Barron’s attempts at Dow Theory has failed miserably…again. In the September 29, 2012 article by Jacqueline Doherty titled “Broken Dow Theory,” it is suggested that “A lagging transportation sector historically has been considered a bad omen…” and then recites the standard, sub-standard nomenclature “…less shipping means fewer goods are being produced and purchased, which means the economy is slowing and the stock market could be headed for a fall.” Doherty goes on to cite data from Bespoke Investment Group asserting that even though the Transportation index has fallen behind the market in general, it may not mean that the stock market, as represented by the S&P 500, necessarily needs to follow the same script.

Fortunately, Dow Theory is very specific about how to interpret the Dow Jones Industrial and Transportation Averages since the publication of Robert Rhea’s book The Dow Theory. Nowhere in the rules of Dow Theory is there any indication that the vacillations of the S&P 500 are remotely part of the interpretation of the theory. Especially since the S&P 500 came onto the scene over 60 years after the creation of the Dow Industrials.

Despite the fact that there are some Dow Theorists who frequently use the S&P 500 as a substitute for indications of a rising or falling market (this isn’t Dow Theory), there is little evidence that using the additional index is necessary. Alternate indexes are only necessary when and if the Dow Jones Industrial and Transportation Averages no longer exist.

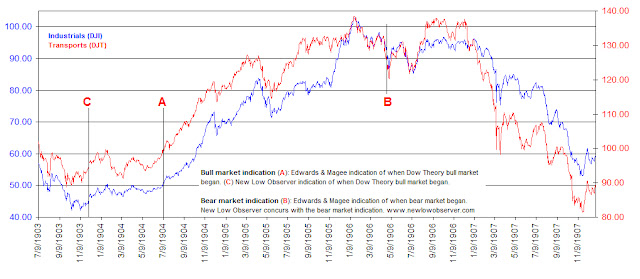

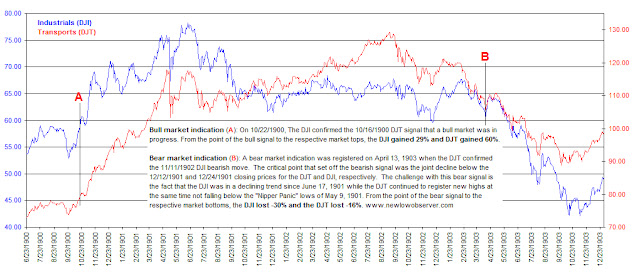

While the prevailing opinion is that the Dow Industrials isn’t a relevant index reflective of the market as a whole, a distinction should be made between a “lagging” index and a “divergent” index. A lagging index is one which is going in the same direction as the other but is not increasing/decreasing at the same rate. A divergence is when one index goes up while the other index is going down. The chart below shows two failures and one divergence between the Industrials and Transports.

![image_thumb[8] image_thumb[8]](https://i0.wp.com/www.newlowobserver.com/wp-content/uploads/2012/10/image_thumb8_thumb.png?resize=500%2C380)

When one index cannot make new highs in accordance with the other index, it should be considered a significant failure and a warning sign. A perfect example is when the Transportation Index made a new high in 2008 and the Industrial Index could not follow through. The subsequent decline in both indexes was staggering.

In situations where there has been a divergence between the Dow Industrials and Transports, it is the Transports that typically leads the divergence to the upside or downside, meaning that the Transports will provide a clue as to the potential market direction in spite of the action of the Dow Industrials. Although historically this has been the case, Barron’s has unwittingly legitimized the view that the spread between the Dow Industrials and Dow Transports is some form of Dow Theory. In no way is this the case. In fact, in the period from 1896 to 1984, the Transports have exceeded the Industrials, on a percentage basis, 15 out of 25 Dow Theory bull and bear market moves.

| Year |

DJI beat by |

DJT beat by |

|

|

|

Year |

DJI lost by |

DJT lost by |

|

|

|

| 1896 |

33.50% |

|

|

|

|

1899 |

-13.30% |

|

|

|

|

| 1900 |

|

51.00% |

|

|

|

1902 |

-6.40% |

|

|

|

|

| 1903 |

88.60% |

|

|

|

|

1906 |

-7.30% |

|

|

|

|

| 1907 |

24.50% |

|

|

|

|

1909 |

-5.30% |

|

|

|

|

| 1910 |

10.10% |

|

|

|

|

1912 |

-13.80% |

|

|

|

|

| 1914 |

78.70% |

|

|

|

|

1916 |

-3.10% |

|

|

|

|

| 1917 |

64.80% |

|

|

|

|

1919 |

-26.00% |

|

|

|

|

| 1921 |

18.40% |

|

|

|

|

1922 |

|

-2.30% |

|

|

|

| 1923 |

192.30% |

|

|

|

|

1929 |

|

-3.80% |

|

|

|

| 1932 |

|

15.60% |

|

|

|

1937 |

|

-21.40% |

|

|

|

| 1938 |

|

20.60% |

|

|

|

1938 |

|

-6.40% |

|

|

|

| 1939 |

|

20.30% |

|

|

|

1939 |

-5.30% |

|

|

|

|

| 1942 |

|

64.40% |

|

|

|

1946 |

|

-16.50% |

|

|

|

| 1947 |

|

39.40% |

|

|

|

1948 |

|

-20.50% |

|

|

|

| 1949 |

|

92.50% |

|

|

|

1953 |

|

-6.50% |

|

|

|

| 1953 |

3.80% |

|

|

|

|

1956 |

|

-27.80% |

|

|

|

| 1957 |

|

819.90% |

|

|

|

1959 |

|

-12.40% |

|

|

|

| 1960 |

5.80% |

|

|

|

|

1961 |

-2.90% |

|

|

|

|

| 1962 |

|

48.80% |

|

|

|

1966 |

|

-7.00% |

|

|

|

| 1966 |

|

19.20% |

|

|

|

1968 |

|

-22.30% |

|

|

|

| 1970 |

|

82.40% |

|

|

|

1972 |

|

-14.50% |

|

|

|

| 1974 |

|

10.00% |

|

|

|

1976 |

-13.10% |

|

|

|

|

| 1978 |

|

86.50% |

|

|

|

1981 |

|

-10.60% |

|

|

|

| 1982 |

|

44.00% |

|

|

|

1983 |

|

-9.70% |

|

|

|

| 1984 |

|

177.80% |

|

|

|

1984 |

|

-31.00% |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

DJI |

DJT |

|

|

|

|

DJI |

DJT |

|

|

|

| Total |

520.50% |

1592.40% |

|

|

|

Average: |

-9.65% |

-14.18% |

|

|

|

The table above reflects the percentage by which the respective indexes exceeded the other from either the bull market low or the bear market top. In the timeframe indicated above, the Transports have routinely exceeded the Industrials to the upside by nearly three times. The same is true for Dow Theory bear market moves where the Transports have excessive downside moves as compared to the Dow Jones Industrial average by nearly 50%.

The pattern of excessive gains and losses in the Transports versus the Industrials has remained the case since 1984. As an example, at the peak in 2007, the Dow Industrials declined –54% while the Transports declined –60%. On the rise from the 2009 bottom, the Industrials and Transports registered gains of +110% and +162% based on their respective peaks. Excessive gains and losses, by the Transports above that of the Industrials, demonstrates that the Transports usually act as a leading indicator of market direction.

It should be noted that before the work of Wall Street Journal editor William Peter Hamilton and author Robert Rhea on the topic of Dow Theory, Charles H. Dow (co-founder of the Wall Street Journal) created and analyzed the Rail Index (now Transports) without the existence of the Dow Industrials for 12 years, from 1884 to 1896, for indications of market direction. Those 12 years are the basis of what Dow was able to formulate his observations on the market.

Unfortunately, the Barron’s article goes on to quote a CIO who states that the “…Nasdaq 100 and S&P 500 are better leading indicators than the transports.” Based on the available data, the Nasdaq 100 has not been able to exceed the all-time high set in January 2000. Additionally, the S&P 500 has not managed to exceed the all-time high set in October 2007. In the bull market run since the 2009 low, the Transportation Average has managed to exceed its all-time high unlike the Nasdaq 100 and S&P 500.

Finally, Barron’s quotes data from Bespoke which reviews, “…periods when the S&P 500 exceeded the transport index by 10 percentage points over a 50-day trading period. Going back to 1928, the S&P 500 gained 1% in the subsequent six months, not awful although below the average six-month gain of 3.5%.” Using a “50-day trading period” to arrive a conclusion about the next six months is inadequate in making even a cyclical determination of a bull or bear market based on Dow Theory, let alone a secular indication. Dow Theory is about the primary trend of the market which tends to last from 3-4 1/2 years at a time.

In order to make a “complete” secular and cyclical analysis based on Dow Theory, interpretation should begin at the prior dual Industrial and Transport peaks in 2007/2008, at minimum. Until there is a dual Industrial and Transport new high, cyclical new highs in one index or the other would be a bear market reaction as indicated in our August 9, 2011 note titled “Bear Market Rally Targets.” Our indication that a bear market rally was about to take place was with 2% of the October 3, 2011 low, giving full opportunity to seek out new investment opportunities before the bear market rally to the current peak in the Industrials. The current divergence of the two indexes is confirmation of the fact that we’re still in a bear market rally until the prior 2009-2011/2012 highs are exceeded for a cyclical bull market and all-time highs for a new secular bull market.

Until 1956, Barron’swould include Dow Theory analysis in the Market Laboratory section every week. Since 1956, Dow Theory would show up only in feature articles from experts on the topic. Now, it seems that anyone making mention of either the Dow Industrials or Dow Transports can suffice as knowledgeable on the topic of Dow Theory.

Naturally, there are many critics who adamantly speak out against Dow Theory, which is surprising since Charles H. Dow’s work of creating the Wall Street Journalalong with his theories of the stock market are the foundation of both fundamental and technical analysis in the United States. However, the critics, even without knowing the nuances of Dow Theory, are justified in their claims especially when the “analysis” is so incomplete and inaccurate.

If the goal is to do away with Dow Theory and eliminate the indexes then that is fine. However, if the goal is to actually interpret the theory in some mediocre fashion then it should be done by someone who has actually studied the topic extensively. Barron’s, a place where William Peter Hamilton and many other great Dow Theorists were prominently featured, is doing a disservice by connecting unrelated and disparate themes and suggesting that somehow the theory is “broken.”

![image_thumb[8] image_thumb[8]](https://i0.wp.com/www.newlowobserver.com/wp-content/uploads/2012/10/image_thumb8_thumb.png?resize=500%2C380)