I am assuming that by "portfolio" is meant all investable funds among all asset classes like stocks, bonds, commodities, etc.

1) You had 94% of all investable funds in Wesco at one time which to me appears extreme concentration in one asset class, regardless of how confident one is about the prospects. And since the future is unpredictable, I believe the risk/reward outcome unnecessarily becomes a hostage to the "Black Swan" events.

I do note that you had a timely and efficient loss control mechanism in place and that you sold out at a minimal loss. But that might be because you had such a huge overweight in that one stock, forcing you to watch it like a hawk. Had it been a small weight, you might have acted differently, even not having sold out and thus made a much greater profit in absolute terms since Wesco climbed 10% to 15% higher soon after you sold it.

This is a good example of why single, huge overweight concentration in one security is generally counterproductive because we are forced into taking quick actions based on short term volatility and transient perceptions of risk.

2) Almost ten times out of a total of 40 trades you let your realized losses exceed 10% and in one case even go as high as 46%. I am not averse to enduring high unrealized losses in special cases wherein we are convinced about the intrinsic value of the investment, and are willing to "ride out the storm". This is a part of the process of investing. However, I wonder what intrinsic value, or a miraculous turnaround, you were seeing holding Fannie May during the summer and early fall of 2008. Granted, you had a small allocation to this name at the time, but the expectations surrounding this trade appear to me to be speculative in nature.

3) After September every trade was a losing trade (except the three with small profits), all the way through the end of the year. And that was not in the least unusual, since being in the stock market was simply not the right strategy at the time. I am not sure what the Dow Theory was telling us around this time -- during this period of extreme volatility and spreading risks throughout the investment landscape globally. Maybe you can throw some light with respect to the Dow Theory in this context, for this period. And also whether any other asset allocations were considered and rejected. (For instance, 4Q08 provided bountiful profits in the Treasury bonds with minimal volatility and low risk.)

Touc's Reply:

Yes, by portfolio I mean all investable funds that are transacted through a brokerage firm. The percentages given are specific to any and all cash holdings in all brokerage accounts. As part of a truly diversified portfolio, I hold physical gold and silver, real estate and a minority ownership in a restaurant.

Your points about extreme concentration are quite valid, on the surface. However, as you’ll note in my article “

Diversification Doesn’t Matter,” the general declines of the market are going to take out an investor no matter how diversified. In fact, the more diversified the account within the realm of stocks, the more likely diminished returns will occur.

Regarding the issue of “

black swan” events, as a student of stock market crashes and panics, I have built in the prospect of a “

black swan” in every transaction. First, I assume that I will lose at least 50% of my investment before entering into an investment. Second, I accept the reality of the situation based on such thinking. Third, by having an undiversified portfolio, I can clearly address scenarios that exceed losses of 50% or more without a deleterious impact on my mental faculties. With this in mind, I can better determine the risks that I’m about to take.

The matter of Wesco Financial (WSC) is an interesting one to point out. There are at least a couple thoughts, which I will try to elucidate upon. First and foremost is the transaction that preceded the WSC trade. In less than 2 months I was able to advance 96% of my portfolio by 10% with Family Dollar Stores (FDO). All that mattered to me was to not wipe out the gain immediately after accomplishing such a feat. As pointed out, I probably would have acted differently had the position been smaller. The tendency of most diversified (smaller postions) investors is to watch calmly as their entire portfolio declines until the market or stock cannot fall any further, at which point the investor panics and sells at the bottom.

The next issue of concern regarding the Wesco (WSC) trade is the missed gains that followed after selling the stock. This is something that is most pronounced with the entire

sell recommendations that I have given on both Dividend Inc. and New Low Observer. In my opinion, investors face two types of greed, one for profit and one for loss. Under the conditions of both forms of greed, only losses can become permanent. I seek to mitigate both extremes of greed for what I am ultimately able to keep. I am unanimous (wink) in declaring that I seek mediocre returns or “

fair profits.” In some respects, my willingness to accept missed gains and 50% losses keeps me righted. The fact that my returns have exceeded the downward spiral of 2008 with positive gains is only icing on the cake.

To be honest, I never felt the strain of getting in or out of a stock quickly enough. There never was a sense of being rushed. No wondering in the middle of the night what is going to happen to my outsized trade? After all, either I’m right or I am wrong and the markets will tell me soon enough. For this reason, I was never overwhelmed by the sense that somehow I missed an opportunity. I kept my eye on all the current and former Dividend Achievers and stuck to my core competency.

Fannie Mae (FNM) wasn’t a situation of whether the company had any intrinsic value or not. I simply speculated that the government assurance would bolster the share price of FNM. I was completely wrong about the FNM speculation. However, I ensured that the losses didn’t exceed the gains from the (AIG) speculation that occurred on 2/28/2008, 9/23/2008 with 82% and 38% respectively. Also, I didn’t want to wipe out the Bear Stearns (BSC) speculation of March 14, 2008 with 26% of the portfolio. Another matter of concern is the fact that by September 29, 2008, I had amassed gains of 41% in the same portfolio. I knew I was “playing” with house money. FNM just happened to be one (of many) that didn’t go my way.

The question of my take on Dow Theory in the last quarter of 2008 is very clear. In a Dividend Inc. article titled “A Key Point for the Market” dated October 6, 2008, I stated the following*:

“Today the Dow Jones Industrial Average has fallen to the minimum of 9525.32. This exceeds the Dow Theory projection of 9531.11 posted on this blog on September 17, 2008. Nothing that has happened thus far is surprising according to Dow's Theory. It becomes academic at this point to suggest that we are either going to the 7197.60 level…”

On September 17, 2008, in an article titled “Dow Theory on the Dow Industrials,” I stated the following*:

“After today's stock market action the Dow Jones Industrial Average closed at the level of 10,609.66. This is below the 50% Principal as devised by E. George Schaefer. The 50% principal indicates that if a stock or index falls below this level it will fall, at minimum to the 2/3 level of Dow's Theory. Right now the 2/3 level for the Dow Jones Industrial Average is 9531.11. If the Dow falls below the 2/3 level the next stop will be 7,197.60.”

Although Dow Theory had given a bear market signal, as indicated by Richard Russell’s

November 2007 Barron’s article, I stuck to my core competency which is current and former Dividend Achievers with some speculation in gold and silver stocks. Dow Theory, for me, has acted as a guidepost for the market’s general direction, which affects the concentration of each individual stock. However, if Dow Theory were interpreted as Charles Dow has indicated (an approach which I reiterate throughout the site), investors would do well to heed Dow’s remark that “

even in a bear market, this method of trading will usually be found safe…”

Thank you for your sincere interest and the opportunity to discuss, at length, the ideas that went into some of my trades during 2008.

-Touc

*

anyone interested in the articles dated September 17, 2008 or October 6, 2008 can send an email to me. Those who regularly received the RSS feed or automatic updates should look under the respective dates that the feeds or emails went out from Dividend Inc. I hope you still have those articles.

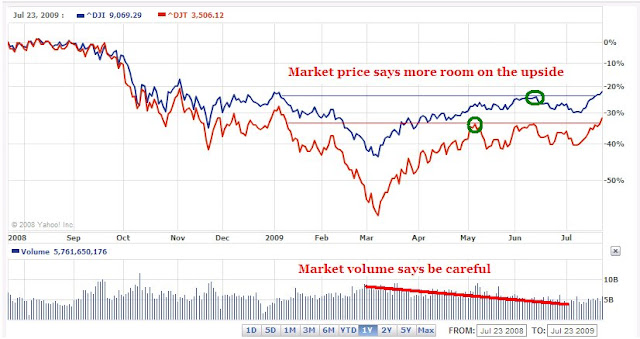

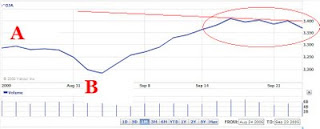

Currently, we're faced with the double top indicated as D1 and D2. From what I can tell, if the decline from D2 goes any further below the August 17th low then we may retrace up to 75% of the gains from C2 to D1. This assessment is based on the prior correction of A2 to C1 from the rise of B2 to A2. On the way down to C2 there are smaller support levels however their significance is not as pronounced as the percentage change from A2 to C1. We should assume the worst case scenario and expect that the Transports will go to 3239.36. Falling to points C1 and B1 would be the next order of operation.

Currently, we're faced with the double top indicated as D1 and D2. From what I can tell, if the decline from D2 goes any further below the August 17th low then we may retrace up to 75% of the gains from C2 to D1. This assessment is based on the prior correction of A2 to C1 from the rise of B2 to A2. On the way down to C2 there are smaller support levels however their significance is not as pronounced as the percentage change from A2 to C1. We should assume the worst case scenario and expect that the Transports will go to 3239.36. Falling to points C1 and B1 would be the next order of operation.