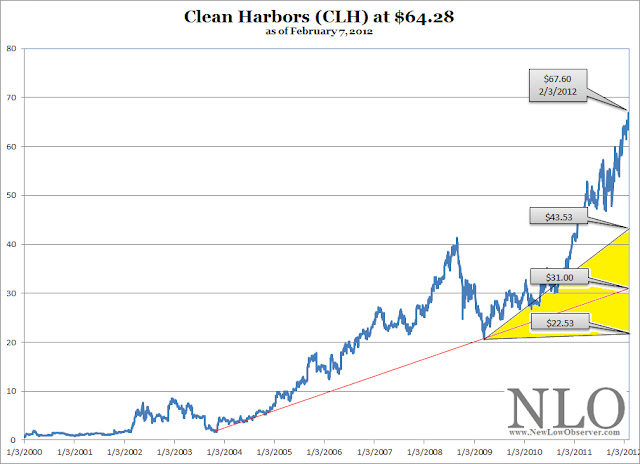

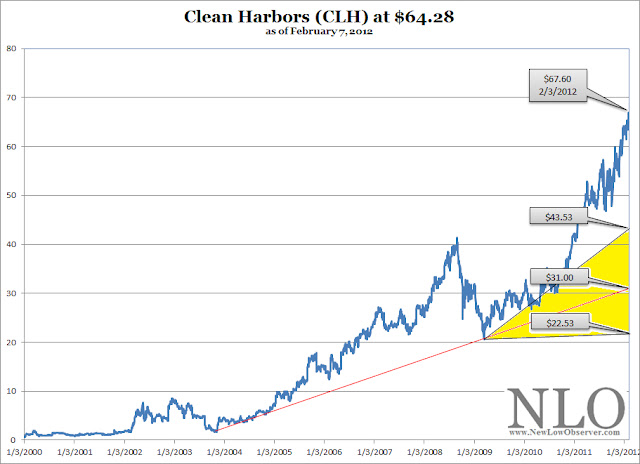

On February 9, 2012, we posted Edson Gould’s Speed Resistance Lines [SRL] regarding Clean Harbors (CLH). Our hope at the time was that our prior work on the top of Gould’s work would be handily refuted or confirmed. At the time we posed the following SRL:

For us, our expectation was that the Clean Harbors would, at minimum, descend to the conservative downside target of $43.53. Well, the timing and coincidence were in our favor as CLH fell –40% to the appointed levels that we thought the stock should descend.

As with all Speed Resistance Lines, there is a chance that the stock will continue to move higher. However, at each point higher we readjust the SRL and arrive at new downside target. In the case of CLH, the stock increased from the $67.60 price to as high as $70.30 thereby requiring an adjustment of the downside targets higher as well. Remember, if the stock does not hit downside targets avoid it. When and if the stock falls to the target, review for potential investment.

Finally, for no explicable reason, when all seemed in favor of the stock, CLH declined from the $70.30 peak to the low of $37.09 achieved in January 2016. By achieving such an improbable low (improbable to those who were buying CLH in February 2012) CLH stock price appeared to be worth considering. For this reason, we iterated a review of CLH for investment consideration on December 14, 2015. Since our mid-December 2015 review, CLH has increased by +39%.

At this point, we’d consider our general analysis of CLH a success from the December 2015 posting. What do we see going forward? We see two critical upside resistance levels to watch for. The first upside resistance is at $59.00 and the second upside resistance level is at $69.00. Obtaining a +39% gaining in a 1-year period might suggest that an investor consider selling all of their CLH holdings and reinvesting the funds somewhere else.

The Cold Hard Truth

Granted, luck and timing have a lot to say in any and all the work that we produce, however, that does not mean that our efforts on the topic should be dismissed as there may be some value in what we’re trying to accomplish. Since the very first of our SRLs we’ve had more than 80% of the SRL downside targets achieved at the point of the initial examination. This generally could could be considered a success. However, of the 20% that have not been successful are positions that we’ve taken a real world investment in, which totally sucks.

In spite of the prevailing reality we continue to attempt to mitigate the available information with the stocks of interest to us. We’ll narrow down this situation to a point where the SRL will work and/or we’ll still be able to benefit regardless of whether an immediate rebound is experienced.