Members

-

Topics

Archives

-

-

Recent Posts

-

-

-

Investor Education

Market Return After Exceptional Years

Dollar Cost Averaging Tool

Dow Theory: The Formation of a Line

Dividend Capture Strategy Analysis

Golden Cross – How Golden Is It?

Debunked – Death Cross

Work Smart, Not Hard

Charles H. Dow, Father of Value Investing

It's All About the Dividends

Dow Theory: Buying in Scales

How to Avoid Losses

When Dividends are Canceled

Cyclical and Secular Markets

Inflation Proof Myth

What is Fair Value?

Issues with P-E Ratios

Beware of Gold Dividends

Gold Standard Myth

Lagging Gold Stocks?

No Sophisticated Investors

Dollar down, Gold up?

Problems with Market Share

Aim for Annualized Returns

Anatomy of Bear Market Trade

Don’t Use Stop Orders

How to Value Earnings

Low Yields, Big Gains

Set Limits, Gain More

Ex-Dividend Dates -

-

Historical Data

1290-1950: Price Index

1670-2012: Inflation Rate

1790-1947: Wholesale Price Cycle

1795-1973: Real Estate Cycle

1800-1965: U.S. Yields

1834-1928: U.S. Stock Index

1835-2019: Booms and Busts

1846-1895: Gold/Silver Value

1853-2019: Recession/Depression Index

1860-1907: Most Active Stock Average

1870-2033: Real Estate Cycles

1871-2020: Market Dividend Yield

1875-1940: St. Louis Rents

1876-1934: Credit-New Dwellings

1896-1925: Inflation-Stocks

1897-2019: Sentiment Index

1900-1903: Dow Theory

1900-1923: Cigars and Cigarettes

1900-2019: Silver/Dow Ratio

1901-2019: YoY DJIA

1903-1907: Dow Theory

1906-1932: Barron's Averages

1907-1910: Dow Theory

1910-1913: Dow Theory

1910-1936: U.S. Real Estate

1910-2016: Union Pacific Corp.

1914-2012: Fed/GDP Ratio

1919-1934: Barron's Industrial Production

1920-1940: Homestake Mining

1921-1939: US Realty

1922-1930: Discount Rate

1924-2001: Gold/Silver Stocks

1927-1937: Borden Co.

1927-1937: National Dairy Products

1927-1937: Union Carbide

1928-1943: Discount Rate

1929-1937: Monsanto Co.

1937-1969: Intelligent Investor

1939-1965: Utility Stocks v. Interest Rates

1941-1967: Texas Pacific Land

1947-1970: Inventory-Sales Ratio

1948-2019: Profits v. DJIA

1949-1970: Dow 600? SRL

1958-1976: Gold Expert

1963-1977: Farmland Values

1971-2018: Nasdaq v. Gold

1971-1974: REIT Crash

1972-1979: REIT Index Crash

1986-2018: Hang Seng Index Cycles

1986-2019: Crude Oil Cycles

1999-2017: Cell Phone Market Share

2008: Transaction History

2010-2021: Bitcoin Cycles -

Interesting Read

Inside a Moneymaking Machine Like No Other

The Fuzzy, Insane Math That's Creating So Many Billion-Dollar Tech Companies

Berkshire Hathaway Shareholder Letters

Forex Investors May Face $1 Billion Loss as Trade Site Vanishes

Why the oil price is falling

How a $600 Million Hedge Fund Disappeared

Hedge Fund Manager Who Remembers 1998 Rout Says Prepare for Pain

Swiss National Bank Starts Negative

Tice: Crash is Coming...Although

More on Edson Gould (PDF)

Schiller's CAPE ratio is wrong

Double-Digit Inflation in the 1970s (PDF)

401k Crisis

Quick Link Archive

Author Archives: NLObserver Team

In the News: September 10, 2011

Nasdaq 100 Watch List: September 9, 2011

| Symbol | Name | Trade | P/E | EPS | Yield | P/B | Div/Shr | payout ratio | % from Low |

| QGEN | Qiagen N.V. | 13.87 | 25.22 | 0.55 | 0 | 1.30 | 0 | 0.65% | |

| ESRX | Express Scripts, Inc. | 43.67 | 17.89 | 2.44 | 0 | 12.25 | 0 | 0.81% | |

| FISV | Fiserv, Inc. | 51.47 | 16.88 | 3.05 | 0 | 2.44 | 0 | 1.00% | |

| INFY | Infosys Limited | 47.17 | 17.34 | 2.72 | 1.70% | 4.57 | 0.85 | 31.25% | 1.46% |

| AMAT | Applied Materials | 10.73 | 7.39 | 1.45 | 2.90% | 1.67 | 0.32 | 22.07% | 2.14% |

| PAYX | Paychex, Inc. | 25.93 | 18.26 | 1.42 | 4.60% | 6.44 | 1.24 | 87.32% | 3.22% |

| BMC | BMC Software | 38.46 | 15.19 | 2.53 | 0 | 4.23 | 0 | 3.41% | |

| FSLR | First Solar, Inc. | 84.96 | 14.48 | 5.87 | 0 | 2.03 | 0 | 3.47% | |

| WCRX | Warner Chilcott plc | 14.95 | 31.81 | 0.47 | 0 | 141.57 | 0 | 4.18% | |

| URBN | Urban Outfitters | 24.56 | 16.63 | 1.48 | 0 | 3.01 | 0 | 4.51% | |

| EXPD | Expeditors Intl of Wash. | 42.06 | 24.03 | 1.75 | 1.10% | 4.88 | 0.5 | 28.57% | 4.78% |

| VOD | Vodafone Group Plc | 25.77 | 10.6 | 2.43 | 7.30% | 0.95 | 1.92 | 79.01% | 4.80% |

| NIHD | NII Holdings, Inc. | 36.18 | 14.7 | 2.46 | 0 | 1.67 | 0 | 4.84% | |

| VRSN | VeriSign, Inc. | 29.03 | 6.47 | 4.49 | 0 | N/A | 0 | 4.99% | |

| PCAR | PACCAR Inc. | 35.38 | 17.96 | 1.97 | 2.00% | 2.26 | 0.72 | 36.55% | 5.20% |

| SIAL | Sigma-Aldrich | 59.18 | 17.45 | 3.39 | 1.10% | 3.27 | 0.72 | 21.24% | 5.34% |

| DTV | DIRECTV | 41.42 | 13.66 | 3.03 | 0 | N/A | 0 | 5.89% | |

| CA | CA Inc. | 19.71 | 11.87 | 1.66 | 1.00% | 1.76 | 0.2 | 12.05% | 5.91% |

Disclaimer:

PG&E fleeces investors and consumers alike

In the News: September 3, 2011

- What to Do With All That Cash at Barron’s

- Microsoft Dividend Should Be A ‘Payout Ratio,’ Says Ticonderoga at Barron’s

- BofA, JPMorgan Among 17 Banks Sued by U.S. for $196 Billion at Bloomberg

- Monsanto Corn Falls to Illinois Bugs as Investigation Widens at Bloomberg

- First Solar Receives $455.7 Million Ex-Im Bank Loan Guarantee at Bloomberg

- BofA Can Meet Capital Goals Without Share Sale, CFO Says in Internal Memo at Bloomberg

- Debt after death: Banks chase down mourners at Yahoo!Finance

- Gold wedding bands get dumped for tungsten at Money

- Bank of America faces FDIC questions at Money

- Groupon effect: Facebook shuts down Deals, Yelp scales back at Money

- Sino-Forest's fall from grace at Money

- What went wrong at Solyndra at Fortune

- 5 warning signs that Apple has lost its magic at Fortune

- Buffett says WSJ wrong about BoA dividends at Fortune

- Bove: Nothing Unusual About Fed's Request to BofA at Fox Business News

- BofA Contigency Plan to Fed Includes Partial Separation of Merrill at Fox Business News

- Revised Dow Theory Bear Market Rally Targets at NLO

- Our Recent Market Commentary on Seeking Alpha

Comments Off on In the News: September 3, 2011

Posted in In the news

There is no such thing as a Sophisticated Investor

“ …there on your statement, it looked like you owned a widely diversified portfolio of blue chips, everything from J&J to Wal-Mart, and so you had this sense, ‘well I am kinda diversified,’ there was this illusion of a diverse portfolio and you move into cash safely and into treasury bonds and back into these blue chips, so not to defend people who were willing to trust every penny they had to Bernie Madoff, they may have been deluded by the notion that they did have a balanced and very highly diverse portfolio almost like a mutual fund, of course it was nothing like a mutual fund, in fact, and the notion that you would give all your money to Bernie Madoff, in hindsight, of course looked dreadful, but how many of your listeners actually invest all of their money with Vanguard or different mutual funds but they will invest it all with a fund family because of the convenience that comes with it."

(interrupting Diana) "That’s a good point, that’s a good point, but I’m willing to propose to you that a listener that invests with the Vanguard, a listener that invests with a Fidelity, a listener that invests with a T. Rowe Price, can simply not be compared to somebody giving their money to Bernie Madoff. He is not Vanguard, he is not Fidelity, he is not T. Rowe Price."

"Yeah, but neither is he Joe’s Plumbing and Ponzi Scheme operation down on the corner. He was a very respectable."

(interrupting Diana) "No but actually he was that Diana, he had a po-dunk auditing system set up in a storefront in NY, I mean, he was Joe’s Plumbing and Heating."

"I’ve got to disagree with you there because I knew Bernie Madoff back when he was in the wild before he was in captivity, and I knew his firm very well. As a reporter at Barron’s it was one of the first places you’d call if were trying to find out what news, what impact, breaking news would had had on specific stocks or segments of stocks. For example, the night the first gulf war broke out, it hit us in NY at a very tough time right against our deadline for the next day’s business section. We took the whole section apart and put it back together again. Well, what would the out break of war going to mean to the oil stocks? How do you find out? The NYSE had been closed for hours. You called Bernie Madoff, because he pioneered after hours trading. There was a period in time when Madoff’s trading firm handled up to 10% of the daily volume of the NYSE stocks; in what is called the third market. We didn’t know him as retail investors, I knew him as a business reporter, but he had no retail customers, so far as we knew. He was a wholesale trading house but he was very well known on the street as a whole sale trading house one of the biggest, one the fastest, one of the most technologically advanced and a firm that had always set the standard for the speed of processing orders, so I have to disagree with you, people who knew wall street and who did a little 'due diligence' on Bernie Madoff would have learned that he was a very well respected wholesale trader."

"All of which led them to the false conclusion that he was someone that you could do business with."

"Yes…and he was someone that they could trust."

(interrupts Diana while she is talking) (incredulously says...) "TRUST!…are you serious Diana?…you could trust!…what do you mean you could trust?"

"He was someone certainly that they thought they could trust clearly they would not have given their money to him otherwise. On the surface, you know Bill, a shifty eyed guy with a cheap suit and scoffed shoes may commit a lot of crimes but a ponzi scheme is never going to be one of them. Ponzi schemers are by definition done by people who seem trustworthy, if they’re not they can’t even start. The can’t pull it off. So, people who think they would instantly recognize a crook like Bernie Madoff, are deluding themselves. That’s one of the dangerous lies we tell ourselves. They’re going to look like responsible respectable people."

Considering the Crisis at Bank of America

“London banks, the Bank of England, Germany's Reichsbank, Bank for International Settlement and the Bank of Austria all threw money at CreditAnstalt starting in May of 1930 in a failed attempt to shore up the problem.”

-

$18.59

-

$13.44 (1/3)

-

$10.865 (fair value)

-

$8.29 (2/3)

-

$3.14 (3/3)

-

$8.29

-

$6.65

-

$5.72

-

$4.83

-

$3.14

"The element of character in the choice of bank is eliminated, and the competitive appeal is shifted to other and lower standards, such as liberality in making loans. The natural result is that the standards of management are lowered, bankers may take greater risks for the sake of larger profits and the economic loss which accompanies bad bank management increases."Grant, James. Mr. Market Miscalculates. Axios Press. 2008. page 202.

Posted in 1929, Bank of America, Bodenkreditanstalt, Citigroup, CreditAnstalt, National City Bank

Tagged members

Dow Theory: Values and Price

“The best way of reading the market is to read from the standpoint of values. The market is not like a balloon plunging hither and thither in the wind. As a whole, it represents a serious, well-considered effort on the part of farsighted and well-informed men to adjust prices to such values as exist or which are expected to exist in the not too remote future. The thought with great operators is not whether a price can be advanced, but whether the value of property which they propose to buy will lead investors and speculators six months hence to take stock at figures from ten to twenty points above present prices."In reading the market, therefore, the main point is to discover what a stock can be expected to be worth three months hence and then to see whether manipulators or investors are advancing the price of that stock toward those figures. It is often possible to read movements in the market very clearly in this way. To know values is to comprehend the meaning of movements in the market."Source: Hamilton, William Peter. Stock Market Barometer. Page 38.

“The lack of attention paid to the price as it relates to values, in the case of the recommendation of DISH, may cost an investor a decline of 30% before a material gain is achieved unless the company is bought by a larger institution.”

Posted in Dow's Value Theory

In the News: August 21, 2011

The 2012 Crystal Ball at The Big Picture (blog)

Sending the Police Before There’s a Crime at NYTimes

And Back To Munis, As Fitch Downgrades New Jersey GO From AA To AA- at ZeroHedge (blog)

Harsh lessons from Evergreen Solar flame-out at CNET

Comments Off on In the News: August 21, 2011

Posted in In the news

NLO Dividend Watch List: August 19, 2011

August 19, 2011 Watch List

| Symbol | Name | Price | % Yr Low | P/E | EPS (ttm) | Dividend | Yield | Payout Ratio |

| BOH | Bank of Hawaii Corp. | 37.44 | -3.41% | 11.11 | 3.37 | 1.80 | 4.81% | 53% |

| LNC | Lincoln National Corp. | 19.46 | -3.28% | 5.67 | 3.43 | 0.20 | 1.03% | 6% |

| SEIC | SEI Investments Company | 15.71 | -2.06% | 12.88 | 1.22 | 0.24 | 1.53% | 20% |

| STT | State Street Corp. | 31.91 | -1.75% | 10.10 | 3.16 | 0.72 | 2.26% | 23% |

| BBT | BB&T Corp. | 19.27 | -1.73% | 14.27 | 1.35 | 0.64 | 3.32% | 47% |

| AFL | AFLAC Inc. | 34.61 | -1.23% | 9.11 | 3.80 | 1.20 | 3.47% | 32% |

| NTRS | Northern Trust Corp. | 34.78 | -0.91% | 13.80 | 2.52 | 1.12 | 3.22% | 44% |

| WFSL | Washington Federal, Inc. | 13.85 | -0.86% | 16.10 | 0.86 | 0.24 | 1.73% | 28% |

| MDP | Meredith Corp. | 23.63 | -0.59% | 8.50 | 2.78 | 1.02 | 4.32% | 37% |

| EV | Eaton Vance Corp. | 21.16 | -0.47% | 13.74 | 1.54 | 0.72 | 3.40% | 47% |

| SYY | Sysco Corp. | 27 | -0.44% | 13.78 | 1.96 | 1.04 | 3.85% | 53% |

| HHS | Harte-Hanks, Inc. | 7.37 | -0.27% | 10.10 | 0.73 | 0.32 | 4.34% | 44% |

| FII | Federated Investors Inc | 16.39 | -0.18% | 10.18 | 1.61 | 0.96 | 5.86% | 60% |

| DNB | Dun & Bradstreet Corp. | 62.32 | -0.08% | 12.12 | 5.14 | 1.44 | 2.31% | 28% |

| MMM | 3M Co | 76.87 | -0.17% | 13.05 | 5.89 | 2.20 | 2.86% | 37% |

| BRC | Brady Corp. | 24.94 | 0.24% | 13.13 | 1.90 | 0.72 | 2.89% | 38% |

| USB | U.S. BanCorp. | 20.56 | 0.59% | 9.98 | 2.06 | 0.50 | 2.43% | 24% |

| AVY | Avery Dennison Corp. | 26.05 | 0.77% | 9.37 | 2.78 | 1.00 | 3.84% | 36% |

| MUR | Murphy Oil Corporation | 48.69 | 0.83% | 9.88 | 4.93 | 1.10 | 2.26% | 22% |

| ANAT | American National Insurance | 72.5 | 0.95% | 12.00 | 6.04 | 3.08 | 4.25% | 51% |

| SON | Sonoco Products Co. | 28.04 | 1.23% | 14.09 | 1.99 | 1.16 | 4.14% | 58% |

| AVP | Avon Products, Inc. | 20.53 | 1.38% | 12.01 | 1.71 | 0.92 | 4.48% | 54% |

| WEYS | Weyco Group, Inc. | 22.02 | 1.43% | 18.20 | 1.21 | 0.64 | 2.91% | 53% |

| GS | Goldman Sachs Group, Inc. | 111.76 | 1.56% | 10.96 | 10.20 | 1.40 | 1.25% | 14% |

| ECL | Ecolab, Inc. | 44.53 | 1.64% | 20.06 | 2.22 | 0.70 | 1.57% | 32% |

| NC | NACCO Industries Inc. | 69.16 | 1.71% | 4.33 | 15.99 | 2.13 | 3.08% | 13% |

| BMS | Bemis Co Inc | 28.6 | 1.92% | 14.23 | 2.01 | 0.96 | 3.36% | 48% |

| TRV | The Travelers Companies, Inc. | 49.46 | 2.06% | 9.35 | 5.29 | 1.64 | 3.32% | 31% |

| FFIC | Flushing Financial Corp. | 10.73 | 2.09% | 8.19 | 1.31 | 0.52 | 4.85% | 40% |

| BMI | Badger Meter, Inc. | 32.03 | 18.20 | 1.76 | 0.64 | 2.00% | 36% | |

| CHRW | C.H. Robinson Worldwide | 63.67 | 2.20% | 25.47 | 2.50 | 1.16 | 1.82% | 46% |

| BRK-A | Berkshire Hathaway Inc. | 102591 | 2.32% | 13.76 | 7457.95 | N/A | N/A | N/A |

| HIG | Hartford Financial Services | 17.72 | 2.43% | 5.08 | 3.49 | 0.40 | 2.26% | 11% |

| SYK | Stryker Corp. | 43.8 | 2.48% | 13.86 | 3.16 | 0.72 | 1.64% | 23% |

| EOG | EOG Resources, Inc. | 87.57 | 2.52% | 55.08 | 1.59 | 0.64 | 0.73% | 40% |

| ITW | Illinois Tool Works, Inc. | 41.36 | 2.55% | 10.91 | 3.79 | 1.44 | 3.48% | 38% |

| EMR | Emerson Electric Co. | 42.46 | 2.63% | 13.10 | 3.24 | 1.38 | 3.25% | 43% |

| EXPD | Expeditors International | 40.33 | 2.86% | 23.05 | 1.75 | 0.50 | 1.24% | 29% |

| PNR | Pentair, Inc. | 30.26 | 2.89% | 13.82 | 2.19 | 0.80 | 2.64% | 37% |

| TMP | Tompkins Financial Corp. | 37 | 2.98% | 11.75 | 3.15 | 1.44 | 3.89% | 46% |

| SJW | SJW Corp. | 21.52 | 3.02% | 16.18 | 1.33 | 0.69 | 3.21% | 52% |

| MATW | Matthews International Corp. | 30.05 | 3.23% | 12.37 | 2.43 | 0.32 | 1.06% | 13% |

| PEP | PepsiCo Inc. | 62.07 | 3.28% | 15.79 | 3.93 | 2.06 | 3.32% | 52% |

| APD | Air Products & Chemicals | 75.24 | 3.34% | 14.01 | 5.37 | 2.32 | 3.08% | 43% |

| WFC | Wells Fargo & Co. | 23.36 | 3.45% | 9.05 | 2.58 | 0.48 | 2.05% | 19% |

| LLTC | Linear Technology Corp. | 26.31 | 3.54% | 10.52 | 2.50 | 0.96 | 3.65% | 38% |

| GD | General Dynamics Corp. | 57.47 | 3.62% | 8.20 | 7.01 | 1.88 | 3.27% | 27% |

| MDT | Medtronic, Inc. | 31.29 | 3.68% | 10.94 | 2.86 | 0.97 | 3.10% | 34% |

| TFX | Teleflex InCorp.orated | 49.87 | 4.07% | 9.39 | 5.31 | 1.36 | 2.73% | 26% |

| UTX | United Technologies Corp. | 67.45 | 4.46% | 13.07 | 5.16 | 1.92 | 2.85% | 37% |

| LLY | Eli Lilly & Co. | 35.01 | 4.63% | 8.24 | 4.25 | 1.96 | 5.60% | 46% |

| AOS | AO Smith Corp. | 34.43 | 4.86% | 10.28 | 3.35 | 0.64 | 1.86% | 19% |

52 companies

Watch List Summary

Top Five Performance Review

| Symbol | Name | 2010 Price | 2011 Price | % change |

| SVU | SUPERVALU Inc. | 10.08 | 6.8 | -32.54% |

| HRB | H&R Block, Inc. | 13.47 | 13.26 | -1.56% |

| BBT | BB&T Corp. | 23.11 | 19.27 | -16.62% |

| MDT | Medtronic, Inc. | 34.77 | 31.29 | -10.01% |

| WFC | Wells Fargo & Co. | 24.60 | 23.36 | -5.04% |

| Average | -13.15% | |||

| DJI | Dow Jones Industrial | 10,213.62 | 10,817.65 | 5.91% |

| SPX | S&P 500 | 1,071.69 | 1,123.53 | 4.84 |

Disclaimer:

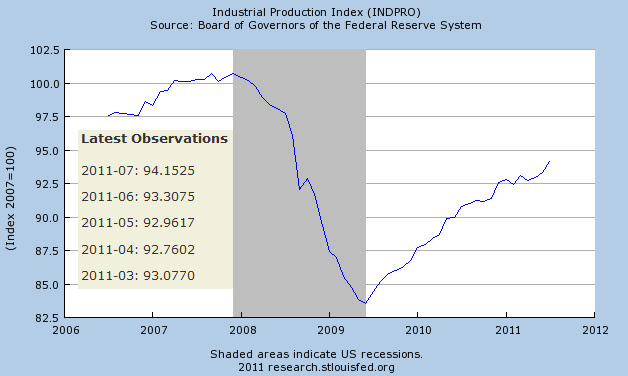

Dow Theory: Bear Market Remains as INDPRO Surges

Posted in bear market rally targets, Dow Theory, Industrial Production Index

Tagged members

2 Years of Profitable Dow Theory Analysis

| Date | Article Title | Topic |

| 8/2/2011 | Dow Theory: August 2, 2011 | A new bear market begins, bull market ends |

| 6/30/2011 | Waiting for Confirmation | Bull market confirmation, next target Apr & May high |

| 6/24/2011 | Dow Theory: Price and Values | Values, price, seeking fair profits |

| 6/13/2011 | Russell: Wrong about the Industrial Production Index | Industrial Production: 1929 and today |

| 5/4/2011 | Price Decline equals Dividends Canceled | Values, dividends, fair profit |

| 4/6/2011 | Richard Russell's Miscue | Russell says 2007-2009 was not bear market |

| 4/6/2011 | Dow Theory: Cyclical Bull Market Confirmed | cyclical bull market confirmation |

| 2/14/2011 | Dow Theory: Continuation of Bull Market Confirmed | cyclical bull market confirmation |

| 11/8/2010 | Dow Theory Q&A | Primary trends, confirmations, S&P in Dow Theory |

| 11/7/2010 | A Lesson In Dow Theory | When to buy, sell, and wait for confirmation |

| 11/4/2010 | Dow Theory: Continuation of Bull Market Confirmed | cyclical bull market confirmation |

| 9/25/2010 | Seeking Ten Percent | Seeking pair profits |

| 9/8/2010 | Dow Theory: The Formation of a Line | Lines |

| 8/5/2010 | Dow Theory, Stock Markets and Economic Forecasting | Economic forecasting, stock markets |

| 6/30/2010 | Dow Theory | Bear market non-confirmation |

| 5/13/2010 | Dow Theory | Secondary reactions |

| 4/13/2010 | Dow Theory Q&A | When to sell; asset allocation |

| 4/11/2010 | Dow Theory | cyclical bull market confirmation |

| 3/23/2010 | Dow Theory | cyclical bull market confirmation |

| 2/23/2010 | Dow Theory Q&A | Manipulation; Averages discount everything |

| 2/22/2010 | Dow Theory | 50% principle |

| 1/24/2010 | Dow Theory | Downside targets |

| 1/19/2010 | Dow Theory on Fair Value | Values and Price |

| 1/10/2010 | Dow Theory | confirmation; line; 50% principle |

| 9/24/2009 | Dow Theory | retest recent lows; going higher |

| 9/2/2009 | Dow Theory | Double tops and Double bottoms |

| 8/25/2009 | Dow Theory | Russell changes from bear to bull |

| 8/24/2009 | Dow Theory | possible non-confirmation |

| 7/24/2009 | Dow Theory | a new bull market begins, bear market ends |

In the News: August 14, 2011

Comments Off on In the News: August 14, 2011

Posted in In the news

Nasdaq 100 Watch List: August 12, 2011

| Symbol | Name | Trade | P/E | EPS | Yield | P/B | % from Low |

| INFY | Infosys Limited | 53.78 | 19.77 | 2.72 | 1.60% | 4.97 | 2.56% |

| ATVI | Activision Blizzard, Inc | 10.71 | 19.76 | 0.54 | 1.50% | 1.16 | 2.98% |

| LIFE | Life Technologies | 38.42 | 19.77 | 1.94 | 0 | 1.53 | 3.36% |

| NIHD | NII Holdings, Inc. | 36.9 | 14.99 | 2.46 | 0 | 1.66 | 4.44% |

| AMGN | Amgen Inc. | 50 | 10.4 | 4.81 | 2.30% | 1.79 | 4.91% |

| FLIR | FLIR Systems, Inc. | 23.66 | 18.05 | 1.31 | 1.00% | 2.31 | 6.29% |

| ADBE | Adobe Systems | 24.1 | 12.91 | 1.87 | 0 | 2.2 | 6.31% |

| PCAR | PACCAR Inc. | 36.84 | 18.7 | 1.97 | 2.00% | 2.27 | 6.84% |

| WCRX | Warner Chilcott plc | 17.25 | 36.7 | 0.47 | 0 | 159.35 | 7.41% |

| MSFT | Microsoft Corporation | 25.1 | 9.33 | 2.69 | 2.50% | 3.7 | 7.63% |

| QGEN | Qiagen N.V. | 15.12 | 27.49 | 0.55 | 0 | 1.33 | 8.08% |

| LLTC | Linear Technology | 27.47 | 10.99 | 2.5 | 3.50% | 12.58 | 8.11% |

| PAYX | Paychex, Inc. | 26.66 | 18.77 | 1.42 | 4.70% | 6.41 | 8.11% |

| AKAM | Akamai Technologies | 22.55 | 22.48 | 1 | 0 | 1.86 | 8.94% |

| MU | Micron Technology, Inc. | 6.18 | 9.78 | 0.63 | 0 | 0.75 | 9.38% |

| ADSK | Autodesk, Inc. | 29.18 | 28.3 | 1.03 | 0 | 3.79 | 9.58% |

| CHRW | C.H. Robinson Worldwide | 68.4 | 27.36 | 2.5 | 1.80% | 8.49 | 9.79% |

| ESRX | Express Scripts, Inc. | 46.69 | 19.13 | 2.44 | 0 | 12.43 | 9.86% |

Watch List Performance Review

| Symbol | Name | 2010 | 2011 | % change | 11/9/2010 | approx. annualized gain | |

| GRMN | Garmin Ltd. | 27.05 | 31.32 | 15.79% | 10.94% | 37.68% | |

| PAYX | Paychex, Inc. | 24.97 | 26.66 | 6.77% | 11.21% | 38.61% | |

| MXIM | Maxim Int. | 16.75 | 22.65 | 35.22% | 35.28% | 121.50% | |

| KLAC | KLA-Tencor | 29.10 | 35.93 | 23.47% | 28.59% | 98.45% | |

| INTC | Intel Corp. | 19.15 | 20.65 | 7.83% | 10.50% | 36.14% | |

| Average | 17.82% | 19.31% | 66.48% | ||||

| ^NDX | Nasdaq 100 | 1818.80 | 2182.05 | 19.97% | 19.69% | 67.79% | |

The General Nature of Bear Market Declines According to Charles H. Dow

-

Declines are seldom uninterrupted

-

Short sellers must eventually buy, investors that are long the market can remain inactive

-

There are more rallies in a bear market than there are secondary reaction in a bull market even when the total movement is the same

-

Buyers produce self-fulfilling rebounds in the market

Comments Off on The General Nature of Bear Market Declines According to Charles H. Dow

Posted in Uncategorized

Tagged members

Bear Market Rally Targets

- 11,527.87

- 11.767.18

- 12,073.49

- 12,724.41

- 12,807.51

Posted in bear market rally targets, Dow Theory