Members

-

Topics

Archives

-

-

Recent Posts

-

-

-

Investor Education

Market Return After Exceptional Years

Dollar Cost Averaging Tool

Dow Theory: The Formation of a Line

Dividend Capture Strategy Analysis

Golden Cross – How Golden Is It?

Debunked – Death Cross

Work Smart, Not Hard

Charles H. Dow, Father of Value Investing

It's All About the Dividends

Dow Theory: Buying in Scales

How to Avoid Losses

When Dividends are Canceled

Cyclical and Secular Markets

Inflation Proof Myth

What is Fair Value?

Issues with P-E Ratios

Beware of Gold Dividends

Gold Standard Myth

Lagging Gold Stocks?

No Sophisticated Investors

Dollar down, Gold up?

Problems with Market Share

Aim for Annualized Returns

Anatomy of Bear Market Trade

Don’t Use Stop Orders

How to Value Earnings

Low Yields, Big Gains

Set Limits, Gain More

Ex-Dividend Dates -

-

Historical Data

1290-1950: Price Index

1670-2012: Inflation Rate

1790-1947: Wholesale Price Cycle

1795-1973: Real Estate Cycle

1800-1965: U.S. Yields

1834-1928: U.S. Stock Index

1835-2019: Booms and Busts

1846-1895: Gold/Silver Value

1853-2019: Recession/Depression Index

1860-1907: Most Active Stock Average

1870-2033: Real Estate Cycles

1871-2020: Market Dividend Yield

1875-1940: St. Louis Rents

1876-1934: Credit-New Dwellings

1896-1925: Inflation-Stocks

1897-2019: Sentiment Index

1900-1903: Dow Theory

1900-1923: Cigars and Cigarettes

1900-2019: Silver/Dow Ratio

1901-2019: YoY DJIA

1903-1907: Dow Theory

1906-1932: Barron's Averages

1907-1910: Dow Theory

1910-1913: Dow Theory

1910-1936: U.S. Real Estate

1910-2016: Union Pacific Corp.

1914-2012: Fed/GDP Ratio

1919-1934: Barron's Industrial Production

1920-1940: Homestake Mining

1921-1939: US Realty

1922-1930: Discount Rate

1924-2001: Gold/Silver Stocks

1927-1937: Borden Co.

1927-1937: National Dairy Products

1927-1937: Union Carbide

1928-1943: Discount Rate

1929-1937: Monsanto Co.

1937-1969: Intelligent Investor

1939-1965: Utility Stocks v. Interest Rates

1941-1967: Texas Pacific Land

1947-1970: Inventory-Sales Ratio

1948-2019: Profits v. DJIA

1949-1970: Dow 600? SRL

1958-1976: Gold Expert

1963-1977: Farmland Values

1971-2018: Nasdaq v. Gold

1971-1974: REIT Crash

1972-1979: REIT Index Crash

1986-2018: Hang Seng Index Cycles

1986-2019: Crude Oil Cycles

1999-2017: Cell Phone Market Share

2008: Transaction History

2010-2021: Bitcoin Cycles -

Interesting Read

Inside a Moneymaking Machine Like No Other

The Fuzzy, Insane Math That's Creating So Many Billion-Dollar Tech Companies

Berkshire Hathaway Shareholder Letters

Forex Investors May Face $1 Billion Loss as Trade Site Vanishes

Why the oil price is falling

How a $600 Million Hedge Fund Disappeared

Hedge Fund Manager Who Remembers 1998 Rout Says Prepare for Pain

Swiss National Bank Starts Negative

Tice: Crash is Coming...Although

More on Edson Gould (PDF)

Schiller's CAPE ratio is wrong

Double-Digit Inflation in the 1970s (PDF)

401k Crisis

Quick Link Archive

Category Archives: Dow Theory

Dow Theory: Downside Targets

It has been almost two months since our last Dow Theory posting. This is as it should be, since Dow Theory does not require a daily accounting of changes to the market. As indicated in Robert Rhea’s The Dow Theory:

“There are three movements of the averages, all of which may be in progress at one and the same time. The first, and most important, is the primary trend: the broad upward or downward movements known as bull or bear markets, which may be of several years’ duration. The second, and most deceptive movement, is the secondary reaction: an important decline in a primary bull market or rally in a primary bear market. These reactions usually last from three weeks to as many months. The third, and usually unimportant, movement is the daily fluctuation.” (source: Rhea, Robert. The Dow Theory. Barron’s, New York. 1932. Page 32.)

Posted in Dow Industrials, Dow Theory, Dow Theory Bull Market indication, Dow Transports, downside

Tagged members

Dow Theory Q&A

Reader BlueIce comments (found here):

“So for the past four years, the NYSE is up but volume down…What is the root cause, if any? Bank Bernankski ?”

Our Response:

While there is considerable belief that the Federal Reserve has been the main driver in the financial markets since the March 2009 low, we believe that the Fed’s activity has NOT YET been felt in the stock market. First we’ll explain the two primary reasons we believe this. Afterwards, we’ll explain what we believe are the possible outcomes to the Fed’s current policies.

First, in our January 19, 2011 article titled “Federal Reserve Isn’t to Blame for the Current Market Run” (found here), we concluded with the following thought:

“A cursory review of market data during the periods from 1860 to 1914 makes it clear that declines of nearly -50% or more are likely to retrace +66% to +100% of prior declines. This pattern has been easily demonstrated in the periods after 1914. However, we’re only trying to illustrate that the acceptance of the Federal Reserve’s role as the leading cause of the current +69% retracement of the prior decline (2007-2009) is false.”

We’ve maintained the view that the Federal Reserve’s impact on the stock market has been muted so far.

Second, regarding the issue of manipulation of the markets, which is implicit in the discussion of the Federal Reserve’s involvement in the rise of the stock market, we take the Dow Theory view on the topic. Charles H. Dow was very specific about market manipulators and manipulation. Dow has said that manipulation is a factor of the market in the day-to-day movement. However, the long-term trend of the market cannot be manipulated as demonstrated in detail from the writings of William Peter Hamilton, former editor of the Wall Street Journal.

Hamilton says of manipulation:

“The market is always under more or less manipulation.”

“Even with manipulation, embracing not one but several leading stocks, the market is saying the same thing, and is bigger than the manipulation”

“Major Movements Are Unmanipulated-One of the greatest of misconceptions, that which has militated most against the usefulness of the stock market barometer, is the belief that manipulation can falsify stock market movements otherwise authoritative and instructive”

“These discussions [of manipulation] have been made in vain if they have failed to show that all the primary bull markets and every primary bear market have been vindicated, in the course of their development and before their close, by the facts of general business, however much over speculation or over-liquidation may have tended to excess, as they always do, in the last stage of the primary swing”

“It has been shown that, for all practical purposes, manipulation has, and can have, no real effect in the main or primary movement of the stock market, as reflected in the averages. In a primary bull or bear market the actuating forces are above and beyond manipulation. But in the other movements of Dow’s theory, a secondary reaction in a bull market or the corresponding secondary rally in a bear market, or in the third movement (the daily fluctuation) which goes on all the time, there is room for manipulation, but only in individual stocks, or in small groups, with a well-recognized leading issue”

(Source: Hamilton, William Peter, The Stock Market Barometer, Wiley & Sons, New York, 1922.)

The Fed and world central bank manipulation has an impact on the day-to-day and maybe the medium-term, however, the long term will exert itself regardless of the manipulation.

Finally, while we are skeptical about the Dow Theory secular bull market indication, we have to accept that it is real. As with most economic policy, the impact is felt long after the implementation. Dow Theory might be saying that we’re about to enter a phase hyper-activity in the stock market. If this is the case, then we just might see the impact of the Federal Reserve’s stimulus of the last several years finally kick in, catapulting the stock market to unbelievable heights.

The lack of trading volume in the stock market since 2009 reflects little or no participation on the part of the public. If this is true, then any meaningful rise in trading volume (on the buying side) due to added participation from the public could result in tremendous gains. This thought sits in the back of our mind as we strategize the best way to take advantage while not being over exposed.

When we say that the public hasn’t participated in the stock market’s rise, who cares? The answer is the very financial institutions that required bailouts in 2008. They have been trading amongst each other in a game of hot potato. If the public doesn’t jump in soon there could be major fireworks to the downside.

Again, if the Dow Theory bull market indication isn’t real then we’ll see another round of “too big to fail” institutions coming with hat in hand to the U.S. government. The most vulnerable institutions could be those that were forced to merge with companies like Bank of America/Merrill, Wells Fargo/Wachovia and JPMorgan/Bear Stearns. From our research on this topic, we’ve seen what happens when a sizable failed institution is forcibly merged with an ailing but salvageable company (i.e. our article on CreditAnstalt).

Comments Off on Dow Theory Q&A

Posted in Dow Theory, manipulation, Q and A, William Peter Hamilton

Apple’s Pain May Be a Warning for the Dow Indices

Since the bull market run began in 2009, Apple (AAPL) analysts have been making persuasive arguments for the stock. The fundamental case for Apple includes price-to-earnings, price-to-sales, cash reserves, China as an untapped market, etc. However, as investors have found out, it is the price that matters most as Apple’s stock has taken a hit from the high of $702 on September 19, 2012 to the current price of $443 (March 18, 2013). While fundamentals are important, there is one obvious problem and that is the trading volume.

In the section on Dow Theory, in the Edwards and Magee book Technical Analysis of Stock Trends, volume is interpreted in the following manner:

“…in a Bull Market, volume increases when prices rise and dwindles as prices decline; in Bear Markets, turnover [volume] increases when prices drop and [volume] dries up as they [prices] recover (33).”

When we compare the previous bullish moves in Apple’s stock price, we find that the most recent run-up stands out as trading volume has not only failed to increase with the stock price, it has been on a divergent path by declining. However, we need to see how different this most recent rise in the stock price is in contrast with the previous bullish moves.

In the bull market run of Apple from December 30, 1997 to February 29, 2000, the stock price rose +900% while average trading volume increased +1,000%.

In the bull market run of Apple from April 1, 2003 to December 30, 2007, the stock price rose over +1,400% while average trading volume increased +1,000%.

In the bull market run of Apple from January 21, 2009 to the present, the stock price rose nearly +900% while average trading volume decreased -51%.

The obvious problem with the current rise in the price of Apple from the January 21, 2009 low to the September 19, 2012 high is that while the stock price has increased dramatically, the trading volume has fallen precipitously. Already, Apple has inexplicably declined –36% from the high. There is little in the way to indicated that the blood-letting is over.

According to Robert Rhea, in his book The Dow Theory, “…the volume of trading has proved to be such a useful guide in attaining proficiency in the art of forecasting market trends that it is necessary to urge all students to study intently the relation of volume to price movement (88).”

It would be foolish for us to think that the decline in volume, from 2009 to the present, while the stock price increased wasn’t a warning sign. It is suggestive of the fact that all was not well and therefore the party had to end at some point in time. This is despite the otherwise glowing fundamentals that are associated with Apple.

Now, if the almighty Apple can decline –36% in spite of the glowing fundamentals as the Dow Industrials and Dow Transports keep going higher, then what is the fate of two main components of Dow Theory? By all indications, we should be considered to be in a bear market based on the fact that the price of the Industrials and Transports is increasing as the trading volume dries up.

From our vantage point, there are two distinct outcomes possible for the stock market, based on the above quoted sources. Either the stock market explodes higher than anyone has ever imagined possible or the stock market declines, –20% to –30% from the current level, as average trading volume skyrockets. However, our experience so far has been for volume to decrease as the price increased. Therefore, by our logic, when and if volume starts to increase it will be because institutions will be selling instead of buying the market.

While we have constructed two possibilities, the probabilities are something else altogether. We think that the fact that volume has been in a clear declining trend, the probabilities favor a decline of the stock market over a sustained increase. To put this idea into perspective, when we wrote our April 14, 2012 article titled “Consider the Downside Prospects for Apple,” we said that Apple would decline to $424 (found here). After the article was written, Apple increased by +11%. However, after Apple peaked, the stock declined –30% from the price where our article was written. Our only question is, was it worth seeing a rise of +11% only to realize a loss of –30%?

Notes:

-

Because we have a substantial amount in cash and a majority of our holdings that are the profit portion intended to compound over time, we are only compelled to sell those positions that are recent short-term purchases that are more than 5% of our existing portfolio.

-

Our Canadian Dividend Watch List should be coming out this week

Comments Off on Apple’s Pain May Be a Warning for the Dow Indices

Posted in AAPL, Dow Industrials, Dow Theory, Dow Theory Non confirmation, Dow Transports

Dow Theory: The Beginning of a Cyclical and Secular Bull Market?

The world of Dow Theory was abuzz after the Dow Jones Industrial Average and the Dow Jones Transportation Average charged to all-time highs on March 5, 2013 (found here). At the time, the Dow Jones Industrial Average had finally capitulated to the inexorable forces that had long since propelled the Dow Jones Transportation Average above the 2011 all-time high. The confirmation of a Dow Theory bull market came when the Dow Jones Industrial Average finally exceeded the all-time high of 14,164 set in October 2007.

The action of the Dow Industrials and Transports has been so compelling that Dow Theorist Richard Russell acquiesced to the strength of the market on March 11, 2013 by saying the following:

“Yes, I know that this market is uncorrected during its long rise from the 2009 low, and I know that there are risks in buying an uncorrected advance that is becoming uncomfortably long in the tooth, but my suggestion is that my subscribers should take a chance (after all, Columbus took a chance) and take a position in the DIAs.”

In the same posting, Russell later punctuates the point by saying:

“I really believe that subscribers should take a flyer on this market. After all, after weeks of flirting with a new high in the Industrial Average, the Dow finally confirmed the previous record high of the Transportation Average. With the Industrials and the Transports both in record high territory, I think being in the market is justified under Dow Theory.”

By all indications, this Dow Theory bull market indication is the real deal, especially when it is endorsed by Russell’s 55 years of experience on the topic. The implications of this signal are significant for one very important reason, this time we’ve achieved a secular bull market indication (learn about cyclical and secular trends).

Throughout stock market history, cyclical primary bull markets tend to last 2-4 years. These bull markets require rapt attention to the nuances and vagaries of changes in the trend. The last indication of a cyclical primary bull market was on July 23, 2009, when the Dow Industrials traded at 9,069.29. Based on our interpretation of Dow Theory, we received a cyclical primary bear market indication on August 2, 2011 when the Dow Jones Industrial Average was at 11,866.62.

Secular bull markets, on the other hand, require very little attention and have typically lasted between 15 and 18 years. Secular bull markets are the proverbial sweet spot of investing with the trend, where “buy-and-hold” is the rule. The two most prominent secular bull markets resulted in the Dow Jones Industrial Average increasing by 10-fold or more. From 1942 to 1966, the Dow rose from 100 to 1000 and in the period from 1982 to 2000, the Dow went from 1,000 to 11,722. If the current implications are correct, we could be on the cusp of a run to Dow 100,000.

Volume: The Lone Holdout

The three major components of Dow Theory are the Industrials, Transports and trading volume. As described above, the Industrials and Transports have achieved the required all-time highs at (or near) the same time which would indicated that we are in a new cyclical AND secular bull market. However, volume has been the holdout in the current move higher.

In the seminal book on Dow Theory titled The Stock Market Barometer, written by William Peter Hamilton, it says the following about trading volume, “It is worth while to note here that the volume of trading is always larger in a bull market than in a bear market. It expands as prices go up and contracts as they decline.”

The average trading volume for the Industrials and Transports has been in a declining trend (contracting) since the 2009 low, as seen in the charts below.

In order for Dow Theory to have relevance, increasing volume needs to accompany the rise of the stock market to ensure that there is sufficient participation and interest. Unfortunately, average trading volume, as indicated in the above charts for the respective indexes, has been trending lower since 2009. This suggests that we could only be in an extended cyclical bull market, within a secular bear market, rather than at the beginning of a cyclical and secular bull market. The key to understanding trading volume and its interpretation are found in the table below.

| volume | price | interpretation |

| decrease | decrease | positive |

| decrease | increase | negative |

| increase | decrease | negative |

| increase | increase | positive |

In the days before volume was tabulated for the individual Dow indexes, the New York Stock Exchange trading volume was the proxy for the market trend in conjunction with the Industrials and Transports. Below is the 200-day average trading volume of the NYSE since 2001.

What is evident is the dramatic rise and peak of average trading volume during the decline of the stock market from the peak in 2007 to the bottom in 2009. However, once the market started taking off, the trading volume uncharacteristically plunged. To emphasis the point, below we have included the charts for the cyclical bull markets from 2001-2007 and 2009 to the present.

In the chart from 2001, we can see that NYSE average trading volume hit a peak in 2002 and then flat-lined for a couple of years until 2005. However, as the strength in the stock market grew, the trading volume accelerated to new highs. This was the hallmark of a true bull market run, rising prices and rising volume.

In the chart from 2008, the average trading volume for the NYSE has had a declining trend throughout the whole bull market run from 2009 to the present. As indicated in the table above, declining volume with increasing prices should be interpreted as a negative. After volume has been in a declining trend for so long, the only alternative is for a dramatic increase.

When the increase in volume arrives, the question then becomes, will there be a dramatic increase or decrease in stock market price? Will the general public’s lack of participation be the catalyst that charges the market to move higher? This situation has to be resolved at some point.

To round out our thoughts on the potential secular bull market signal that we recently received, we thought we would compare it to the last secular bull market change in trend. In the period from 1966 to 1982, the Dow Industrials never traded significantly above 1,000. However, that all ended in late 1982 when the stock market broke above 1,000 and never looked back.

Below is a chart of the Industrials, Transports and NYSE trading volume from March 1982 to November 1982:

The most important information to be gleaned from this chart is the fact that all three of the essential indicators for Dow Theory were confirming each other at a critical point in time. They all achieved clear bull market indications by rising in unison. The current divergence between the Dow indexes with the NYSE trading volume suggests that we will be witness to the greatest transition in the history of the stock market.

The above examination of trading volume, based on a what we believe to be reliable sources, has us concerned that a new secular bull market is not really what we’re witness to.

As William Peter Hamilton has said in The Stock Market Barometer:

“The professional speculator is no more superfluous than the pressure gauge of the steam-heating plant in your cellar. Wall Street is the great financial power house of the country, and it is indispensably necessary to know when the steam pressure is becoming more than the boilers can stand.”

The pressure in the market is building and we may be watching the beginning of the most spectacular stock market blow-off ever. Just before an even more astonishing decline.

Dow Theory

On March 5, 2013, we got a declarative indication from Dow Theory suggesting that we are now in a new primary bull market that has cyclical and secular implications. As seen in the chart below, both the Dow Jones Industrial Average and Dow Jones Transportation Average have reached new all-time highs, designated by going above the respective dashed lines.

NLO Q&A

Subscriber F.H. asks:

“[Have you] ever consider[ed] constructing a market trend indicator like Richard Russell’s PTI?”

Our Response:

This is a great question and one that we’ve examined in the past.

We are familiar with Russell's Primary Trend Indicator (PTI). In fact, we know the exact constituents of the indicator. According to Richard Russell, editor of The Dow Theory Letters since 1958( www.dowtheoryletters.com), the PTI is a “technical spectrum of the stock market” that cannot be manipulated. Russell goes on to say "...you can fool one or two of these technical items, but you can’t fool all eight of them, and that’s what the PTI is all about." The goal of the indicator is to provide solid indications of market direction that cannot be manipulated.

As a subscriber to Russell's Dow Theory Letters, you are well aware of the many times that the PTI was right and Russell was wrong about the direction of the stock market. However, we're more concerned with the fact of how much advantage does the PTI provide compared to simply using Dow Theory.

Here is what we’ve found. According to Dow Theory, on July 23, 2009 a new cyclical bull market began. At the time we recommended investing in the highest weighted stocks of either the Industrials or Transports index or the purchase of ETFs for the Industrials (DIA) or Transports (IYT) (article found here).

On the other hand, the Primary Trend Indicator (PTI) gave the first hint that we were in a cyclical bull market on August 25, 2009. In addition, the PTI didn’t give the “all clear”, in terms of being in a bull market, until November 30, 2009 (as seen in chart below). In fact, a good technical analyst would have had tremendous difficulty in getting a clear indication based on the PTI until after the December 8, 2009 rebound.

There is an alternative view on interpreting an earlier signal than the Dow Theory indication using the PTI. However, you would need to apply Dow’s theory in order to properly achieve the earlier signal based on the PTI movement. Using the purple line above, an individual could have interpreted that a cyclical bull market tentatively started as early as May 4, 2009, when the PTI exceeded the January 2009 peak. Subsequent to the May 4th peak, the PTI did not decline below the 89-day moving average on May 27, 2009, suggesting that more upside existed.

However, when we refer back to Russell’s June 3, 2009 issue there is no indication that a tentative new bull market was in play. No mention that May 4, 2009 or May 27, 2009 were possible indications of a new bull market in stocks. In fact, Russell commented that “…ridiculous but unseen green shoots is now repeated everywhere. I’ve stated that a true bear market bottom usually requires many weeks or even months before the crowd turns bullish.” This comment along with the picture of a bear at the top of his newsletter was the only indication that we had that we were still in a bear market, according to Richard Russell.

Because we have studied the PTI in detail, we've determined that it is not worth including in our work. In fact, we’ve found that it is more noise on the market when compared to correct, albeit conservative, interpretation of Dow Theory. If we get Dow Theory right, then we don’t need another indicator to follow that could potentially confuse our primary indications based on Dow’s work. Yes, we will take in as many views as possible, however, we will rely on Dow Theory as the primary indicator for market direction.

Finally, to create an indicator that is supposed to be impervious to manipulation while at the same time practicing Dow Theory is doubling the effort necessary in watching the movements of the market. We’ve outlined in extensive detail the role that manipulation plays in the stock market and how the interpretation of Dow Theory mitigates the most extensive manipulation possible (found here).

Subscriber F.H. Asks:

In regards to our recent posting of the 2012 Portfolio Performance Review F.H. asks, “…I am wondering if the methodology will allow this streak to continue. the process, as I understand it, is to buy stocks at their lows, hold them for a significant gain, and then sell a portion of the position but retain some % of original principal in the investment. won’t the portfolio eventually have such a large percentage of these residual holdings that the incremental effect on returns from the new positions will be overwhelmed?”

Our Response:

In theory, the primary drawback would be that we’ll be working with the same amount of cash over an extended period of time whenever we sell the principal. However, we’re comfortable with continually adding new cash to the portfolio so that we are not faced with the very real potential of our residual holdings dwarfing our capital base.

Our strategy is the literal application of a concept that is outlined in the book Rocking Wall Street by Gary Marks. In an interview on June 2, 2007 with Financial Sense Newshour host Jim Puplava (found here), Marks gives insight as to the reasons why an investor might want to employ the strategy that we’ve outlined with selling the principal and letting the profits run. The interview is so good that we’ve indexed the various topics covered in the interview below.

| minutes | topic | |

| 3:57-4:57 | Art and Craft of Investing | |

| 6:48-8:25 | Investing is About Less Risk Over Time | |

| 16.03-17:13 | Emotional Risk causes Gambling Modality | |

| 17:15-19:28 | Myth of Tax Savings from Buy and Hold | |

| 19:29-21:39 | Myth of Buy and Hold | |

| 25:32-28:10 | Risk to Real Estate | |

| 28:11-31:57 | Cash as a Hedge | |

| 38:58-42:05 | portfolio construction & life balance |

The discussion of the “Art and Craft of Investing,” as described by Marks, is exactly what we’re practicing and what we believe will give any investor the benefits that are claimed that the stock market can offer. Our approach is in stark contrast to the belief that if you practice Dow Theory you must go all in when the signal is bullish and sell everything when the signal is bearish, but at the same time you’re supposed to compound your way to investment wealth.

We agree with 95% of the strategies described by Marks in the Financial Sense interview. After weighing the merits of various investing approaches, we’ve tried to responsibly provide methods for investing while limiting the risk of excessive loss.

Comments Off on NLO Q&A

Posted in Dow Theory, PTI, Richard Russell

Dow Theory: Waiting for Confirmation

Today the Dow Jones Transportation Averaged (DJT) closed at a new all-time high.

Posted in Charles H. Dow, Dow Theory, Dow Theory Bull Market indication, S.A Nelson, William Peter Hamilton

Tagged members

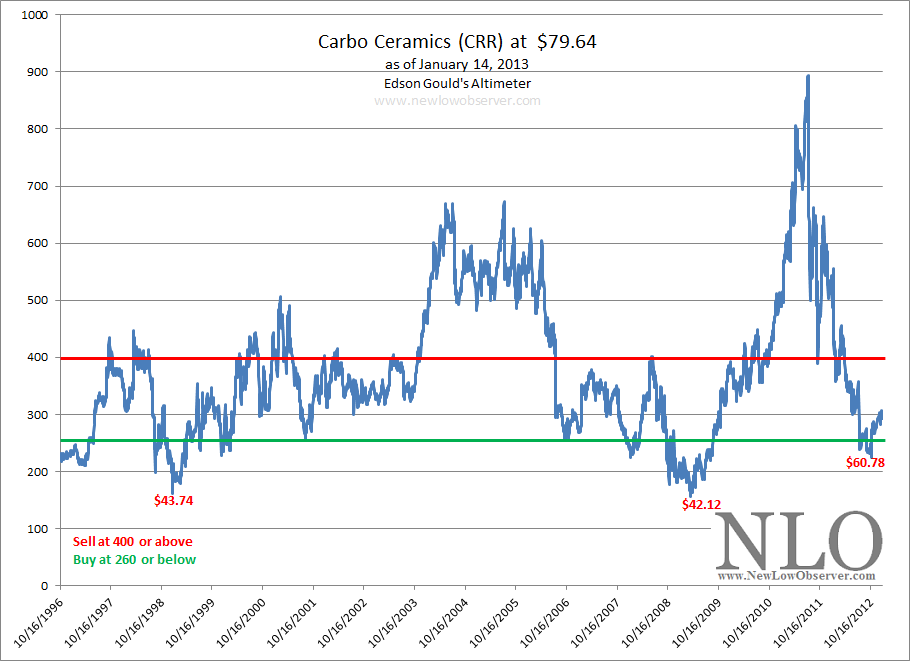

Technical Review: Carbo Ceramics (CRR)

Carbo Ceramics (CRR) was one of the companies that appeared at the top of our dividend watch list for many weeks beginning in February 2012. The watch list served as a beginning point for our research and we took a position in August (found here) at $65.02 (green arrow on chart below). Within three months, we saw shares of CRR rally to $74, a +13.8% gain. As such, we ‘hedged’ our position by selling the principal (found here) and let the profit run (red arrow on chart below).

Recent activity in Carbo Ceramics price suggests that, on a technical basis, the decline is over. Though a rally to its intraday peak of $180 is not expected, we believed there is a good opportunity for those interested in a short to medium-term speculative position in the stock.

In our view, the biggest bull case, on a technical basis, is that the 50-day moving average has crossed above the 150-day moving average creating what some call a "golden cross." We rely on the 150-day versus the more popular 200-day moving average for the fact that it is the road less traveled and provides an indication ahead of the crowd.

Currently, shares of Carbo Ceramics are trading just above the 50-day moving average, making this an ideal short-term transaction. For those who wish to trade this generally significant technical pattern, we’d consider selling if shares close below the 150-day moving average or if the stock gains +10% or more.

From a fundamental standpoint, Carbo Ceramics (CRR) provides long-term holders of the stock with the following attributes:

-

According to Value Line Investment Survey, the fair value for CRR is 14 times 2012 cash flow of $6.50, or a stock price of $91, a gain of +14% above the current price of $79.64. As an alternative, if the estimates by Value Line are correct, the 2013 fair value figure is $100.10, a potential gain of +25.69%.

-

Value Line indicates that Carbo Ceramics has increased the dividend for 12 consecutive years in a row.

-

Carbo Ceramics book value has had an annualized growth rate of +14.73%.

-

Carbo Ceramics has no debt

What Is the Downside Risk If I Want to Hold CRR for the Long-Term?

Dow Theory has the following downside targets for Carbo Ceramics:

-

$61.34

-

$44.39

-

$27.43

Based on the work of Edson Gould, Carbo Ceramics has the following Altimeter:

Carbo Ceramics would have to fall to $70.20 in order to be considered a buy using the Altimeter above. However, as has been the case in the past, seldom does the Altimeter decline to the buy level and then immediately reverse to the upside. therefore we’d expect a push below the $70.20 level for good measure.

Edson Gould’s Speed Resistance Lines have $65 as the downside support level.

The most conservative of the three downside targets mentioned above is the Dow Theory level of $61. This seems be the most appropriate level to consider a first, or second, purchase if the desire is to hold Carbo Ceramics for the long-term.

Comments Off on Technical Review: Carbo Ceramics (CRR)

Posted in Altimeter, CRR, Dow Theory, downside, Edson Gould, SRL

The Convergence of Stock Market Forces

In our last posting of Dow Theory we mentioned the need for caution on premature calls of a new bull market. We pointed out that with the Dow Transports and Dow Industrials so close to their respective all-time highs, investors should wait for confirmation of both indexes before getting too excited. Now we’d like to introduce another observation of Charles H. Dow’s with regards to stock market cycles which might be the perfect antidote to further movement higher.

In June 2010, we published an article titled “The 4 to 4 1/2 Year Market Cycle” (found here). In that article, we quoted Dow as saying the following:

Posted in 4 1/2 year, 4 year, Charles H. Dow, cycle analysis, Dow Theory

Tagged members

Dow Theory Update

We may be on the cusp of a Dow Theory cyclical and secular bull market signal. However, where the rubber hits the road when it comes to Dow Theory is discretion and confirmation. Discretion is needed for the purpose of avoiding frequent and erroneous calls. Confirmation is needed to ensure the quality of the analysis. We’re hoping that the chart below clarifies what investors need to know about the recent stock market activity.

Posted in Charles Dow, Charles H. Dow, Dow Theory, Dow Theory Confirmation, Richard Russell, Schannep

Tagged members

Dow Theory: Secular and Cyclical Markets

We often mention the concept of secular and cyclical markets in our discussion of Dow Theory. So far, we believe that we’re in a secular bear market owing to the fact that the Dow Jones Industrial Average and Dow Jones Transportation Average cannot meaningfully exceed prior peaks. However, we feel it is necessary to provide a graphical representation of what a secular and cyclical market looks like.

Keep in mind that active analysis of Dow Theory provides cyclical indications of moves in the market which usually lasts from 2 to 6 years. Depending on the circumstance, which usually hinges on the quality of analysis, Dow Theory also provides an indication of secular trend changes in the market. However, secular trends usually encompass periods from 16 years to as many as 24 years.

In this assessment, we’re assuming that Dow Theory was only able to provide bullish signals at 1/4 of the move from the bottom and bearish signals 1/4 of the move from the top for each cyclical trend. This is a very generous assumption in favor of those who are critical of the validity of Dow Theory as a market forecasting tool.

Historical Perspective and Highlights

First, let us start with the history of stock market secular trends from 1906 to the present broken into the various cyclical moves that can be easily identified (detailed review of stock market from 1860-1906 found here). The first secular trend is from 1906 to 1924 in what is clearly a bear market. Our definition of a secular bear market is the inability of the Dow Jones Industrial Average to exceed a prior high level for an extended period of time. As seen in the chart below, the 1906 to 1924 period certainly fits the bill.

The secular bear market from 1906 to 1924 was 18 years long. As indicated with the arrows (green arrows for cyclical bull markets and red arrows for cyclical bear markets) there were many instances where an investor could have avoided the losses of buy-and-hold if Dow Theory was applied.

What should follow a secular bear market is a secular bull market, however, the period from 1924 to 1942 was a combination of both with a quasi-secular bull market from 1924-1929 and a quasi-secular bear market from 1929-1932. Charles H. Dow has commented that markets move like a pendulum, swinging from excessive gains to excessive losses. S.A. Nelson has specifically outlined Dow’s point by referring to the extremes of these swings in the market as “artificial advances” and “artificial depressions.” (found here). William Peter Hamilton’s account of Dow Theory on November 17, 1924 was as follows:

“At the opening of the week the industrial and railroad share averages simultaneously broke through all previous points of resistance this year so decisively as to constitute by the Dow theory of analysis as emphatic and indication of a major bull market as has ever been discovered in the long history of the movements of these averages. By the end of the week the industrials were up approximately three points and the railroads two points through their previous best prices this year. That spells a dynamic movement of impressive proportions and unquestionably it forecasts in due time a further sustained upward movement that will eventually better every price yet seen.” (source: Hamilton, William Peter. “What of the Market?. Barron’s. November 17, 1924. page 2.)

The compressed period of time that the Dow Industrial Average rose from 100 to 381 might have been the first clue that the gains were not sustainable. As an example, in the secular bull market from 1942 to 1966, it took 12 years to rise an equal percentage amount. Likewise, in the secular bull market from 1982, it took the Dow Industrials 13 years to equal the percentage gains made from 1924 to 1929. Fortunately for some and unfortunately for many, the 1924-1942 period provided both secular moves within a single secular timeframe.

Shortly before his passing, William Peter Hamilton, Dow Theorist and fourth editor of the Wall Street Journal, wrote his famous “Turn of the Tide” editorial in the Wall Street Journal and Barron’s indicating that the bull market move had ended when the Dow Industrials were trading at around 325.17 (source: “A Turn in the Tide”. Barron’s. October 28, 1929. page 14). The follow-up analysis of a new bull market came from Dow Theorist Charles J. Collins who suggested that “…failure on the part of the rail average to confirm the weakness in the industrial list suggested a rather strong foundation to the market (source: Collins, Charles. Barron’s. August 8, 1932. page 5)”. At that time, the Industrials were trading at the 67.71 level. The subsequent move in the Dow Industrials to the March 1937 high was over +180%. Likewise, the decline that followed to the 1942 low was equal to -48%.

With the stock market reeling from the “adjustment” from the 1929 peak and crash, the next move in the market should have been a secular bull market. The next move in the market was, in fact, a secular bull market that ran from 1942 to 1966. The ideal for any market forecaster is to be able to distinguish a secular bull market from a cyclical bull market within a secular bull trend. The reason for this is because, if correct, investors can stay fully invested through the entire secular bull trend while taking advantage of short-term declines with new investment of funds. Cyclical bull markets within a secular bear trend require investors to sell some or all of their stock to be repurchased at the next Dow Theory cyclical bull market indication.

The secular bull market move from 100 to 1,000 was every investor’s dream. However, the stock market collapse and the “Great” Depression that preceded it kept the majority of investors out of the market until the final run-up from 1962 to 1966. Naturally, just as the majority of investors became confident of the secular bull market, the secular bull market was on its last leg. Richard Russell had the following to say of the 1966 Dow Theory bear market signal:

“Having failed to hit new highs on the April [1966] recovery, the two Averages again retreated. On May 5 the March lows were penetrated to the accompaniment of heavy volume. Based on the method formulated by Charles H. Dow at the turn of the century, the two Averages on May 5 gave the signal for a primary bear market. We now know that the February-March [1966]decline was the first leg of the bear market, and the March-April [1966] rise was the first (upward) correction. the second leg began in late April and remains in force (source: Russell, Richard. “Bear Market Signaled Under Dow Theory”. Barron’s. May 9, 1966. page 31.)

The secular bear market that followed from 1966 to 1982 seemed brutal on a relative basis. However, it was no worse or better than the secular bear market from 1906 to 1924. Much of the reason that the period from ‘66-‘82 seemed particularly difficult is mainly due to how recent it occurred rather than the relative depth in the market decline. It lasted from 1966 to 1982 or 16 years.

The secular bear market from 1966 to 1982 experienced five cyclical bear markets and four cyclical bull markets. For all intents and purposes, it was among the worst times to be a buy-and-hold investor. However, our favorite article in review of this period is Jeremy Siegel’s “Nifty Fifty Revisited” which showed what would happen if an investor had bought and held the hottest stocks from the peak in the market in 1972 (those stocks with the highest P/E ratios) and reviewed their performance until 1995 (PDF found here). There is merit in buy-and-hold investing and for our money the Siegel article makes the case quite well, especially if the investor happens start investing in a secular bear market and has an investment horizon with a minimum of 20 years.

The secular bull market that followed the secular bear market of 1966 to 1982 lasted from 1982 to 2000 and saw the Dow Jones Industrial Average rise from 1,000 to approximately 11,500. Although we’ve indicated that the year 2000 was the end to the secular bull market, a valid case can be made for 2007 as the end of the secular bull market. In either case, the Dow Industrial Average is marginally above the 2000 level or below the 2007 peak.

Our interpretation that we’ve been in a secular bear market since 2000 or 2007 only holds water as long as 11,500/14,164 is the range that the Dow Jones Industrials trades in. A common timeframe for our version of secular periods averages around 18.8 years based on the previous five periods. This suggests that if the 2000 peak holds then the secular bear market should end in the years between 2016 to 2023. We’re partial to the idea that the 2007 top was a secular peak. Richard Russell had the following to say on the topic of Dow Theory shortly after the 2007 peak:

“Did last week’s market volatility make you queasy? If you believe in the Dow Theory, there was reason to be wary. The Dow Jones Industrial and Transportation averages plunged to end-of-day lows of 12,845.78 and 4,672.35, respectively, on Aug. 16. Both then rallied. But while the industrials hit a record 14,164.53 on Oct. 9, the transports didn't come near a record, thus failing to confirm the DJIA's strength. This set up the potential for a classic Dow Theory bear-market signal” (Russell, Richard. “What Does Dow Theory Says”. Barron’s. November 12, 2007. link here.).

Summary on Secular and Cyclical Trends

Classic secular bull market moves typically require investors to only buy in the beginning and hold ‘til the end. The obvious challenge is to understand and accept that the prior secular bear market should be followed by a secular bull market. This is a difficult psychological transition for investors after experiencing four or five cyclical bear market moves over the course of 16 to 18 years.

Classic secular bear markets require timing tools like Dow Theory to keep an investor’s expectation in check with the investing environment. Alternatively, investors who expect to buy-and-hold during a secular bear market must have a time horizon that is exceptionally long in duration and hold stocks that provide income to offset inflation and possible lack of capital appreciation. Jeremy Siegel’s article titled the “Nifty-Fifty Revisited” is an exceptional rationale to hold stocks through a secular bear market (PDF found here).

Although Dow Theory can inform an investor of being in a secular bull and bear market after the fact, it is of greatest use at calling cyclical bull and bear markets, especially within a secular bear market. So far, we happen to be in the most ideal period when Dow Theory could be of the most benefit to investors.

Comments Off on Dow Theory: Secular and Cyclical Markets

Posted in cycle analysis, Cyclical Bear Market, Cyclical Bull Market, Dow Theory, Secular Bear Market, Secular Bull Market

Dow Theory: Industrial Production Index Points to Recession

The Industrial Production Index (IPI) is an important lagging indicator that is part of Dow Theory as suggested in Robert Rhea’s book Dow Theory Applied to Business and Banking. Although seldom mentioned by modern Dow Theorists, the IPI is useful in confirming the validity of Dow Theory indications. This explains why a Dow Theory primary bull market was not announced by Robert Rhea in the period from November 1929 to April 1930. Although the stock market was rebounding from the “Great” Crash of 1929, the IPI was still in a declining trend, highlighted in the red bar as shown in the chart below.

In our last review of the Industrial Production Index on April 20, 2012, we had indicated that we’d need to see two consecutive months of decline in order for a confirmation of a recession while in a Dow Theory bear market. Since that piece, we have not seen two consecutive months of declines. However, as the data for the Industrial Production Index is continually updated, as much as six months into the past, we begin to see an emerging pattern.

Since January 2012, the Industrial Production Index has traded in a narrow range, based on the revised data. Already the Industrial Production Index is below the July 2012 high and approaching the April 2012 low of 96.4705. Falling below the April low could indicate that the recession had begun as early as January 2012. The Industrial Production Index has not been mired in such a range since the end if the recession was called in June of 2009. Additionally, the preliminary data suggests that the economic recovery has hit a snag and may be on the cusp of a full blown recession (as defined by the National Bureau of Economic Research).

As can be seen in the chart above, the Dow Jones Transportation Average and the Industrial Production Index seem to have experiences similar troubles at around the same point in time. True to form, the Dow Jones Transportation Index has gyrated widely to the downside with little ability to exceed the 2007 and 2011 highs.

From a historical standpoint, whenever the Industrial Production Index has peaked, 13 out of 17 times since 1920 (76.47%), the result was a recession call by the NBER. All that is left at this point is for the Industrial Production Index to rise, fall or get revised significantly outside of the established range. Rising or falling by a wide margin could definitively answer the question about whether we’re in a recession. The range could be revised out of existence through the process of updating the figures.

Our take is that there has to be a significant amount of economic growth through economic stimulus that dwarfs all prior efforts since 2007. Outside of such efforts by monetary and fiscal actions, we believe that a recession could be considered in effect from either January 2012 or July 2012.

Comments Off on Dow Theory: Industrial Production Index Points to Recession

Posted in Dow Theory, Industrial Production Index, IPI

Tagged members

Dow Theory

How long does a Dow Theory Primary Bull Market last?

Recently, some followers of Dow Theory had suggested that a new primary bull market began on June 4, 2012. Those same Dow Theorists are now put in the awkward position of changing that primary bull market call to a primary bear market indication as recently as November 11th or 16th of this year.

However, when doing the math, those Dow Theorists who claimed that a primary bull market began on June 4, 2012 have very little to show for it, especially when, by their own account, a primary bear market was signaled on November 11th or 16th. To demonstrate how inaccurate that analysis was, since June 4th, the Dow Industrials has increased +4.02% while the Dow Transports increased +0.90%. Even in the period from June 4th until the respective peaks, the gains were marginal with the Dow Jones Transportation Average gaining +8.31% by June 19th without being able to exceed the 2011 peak. At the same time, the Dow Jones Industrial Average gained +12.47% by October 5th without being able to exceed the 2007 peak. The inability to exceed prior all-time highs is uncharacteristic of what one should expect of any market move deemed a “primary bull market.”

In all of the history of the Dow Industrials and Dow Transportation Averages, primary bull market moves have never lasted for only 5 months. The following examples from renown Dow Theorists suggest that any indication that a primary bull market began in June 2012 and ended in November 2012 was done so in error.

When William Peter Hamilton wrote on the topic of the primary bull market movements in his book Stock Market Barometer, he said the following:

“The average duration of six major bull swings is twenty-five months…(page 44).”

According the Robert Rhea’s book The Dow Theory:

“…a primary bull market is a broad upward movement, interrupted by secondary reactions, and averaging longer than two years (page 44).”

From E. George Schaefer’s book How I Helped 10,000 Investors to Profit in Stocks comes this conclusion:

“…in primary bull markets the duration of a typical primary up-trend might last from four to eleven years…(page 42)”

It is more likely that a primary bear market can last as little as 5 months due to panics and crashes. However, in order for Dow Theory to be worth its weight, a primary bull market should see an investor through an extended period of time (at minimum 12 to 18 months and usually 2 years or more) and not a period of less than 6 months.

Dow Theory: The Backdrop

On August 2, 2011, Dow Theory provided us with the first primary bear market signal since the primary bull market indication of July 23, 2009. This bear market indication came with a very interesting backdrop that is worth reviewing. On the very same day as our bear market indication (Aug. 2, 2011), the Senate passed the bill allowing for the extension of the debt ceiling (found here). The Senate vote came one day after the House of Representatives approved legislation to raise the debt ceiling to $14.3 trillion (found here).

The discussion and debate prior to the actual passage of the bill, allowing for the debt ceiling increase, suggested that the country would suffer irreparable damage if Congress didn’t come up with a solution. Once the bill was passed, Congressional members were as giddy as can be. There was a lot of back slapping and praise because both sides of the aisle could finally agree on something.

Suffice to say, only three days (Aug. 5, 2011) after the “bipartisan” agreement to raise the debt ceiling, Standard & Poor's lowered the credit rating of the United States indicating that “…the downgrade reflects our view that the effectiveness, stability, and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economic challenges to a degree more than we envisioned…” (PDF found here).

We wince when politics has to enter our discussion of the markets since we know that there are no winners when it comes to such a debate. However, we have reminded readers of the backdrop at the time of the Dow Theory bear market indication to suggest that we may actually be sitting on another “buy the rumor and sell the news” scenario when the resolution of the “fiscal cliff” arrives. From the May 3, 2011 to August 1, 2011, the Dow Jones Industrial Average declined –5.27% and from August 1, 2011 to August 10, 2011, the Dow Jones Industrial Average declined –11.64%. It appears the stock market anticipated that the debt ceiling would be increased and that ultimately it would be to no avail, resulting in the downgrade from S&P.

Already, the Dow Jones Industrial Average has declined –7.5% from the October 5, 2012 high. Are we slated for a similar reaction to the ultimate “resolution” of the “fiscal cliff” that currently overhangs the U.S.? It is interesting to note that the increase of the debt ceiling and the “resolution” of the “fiscal cliff” will have a negative effect on the U.S. despite the two political parties’ shameless self-promotion for acting in a bi-partisan manner to come to a “resolution.” If the S&P downgrade of the U.S. came 3 days after the agreement to raise the debt ceiling and a stock market plunge of –11% in seven trading days later, what can we expect when the “fiscal cliff” passes?

Also, keep in mind that with the announcement of QE3 on September 13, 2012, the stock market has declined as much as -7.02%. All prior announcements of quantitative easing by the U.S. and European Union were not accompanied with almost immediate declines in the stock market. It appears that the quick fixes are having less of the desired short-term impact since it is clear that the long-term effects of such strategies are harmful and possibly irreversible. Our article on the diminished impact of QE3 can be found here.

We can’t be sure if the past provides any lessons, however, the solution to the “fiscal cliff” may lead to an outcome that is far worse than anticipated. While everyone in Congress was suggesting that there were going to be dire consequences to not raising the debt ceiling there were few that anticipated that the S&P would downgrade the debt anyway. Likewise, providing a solution to the “fiscal cliff” cannot hid the fact that the U.S. is a house that is not in order. Resolving issues like the debt ceiling with increasing the debt “limit” or the “fiscal cliff” with less cutting and more spending than initially planned, with politicians whose goal is to posture until the 11th hour, suggests that S&P’s downgrade of the U.S. debt will be looked upon in retrospect as an understatement.

Dow Theory: Bear Market Confirmation Due

Starting with the movement of the Dow Industrials and Transports, we can seen that the primary bear market began on August 2, 2011. Since that time, the bear market rally (from the August 8, 2011 or October 3, 2011 low) has been very rewarding to anyone who followed our August 9, 2011 (found here) indication that a temporary bottom had been reached.

Now that there has been a substantive decline in the Industrial Average below the April 30, 2012 peak we can see that any decline below the June 4, 2012 low is the level to watch for. Again, Dow Theory indicates that for any signal to have merit, both the Industrials and Transports must simultaneously rise above prior peaks or decline below prior troughs. In order for us to get a bear market confirmation, we’d need the Industrials to decline below 12,101.46 and the Transports to fall below 4,847.73 on a closing basis.

So far, the Industrials are +4.02% above the June 4th low while the Transports are +0.90% above the mid-year level. If either of the indexes fail to fall below the June 4th level we have to put our bear market thesis on hold.

Dow Industrial Upside Targets

The decline that the Dow Jones Industrial Average has experienced isn’t out of the ordinary. However, it is our responsibility to review the prospects of an upside target based on Dow Theory. Taking the most recent intra-day low of 12,471.50 and projecting to the most recent intra-day high of 13,661.90 provides us with the following upside targets:

Each move up to the 13,066.69 level carries the risk that at any point the market can easily descend below the 12,471.50. However, exceeding 13,066.69 and especially the points above the 13,265.10 connotes the prospect that the Dow Industrials can achieve 13,661.90.

Nasdaq 100 Watch List: November 16, 2012

Below are the Nasdaq 100 companies that are within 10% of their respective 52-week lows. Stocks that appear on our watch lists are not recommendations to buy. Instead, they are the starting point for doing your research and determining the best company to buy. Ideally, a stock that is purchased from this list is done after a considerable decline in the price and rigorous due diligence.

| Symbol | Name | Price | P/E | EPS | Yield | P/B | % from low |

| BIDU | Baidu, Inc. | 92.68 | 20.97 | 4.42 | - | 8.87 | 0.95% |

| VOD | Vodafone Group | 25.27 | - | -0.55 | 7.9 | 1.11 | 1.28% |

| BBBY | Bed Bath & Beyond Inc. | 56.4 | 13.1 | 4.3 | - | 3.27 | 1.48% |

| MCHP | Microchip Technology Inc. | 29.37 | 27.94 | 1.05 | 4.8 | 2.93 | 1.56% |

| ^NDX | NASDAQ-100 | 2,534.16 | - | - | - | - | 1.59% |

| FLEX | Flextronics Int’l | 5.54 | 7.55 | 0.73 | - | 1.51 | 1.65% |

| DELL | Dell Inc. | 8.86 | 6.03 | 1.47 | 3.3 | 1.63 | 1.94% |

| AMAT | Applied Materials Inc. | 10.15 | 118.02 | 0.09 | 3.5 | 1.74 | 2.01% |

| NVDA | NVIDIA Corporation | 11.38 | 14.21 | 0.8 | 2.6 | 1.53 | 2.06% |

| INTC | Intel Corporation | 20.19 | 8.81 | 2.29 | 4.5 | 2.03 | 2.12% |

| ALTR | Altera Corp. | 30.45 | 17.02 | 1.79 | 1.3 | 2.97 | 2.91% |

| TEVA | Teva Pharmaceutical | 38.29 | 15.6 | 2.45 | 2.1 | 1.46 | 3.82% |

| EXPD | Expeditors Int'l of WA | 35.76 | 22.35 | 1.6 | 1.5 | 3.62 | 4.56% |

| CTXS | Citrix Systems, Inc. | 59.21 | 32.34 | 1.83 | - | 3.56 | 4.67% |

| MRVL | Marvell Technology | 7.4 | 12.67 | 0.58 | 3.2 | 0.88 | 4.96% |

| NUAN | Nuance Communications | 20.35 | 77.38 | 0.26 | - | 2.4 | 5.28% |

| KLAC | KLA-Tencor Corporation | 44.33 | 10.78 | 4.11 | 3.6 | 2.18 | 5.35% |

| APOL | Apollo Group Inc. | 19.51 | 5.61 | 3.48 | - | 2.37 | 5.69% |

| ATVI | Activision Blizzard, Inc. | 11.05 | 14.26 | 0.78 | 1.7 | 1.08 | 5.75% |

| MU | Micron Technology Inc. | 5.47 | - | -1.04 | - | 0.72 | 6.01% |

| FFIV | F5 Networks, Inc. | 86.64 | 25.11 | 3.45 | - | 5.19 | 6.87% |

| WCRX | Warner Chilcott plc | 11.98 | 8.2 | 1.46 | 4.2 | -4.48 | 6.87% |

| CHKP | Check Point Software | 43.67 | 15.21 | 2.87 | - | 2.71 | 7.56% |

| DLTR | Dollar Tree, Inc. | 38.82 | 15.6 | 2.49 | - | 5.9 | 7.71% |

| GRMN | Garmin Ltd. | 37.18 | 12.57 | 2.96 | 4.8 | 2.14 | 8.05% |

| XLNX | Xilinx Inc. | 32.56 | 17.6 | 1.85 | 2.7 | 3.12 | 8.53% |

| FAST | Fastenal Company | 41 | 29.71 | 1.38 | 2.1 | 7.29 | 9.01% |

| MSFT | Microsoft Corporation | 26.52 | 14.34 | 1.85 | 3.5 | 3.26 | 9.14% |

Watch List Summary

In the November 2, 2012 Watch List summary we pointed out NetApp (NTAP) as a viable investment candidate. In the two weeks since, NTAP has managed to rise +9% while the Nasdaq 100 and Apple Inc. declined –4% and –9%, respectively. NTAP is sitting at $30.26 price and may have found some support at that level. Although we’re hopeful about the prospects of this company, we recommend putting +9% gains in two weeks into perspective and decide if selling the principle is the most prudent approach to take.

On the November 2, 2012, we discussed the prospects for Dell (DELL). At the time we felt that the stock had a high probability of going back to the $8 level. On Friday November 16, 2012, we believe that DELL has fallen through the last line of technical defense against going to the $8 level. We believe that on a short-term basis DELL will rise on a possible market reaction. However, the intermediate-term seems to indicate that DELL will go to $8 before any “true” indication of prospects is revealed, unless the company gets acquired which seems possible. Dell would be one of the best acquistion target of any computer manufacturer since Lenovo bought the personal computer division from IBM.

Apple Inc (AAPL) and short-term Dow Theory analysis

As described in our last Nasdaq 100 Watch List dated November 2, 2012, Apple Inc. (AAPL) is the stock to watch. Right now, there are many who are suggesting that the bottom is in for AAPL. For various reasons, we believe that the verdict has not been delivered on this stock. Especially since AAPL managed to close below the May 2012 low, a previous technical low point for the stock. Regardless of our view on the matter, we’d like to see what Dow Theory has to say about the upside prospects from the current price. The chart below outlines the four upside targets for AAPL.

Starting with the first upside target is the $572.19 level. This is an easily attainable level for the stock and would equal an +8.44% gain from the closing price of Friday November 16, 2012. After coming off of such a dramatic decline that was started on September 17th, we should expect this as the minimum reaction of a declining trend. There is little in the way to suggest that AAPL is clearly on the ascent when it reaches $572.19. However, in theory, this would be the easiest money every made in AAPL stock.

The next upside target for Apple Inc. (AAPL) is $605.41. This level is based on Dow’s 50% principle which indicates the average price paid by long-term investors and would be compelled to continue holding the stock if it rises above this level. If AAPL can manage to rise above this level then long-term investors are likely to hold their positions in the stock, leaving speculators to push the stock higher. However, failure to rise above the $605.41 level and falling below the $505 level will be confirmation that the trend of the stock is much lower than the $505 level.

The $638.63 price falls in line with Dow’s assertion that stocks then can retrace 1/3 to 5/8 of the previous move. In this case, the $638 level is 2/3 of the previous decline. Rising to such a level almost assures that the stock will rise to the previous high. However, those wishing to take advantage of such a “guaranteed” move to the upside should be aware of the risk that any gains that are achieved can be quickly taken away. This would be the hardest money ever made for any speculator in AAPL’s stock.

Finally, rising above the $705 level would be the only indication that the stock is going higher in a meaningful fashion. We believe that if AAPL manages to exceed prior high then there are great opportunities of other tech companies near a new 52-week low to take advantage of the renewed faith in Apple Inc.

Posted in 50% principle, Dow Theory, Nasdaq 100 Watch List, upside target

Tagged members