich quick” way to make money in the stock market. Neither is the theory infallible. Because misinterpretation of Dow Theory is so easy to accomplish, the New Low Observer team attempts to focus more attention on values and the application of Dow Theory as an asset allocation tool rather than being right about the big picture or primary trend.

When you combine the effects of misinterpretation with misapplication by some of the most renowned Dow Theorists, it is no wonder that critics complain that Dow Theory is archaic. However, put in its proper context, observations in Dow Theory can provide better judgment in selecting individual stocks at appropriate times with proper allocations. Although Dow Theory generally gets it right about the stock market direction on a short term basis, I personally wouldn’t rely on the market calls as much as I do with Dow’s writings on values.

Like most market participants, we don’t necessarily know values in the way that someone as smart as Warren Buffett might. However, everyone is clear on the fact that well established companies with consistent dividend increasing histories near a new 52-week low are most likely to be closer to “real” value propositions instead of stocks in a well established rising trend or at a new high. Charles Dow was very clear that values, above all else, determine the direction of the market. This includes the values that can be found within a bull or bear market.

In regards to Richard Russell’s commentary on Dow Theory, it is necessary to take Russell’s bias into account when determining whether he was wrong or right about the markets in 1987, 2000, 2002, 2003, 2007, and 2008. Russell’s bias is infinitely and always to the downside and this bias has grown as time has passed. This is what makes his late 1974, early 1975 call of a market bottom so amazing and worth studying.

Despite being right at the time, it is next to impossible to say whether Russell truly called the tops of 1987, 2000, 2007, and 2008 or was continuing with his downside bias (false positives). However, what we can gather from each call of a market top are the nuances that are very distinct from the other times that Russell was bearish. You’d have to read all of his letters from the beginning of a rising market to the peak to know the distinctions.

How biased against the upside is Richard Russell, despite what Dow Theory and his proprietary Primary Trend Indicator says? The following quote should summarize Russell’s attitude.

“In his latest mailing, Steve [Leuthold] talks about secular bear markets. What’s a secular bear market? They are the really big ones. Steve tells us that the dictionary defines secular as ‘coming once in an age.’ Steve Leuthold says that in 46 years in this business, he has only seen two secular bear markets, the bear market of 1969 to 1974, and the bear market of 1999 to 2002. Fair enough. But I disagree. Writing at the time, I called the bear market as starting in 1966, not 1969, but Steve and I both agree that the secular bear market ended with the crushing market collapse of 1973-1974. We both agree that another secular bear market began in 1999. Steve believes that bear market ended in 2002. But I believe the bear market that started in 1999 is still in force, although it’s been extended due to the manipulations of the Federal Reserve under Alan Greenspan.”

Even though the market bottomed in October 2002 and Dow Theory signaled a bull market in June 2003, Russell stuck to his bearish view. In his July 19, 2006 letter, Russell said, “The Big, Big Picture is this-the bear market that began in January 2000 never ended.” Russell did not indicate that we were in a bull market until January 2009. Russell managed to ignore the Dow Theory signal that was given in June 2003 at around the 9000 level for the Dow Industrials all the way to the peak in 2007 at 14,100. A span of 4 years and 55% wasn’t enough to convince Russell that the last bear market had ended. As I mentioned before, out of the blue we got the January 2009 bull market call by Russell, which seemed, at the time, to defy all available data and logic.

The comment posed by David Rosenberg, in the July 27th issue of Time Magazine, “that the markets continuously get it wrong,” is certainly a matter of subjectivity. Rosenberg’s assessment could be very accurate if viewed from the perspective that the popular media outlet’s parade of talking heads, representing the voice of the market, got it all wrong beforehand. However, if viewed from a Dow Theory perspective, especially in retrospect, the message that the market was sending was very clear and quite accurate, albeit somewhat delayed. Naturally, Dow Theory isn’t perfect but the consistency, as compared to the alternatives, is enough to give a general overview of future market activity that is later support by some, not necessarily all, economic indicators.

To be specific with Rosenberg’s contention, let us get the data portion on recessions during secular bull and bear markets out of the way. Below is a side-by-side comparison of the National Bureau of Economic Research (NBER) account of economic peaks to troughs (recessions) and the Dow Jones Industrial Average of peaks to troughs (bear markets).

| Peak |

Trough |

DJIA peak |

DJIA trough |

DJIA % change |

Coincidence |

| June 1899(III) |

December 1900 (IV) |

4/4/1899 |

6/23/1900 |

-29.40% |

YES |

| September 1902(IV) |

August 1904 (III) |

9/19/1902 |

11/9/1903 |

-37.80% |

YES |

| May 1907(II) |

June 1908 (II) |

1/19/1906 |

11/15/1907 |

-48.50% |

YES |

| January 1910(I) |

January 1912 (IV) |

11/19/1909 |

7/26/1910 |

-26.80% |

YES |

| January 1913(I) |

December 1914 (IV) |

9/30/1912 |

12/24/1914 |

-43.50% |

YES |

| August 1918(III) |

March 1919 (I) |

no coincidence |

no coincidence |

no coincidence |

NO |

| January 1920(I) |

July 1921 (III) |

11/3/1919 |

8/24/1921 |

-46.60% |

YES |

| May 1923(II) |

July 1924 (III) |

10/14/1922 |

7/31/1923 |

-16.00% |

YES |

| October 1926(III) |

November 1927 (IV) |

no coincidence |

no coincidence |

no coincidence |

NO |

| August 1929(III) |

March 1933 (I) |

9/12/1929 |

7/8/1932 |

-89.20% |

YES |

| May 1937(II) |

June 1938 (II) |

3/10/1937 |

3/31/1938 |

-49.10% |

YES |

| February 1945(I) |

October 1945 (IV) |

no coincidence |

no coincidence |

no coincidence |

NO |

| November 1948(IV) |

October 1949 (IV) |

6/15/1948 |

6/13/1949 |

-16.30% |

YES |

| July 1953(II) |

May 1954 (II) |

1/5/1953 |

9/14/1953 |

-13.00% |

YES |

| August 1957(III) |

April 1958 (II) |

4/6/1956 |

10/22/1957 |

-19.40% |

YES |

| April 1960(II) |

February 1961 (I) |

8/3/1959 |

10/25/1960 |

-16.50% |

YES |

| December 1969(IV) |

November 1970 (IV) |

12/3/1968 |

5/26/1970 |

-35.90% |

YES |

| November 1973(IV) |

March 1975 (I) |

5/26/1972 |

10/4/1974 |

-39.80% |

YES |

| January 1980(I) |

July 1980 (III) |

no coincidence |

no coincidence |

no coincidence |

NO |

| July 1981(III) |

November 1982 (IV) |

4/27/1981 |

8/12/1982 |

-24.10% |

YES |

| July 1990(III) |

March1991(I) |

10/9/1989 |

10/11/1990 |

-15.30% |

YES |

| March 2001(I) |

November2001 (IV) |

1/14/2000 |

10/10/2002 |

-35.75% |

YES |

| December 2007 (IV) |

no trough announced |

10/9/2007 |

3/9/2009 |

-53.38% |

YES |

For the sake of all the economists out there, we will only view stock market declines with recessions as a coincidence indicator. We cannot know when a sustained market decline is a simple correction or an indicator of a coming recession. However, in the table above, we can see that 19 out of 24 occurrences of a recession were led, or accompanied, by a decline in the stock market. The far right column indicates if there was no coincidence or an/or the percentage change of the market when there was coincidence.

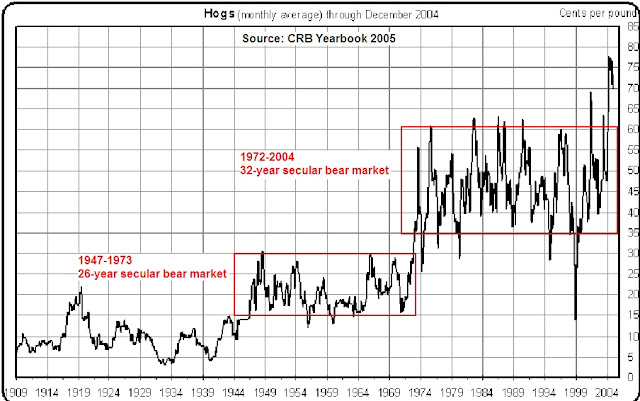

I’m willing to submit to the view that the answer to this question is yes, stock markets lead or coincided with economic contractions. However, the nature of the recover may not meet the expectations of some, if not many, of the participants of the economy in question. During a secular bear market, the frequency and length of recessions will be longer and occur more often than during a secular bull market. The opposite is true during a secular bull market.

It is important to note that the designation of a recession often occurs months and sometimes year(s) after the fact. For example, the indication of the December 2007 recession was given by the NBER exactly one year later. At the same time, the coincidence of the market corresponding with or leading a recession has occurred in real time. Dow Theory gave a confirmed indication of a bear market in the month of December 2007.

During a secular bear market, only certain aspects of the economy will experience growth while other elements will continue to wane or hold in a range. The recession from 2007 to 2009 is just such an example. Housing and employment has not “enjoyed” the tepid growth in the economy that has occurred since the March 2009 bottom. The government has had a crowding out effect with preferential stimulus in housing and jobs, which has only prolonged the uncertainty of the “real” numbers in foreclosures and unemployment. After all, why pay your mortgage when there is a program set up to keep you in the house? Why take any old job when you could hold out for that “ideal” job because you’re getting another extension of unemployment benefits? These aren’t artificial attributes of the rising stock market and economy as some Austrian economists argue. Instead, stimulus and printing of money simply adds to the complexity within an overall secular bear market.

During a secular bull market, the impact of a recession will not be as deep or broad in its scope or as long as in a secular bear market. Most elements in the economy will thrive despite a build up of otherwise dire conditions (which result in severe recessions and bear markets). One industry’s fall will not impair the breadth of the economy. Corruption and scandal, in business and politics, is looked upon as isolated incidents. There is less of a demand for a complete change of the entire system when problems are revealed. Cyclical bear markets within a bull market allow for a healthy purging of excesses and reinforce the view that prior excesses were justified somehow.

Sources: