Today's investment Observation is on Eli Lilly and Co. (LLY). According to Morningstar.com, "Eli Lilly is a pharmaceutical company with a focus on neuroscience, endocrinology, oncology, and cardiovascular therapeutic areas. Lilly's key products include antipsychotic Zyprexa, Cymbalta for depression and fibromyalgia, Gemzar and Alimta for cancer, Evista and Forteo for osteoporosis, Humalog, Humulin, and Byetta for diabetes, and Cialis for erectile dysfunction."

Prior to 2010, Eli Lilly (LLY) had a 41 year history of dividend increases. The normal dividend increase that takes place in February did not occur this year. However, the prospect exists that LLY may actually increase the dividend in the 2nd weeks of February of next year. The fact that there wasn't an increase does not diminish our expectations for LLY. In fact, keeping the dividend the same or reducing it reflects management's acute awareness to preserve capital for future tough times ahead. The current annual dividend of $1.96 provides for a substantial dividend yield of 5.60% at the current price.

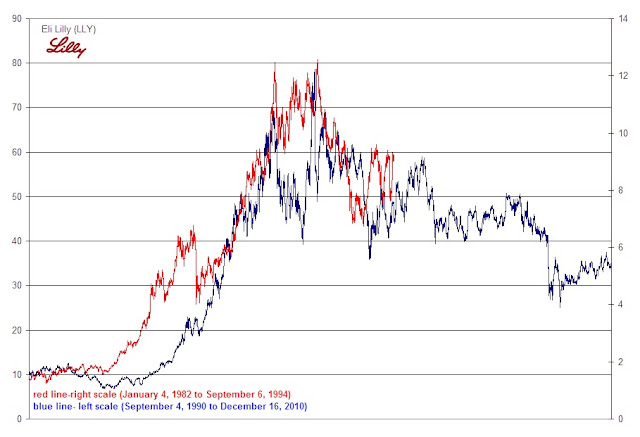

In order to put the current stock price into perspective, we like to see how the dividend payments compare to the stock price on a relative basis. Below is Edson Gould's Altimeter which reflects the stock price relative to the dividend that has been paid since 1982.

The altimeter at the high points reflects that the stock price is overvalued compared to the dividend payment while the low points reflect the opposite. At the current level, Eli Lilly (LLY) is at historic low levels in terms of the stock price compared to the actual dividend paid.

When looking at Eli Lilly's price movement (adjusted for dividends), we intuitively see that there is a pattern that has been repeated and, more recently, overextended. The chart below shows two different periods (January 4, 1982 to September 6, 1994) and (September 4, 1990 to December 16, 2010).

The chart above demonstrates how Eli Lilly (LLY) managed to replicate much of the rise in the respective periods. Only the decline has been different. Whereas the decline from January 1992 at $12.52 (adjusted price) ended relatively quickly before going higher, the decline from August 2000 at $78.75 (adjusted price) has managed to get dragged out much longer. However, regardless of the amount of time that it has taken, both periods have settled at the altimeter levels of undervaluation of between 50 and 100 as was done in the periods of 1984 and 1994 before taking off to the races.

When viewed from the perspective of Value Line Investment Survey's fair value indicator, we arrive at an unbelievable figure of $58.85. This price is 67% above the current level of $35.18. Again, we only consider the fair value level as a marker for when long term investors, after having bought at the current price, should sell. Although we favor the consistency and accuracy of the Value Line fair value estimate, we must defer to the more conservative estimates that we can find. According to Morningstar.com, Eli Lilly (LLY) has a fair value of $42 while Dow Theory has a fair value of $46. We'll settle for the Dow Theory figure since it is close to Morningstar's estimate but well below the Value Line estimate. This leaves us with 30% upside potential for this stock.

We'd like to speak of the return on assets (ROA) and return on equity (ROE) for Eli Lilly (LLY) however they can't be used as a primary motivation for buying this company. We'll just state that according to MergentOnline, Eli Lilly registered ROA of 15.28% and ROE of 53.25% in 2009. For the year 2008, ROA and ROE was severely in the negative due, in part, by excessive financial leverage. 2008 and 1997 were the only years that negative ROA and ROE was indicated since 1983.

In closing, we have saved the most important, and best, part for last. This is has to do with what the downside risks are for the stock price. According to Dow Theory, the following are the downside targets:

Anyone considering investing in Eli Lilly (LLY) should be willing to accept the possibility of the stock price falling to any of the indicated level. If the prospect of falling to $11.66, or 67%, seems far fetched then talk to the share holders who bought for the long term near $100 in 2000. They are literally sitting on a price decline of 60% (excluding dividends) from the previous purchase.

Our only other concern with this stock is if it somehow gets "Mercked." Merck (MRK) was found to have passed off marketing material as clinical studies that indicated that their drug Vioxx was safe at the same time that people were dying from the very same treatment. We can only hope that such a scenario does not darken the door of Eli Lilly in the coming years.

Good luck on your follow-up research on Eli Lilly. We believe the venture will be worth the effort.