Members

-

Topics

Archives

-

-

Recent Posts

-

-

-

Investor Education

Market Return After Exceptional Years

Dollar Cost Averaging Tool

Dow Theory: The Formation of a Line

Dividend Capture Strategy Analysis

Golden Cross – How Golden Is It?

Debunked – Death Cross

Work Smart, Not Hard

Charles H. Dow, Father of Value Investing

It's All About the Dividends

Dow Theory: Buying in Scales

How to Avoid Losses

When Dividends are Canceled

Cyclical and Secular Markets

Inflation Proof Myth

What is Fair Value?

Issues with P-E Ratios

Beware of Gold Dividends

Gold Standard Myth

Lagging Gold Stocks?

No Sophisticated Investors

Dollar down, Gold up?

Problems with Market Share

Aim for Annualized Returns

Anatomy of Bear Market Trade

Don’t Use Stop Orders

How to Value Earnings

Low Yields, Big Gains

Set Limits, Gain More

Ex-Dividend Dates -

-

Historical Data

1290-1950: Price Index

1670-2012: Inflation Rate

1790-1947: Wholesale Price Cycle

1795-1973: Real Estate Cycle

1800-1965: U.S. Yields

1834-1928: U.S. Stock Index

1835-2019: Booms and Busts

1846-1895: Gold/Silver Value

1853-2019: Recession/Depression Index

1860-1907: Most Active Stock Average

1870-2033: Real Estate Cycles

1871-2020: Market Dividend Yield

1875-1940: St. Louis Rents

1876-1934: Credit-New Dwellings

1896-1925: Inflation-Stocks

1897-2019: Sentiment Index

1900-1903: Dow Theory

1900-1923: Cigars and Cigarettes

1900-2019: Silver/Dow Ratio

1901-2019: YoY DJIA

1903-1907: Dow Theory

1906-1932: Barron's Averages

1907-1910: Dow Theory

1910-1913: Dow Theory

1910-1936: U.S. Real Estate

1910-2016: Union Pacific Corp.

1914-2012: Fed/GDP Ratio

1919-1934: Barron's Industrial Production

1920-1940: Homestake Mining

1921-1939: US Realty

1922-1930: Discount Rate

1924-2001: Gold/Silver Stocks

1927-1937: Borden Co.

1927-1937: National Dairy Products

1927-1937: Union Carbide

1928-1943: Discount Rate

1929-1937: Monsanto Co.

1937-1969: Intelligent Investor

1939-1965: Utility Stocks v. Interest Rates

1941-1967: Texas Pacific Land

1947-1970: Inventory-Sales Ratio

1948-2019: Profits v. DJIA

1949-1970: Dow 600? SRL

1958-1976: Gold Expert

1963-1977: Farmland Values

1971-2018: Nasdaq v. Gold

1971-1974: REIT Crash

1972-1979: REIT Index Crash

1986-2018: Hang Seng Index Cycles

1986-2019: Crude Oil Cycles

1999-2017: Cell Phone Market Share

2008: Transaction History

2010-2021: Bitcoin Cycles -

Interesting Read

Inside a Moneymaking Machine Like No Other

The Fuzzy, Insane Math That's Creating So Many Billion-Dollar Tech Companies

Berkshire Hathaway Shareholder Letters

Forex Investors May Face $1 Billion Loss as Trade Site Vanishes

Why the oil price is falling

How a $600 Million Hedge Fund Disappeared

Hedge Fund Manager Who Remembers 1998 Rout Says Prepare for Pain

Swiss National Bank Starts Negative

Tice: Crash is Coming...Although

More on Edson Gould (PDF)

Schiller's CAPE ratio is wrong

Double-Digit Inflation in the 1970s (PDF)

401k Crisis

Quick Link Archive

Category Archives: Dow Theory

Dow Theory: Non-Confirmation

Dow Theory Applied to Silver?

A reader asks:

“How do you relate Dow Theory to the Silver market?”

Our response:

Charles H. Dow was first an economist, then a commodities expert and finally a stock market analyst. Before Charles H. Dow co-founded the Wall Street Journal, he was better known for writing the “Leadville Letters” for the Providence Journal. The “Leadville Letters” reported on Colorado’s silver mining boom in 1879. After co-founding the Wall Street Journal, the lessons learned in the silver mines ofColorado were found to have application on Wall Street.

Charles Dow was keenly aware of the importance and correlation between commodity prices and stock prices. Many of Dow’s articles in the Wall Street Journal were focused on the movement of commodity prices and all costs of production that went into commodity prices from shipping to the finished product.

As an example, Dow made the following observation:

“For the past 25 years the commodity market and the stock market have moved almost exactly together. The index number representing many commodities rose from 88 in 1878 to 120 in 1881. It dropped back to 90 in 1885, rose to 95 in 1891, dropped back to 73 in 1896, and recovered to 90 in 1900. Furthermore, index numbers kept in Europe and applied to quite different commodities had almost exactly the same movement in the same time. It is not necessary to say to anyone familiar with the course of the stock market that this has been exactly the course of stocks in the same period.”

Much of Dow Theory is based on Dow’s observation of the price action of commodities and then later applied to stock prices. The application of Dow Theory to the price of silver, gold or almost any other commodity is bringing Dow’s work back to its roots. In fact, Dow’s observations in commodities and then later applied to stocks is the basis for much of the modern fundamental and technical analysis that is done today, which includes the quest to determine the “value” of a company and the uses of Fibonacci numbers.

Dow Theory is applicable to all prices that are subject to the whims of market forces. Dow Theory also accounts for manipulation and hoarding. Dow Theory attempts to account for what can reasonably be expected of price action in the not too distant future.

Sources:

- Dow, Charles. Review and Outlook. Wall Street Journal.February 21, 1901.

- Bishop, George W. Jr. Who Was the First American Financial Analyst? Financial Analysts Journal, Vol. 20, No. 2 (Mar.-Apr., 1964), p.26-28.

- Bishop, George W. Jr. New England Journalist: Highlights in the Newspaper Career of Charles H. Dow. The Business History Review.Vol. 34, No. 1 (Spring, 1960) p. 77-93.

- More on Dow Theory from NLO

Comments Off on Dow Theory Applied to Silver?

Posted in commodities, Dow Theory, gold, Silver

Dow Theory: 1907-1910

iShares Silver Trust (SLV) Update

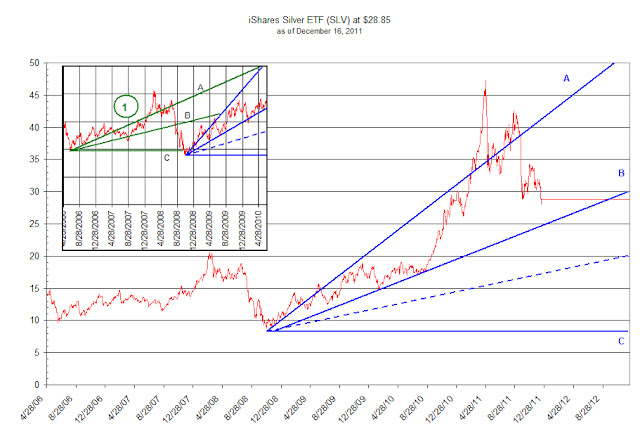

“…we should see SLV tread water for a brief period of time before falling back to the prior low which began with the current run back in November 2008. Dow Theory suggests that a reasonable buying opportunity would exist at [or] below line B (blue line B).”

-

iShares Silver Trust (SLV) Debrief, May 5, 2011

Dow Theory: Bear Market Rally Coming to an End?

Dow Theory: 1903-1907

Dow Theory: 1900-1903

|

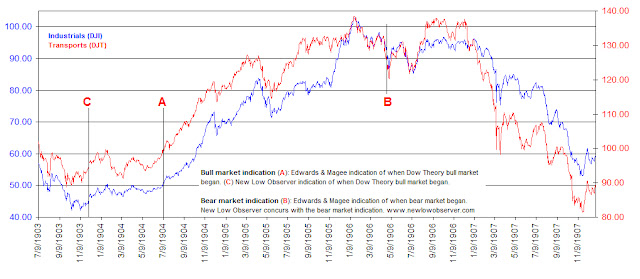

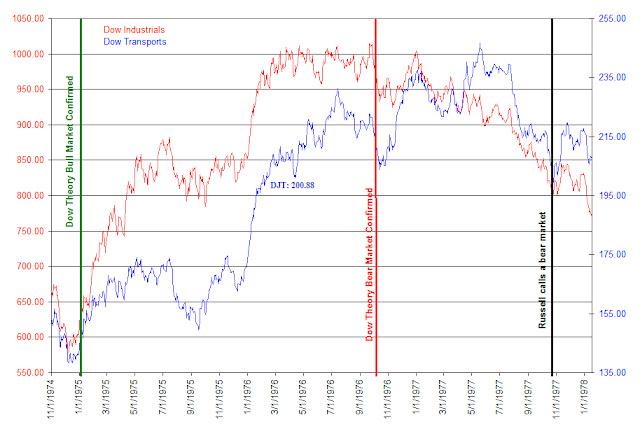

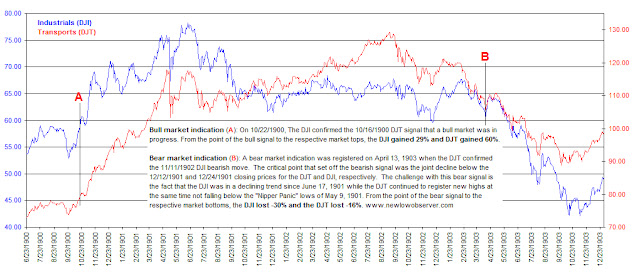

| Industrials (DJI), Transports (DJT) |

Text in chart:

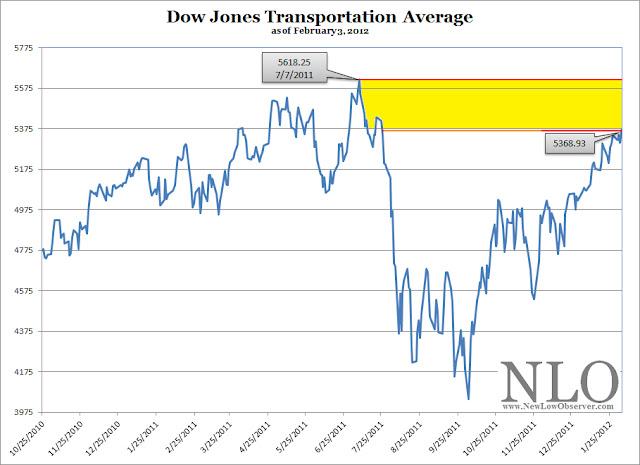

Dow Theory: Market Behaving as Expected

“The coming market volatility will provide great opportunities for traders and allow investors a chance to cash out of otherwise undesirable positions and take profits. Our expectation is that the Dow will go to the July 2011 highs before struggling at the May 2011 highs.”

Dow Theory: Bullish Implications

Posted in aggressive trader, asset allocation, conservative investor, Dow Theory

Tagged members

Dow Theory: Bear Market Downside Target

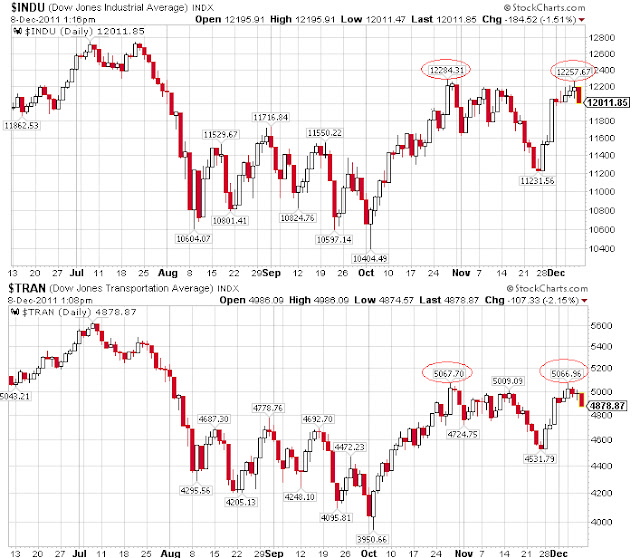

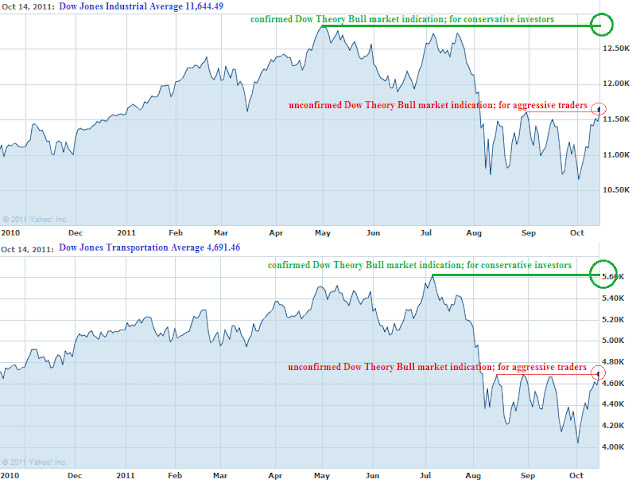

On August 2, 2011, we received what is widely understood to be a Dow Theory bear market indication. According to Dow Theory, a bear market indication shall remain in place until counteracted by a bullish indication. The middle ground, where there is not a new bear market confirmation nor a new bull market signal, is generally considered a range or a “line.”

On August 9, 2011, we presented what we believed to be bear market rally targets according to Dow Theory. In the comment section of that same article, we revised the bear market rally targets based on the low of the Dow Industrials set on August 10, 2011.

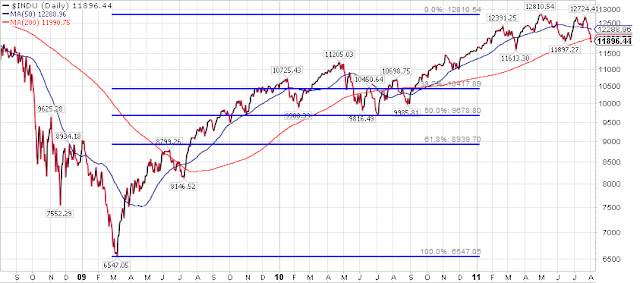

The first bear market rally target, which seems next to impossible for the Dow Industrials to stay above, is 11,416.80. This level was only the first of five upside targets that would need to be breached for any prospect that a renewed cyclical bull market is in the works.

A confirmation of the bear market would be signaled if the Dow Industrials and Dow Transports were to fall below 10,719.94 and 4,149.94, respectively.

According to Dow Theory, we are still in a bear market and the early unconfirmed indications are that we may be headed to the 9,686.48 level.

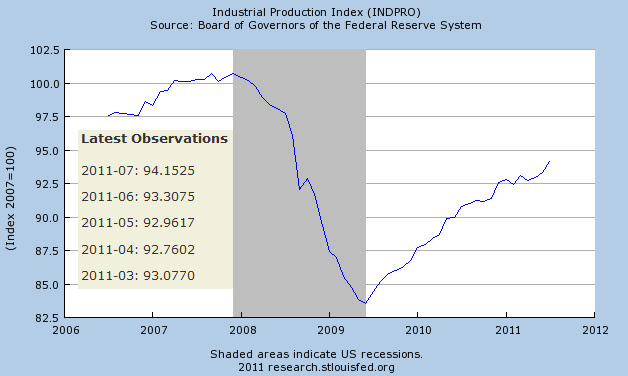

Dow Theory: Bear Market Remains as INDPRO Surges

Posted in bear market rally targets, Dow Theory, Industrial Production Index

Tagged members

2 Years of Profitable Dow Theory Analysis

| Date | Article Title | Topic |

| 8/2/2011 | Dow Theory: August 2, 2011 | A new bear market begins, bull market ends |

| 6/30/2011 | Waiting for Confirmation | Bull market confirmation, next target Apr & May high |

| 6/24/2011 | Dow Theory: Price and Values | Values, price, seeking fair profits |

| 6/13/2011 | Russell: Wrong about the Industrial Production Index | Industrial Production: 1929 and today |

| 5/4/2011 | Price Decline equals Dividends Canceled | Values, dividends, fair profit |

| 4/6/2011 | Richard Russell's Miscue | Russell says 2007-2009 was not bear market |

| 4/6/2011 | Dow Theory: Cyclical Bull Market Confirmed | cyclical bull market confirmation |

| 2/14/2011 | Dow Theory: Continuation of Bull Market Confirmed | cyclical bull market confirmation |

| 11/8/2010 | Dow Theory Q&A | Primary trends, confirmations, S&P in Dow Theory |

| 11/7/2010 | A Lesson In Dow Theory | When to buy, sell, and wait for confirmation |

| 11/4/2010 | Dow Theory: Continuation of Bull Market Confirmed | cyclical bull market confirmation |

| 9/25/2010 | Seeking Ten Percent | Seeking pair profits |

| 9/8/2010 | Dow Theory: The Formation of a Line | Lines |

| 8/5/2010 | Dow Theory, Stock Markets and Economic Forecasting | Economic forecasting, stock markets |

| 6/30/2010 | Dow Theory | Bear market non-confirmation |

| 5/13/2010 | Dow Theory | Secondary reactions |

| 4/13/2010 | Dow Theory Q&A | When to sell; asset allocation |

| 4/11/2010 | Dow Theory | cyclical bull market confirmation |

| 3/23/2010 | Dow Theory | cyclical bull market confirmation |

| 2/23/2010 | Dow Theory Q&A | Manipulation; Averages discount everything |

| 2/22/2010 | Dow Theory | 50% principle |

| 1/24/2010 | Dow Theory | Downside targets |

| 1/19/2010 | Dow Theory on Fair Value | Values and Price |

| 1/10/2010 | Dow Theory | confirmation; line; 50% principle |

| 9/24/2009 | Dow Theory | retest recent lows; going higher |

| 9/2/2009 | Dow Theory | Double tops and Double bottoms |

| 8/25/2009 | Dow Theory | Russell changes from bear to bull |

| 8/24/2009 | Dow Theory | possible non-confirmation |

| 7/24/2009 | Dow Theory | a new bull market begins, bear market ends |

Bear Market Rally Targets

- 11,527.87

- 11.767.18

- 12,073.49

- 12,724.41

- 12,807.51

Posted in bear market rally targets, Dow Theory

Dow Theory: Q&A

“The market is always responsive to the great law of action and reaction. The longer the swing one way the longer it will be the other. One of the best general rules in speculation is the theory that reaction in an advance or a decline will be at least one-half of the primary movement [50% principle].“The fact that the law is working through short ranges and long ones at the same time makes it impossible to tell with certainty what any particular swing may do; but for practical purposes, it is not infrequently wise to believe that when a stock has risen 10 points, and as a result of one or two short swings [double tops] does not go above the high point, but rather recedes from it, that it will gradually work off 4 or 5 points.[1]”

“It often happens that the secondary movement in a market amounts to 3/8 to ½ of the primary movement.[2]”

“Whoever will study our averages, as given in the Journal for years past, will see how uniformly periods of advance have been followed by periods of decline, amounting in a large proportion of cases to from one-third to one-half of the rise. [3]”

“The law of action and reaction applies to both the general market and to individual stocks. This law states that the reaction to an advance or decline will approximate half the original movement.[4]”

“The second type of market low is based on the premise that the Dow fulfills the Wave principle and falls below the upward trending line (red) to the old support level 8100 and then 6440. A true Wave move down to the old low would bring the market below 6440. However, the last time this was fulfilled, in the period from 1970 to 1974, the market only fell 8.5% below the previous low of 631.16 on the Dow Industrials in 1970. Additionally, the Industrials ran up from 631.16 in 1970 to 1051.70 in 1973, an increase of 118% of the previous peak. As more time passes I expect the index to fall to 5474 if we do manage to complete a Wave formation on the downside.”

"Even in a bear market, this method of trading will usually be found safe, although the profits taken should be less because of the liability of weak spots breaking out and checking the general rise.[5]"

[1] Sether, Laura. Dow Theory Unplugged. W&A Publishing. 2009. page 112.

[2] Dow, Charles H. Wall Street Journal. January 22, 1901.

[2] Bishop, George. Charles H. Dow and the Dow Theory. Appleton-Century-Crofts. New York. 1960. page 120.

[2] Sether, Laura. Dow Theory Unplugged. W&A Publishing. 2009. page 117.

[3] Dow, Charles H. Wall Street Journal. January 30, 1901

[3] Bishop, George. Charles H. Dow and the Dow Theory. Appleton-Century-Crofts. New York. 1960. page 120.

[3] Sether, Laura. Dow Theory Unplugged. W&A Publishing. 2009. page 199.

[4] Bishop, George. Charles H. Dow and the Dow Theory. Appleton-Century-Crofts. New York. 1960. page 231.

[5] Schultz, Harry D. A Treasury of Wall Street Wisdom. Investors' Press. (New Jersey, 1966). p. 12. Additional commentary here.

Posted in 50% principle, Dow Theory, law of action and reaction