Members

-

Topics

Archives

-

-

Recent Posts

-

-

-

Investor Education

Market Return After Exceptional Years

Dollar Cost Averaging Tool

Dow Theory: The Formation of a Line

Dividend Capture Strategy Analysis

Golden Cross – How Golden Is It?

Debunked – Death Cross

Work Smart, Not Hard

Charles H. Dow, Father of Value Investing

It's All About the Dividends

Dow Theory: Buying in Scales

How to Avoid Losses

When Dividends are Canceled

Cyclical and Secular Markets

Inflation Proof Myth

What is Fair Value?

Issues with P-E Ratios

Beware of Gold Dividends

Gold Standard Myth

Lagging Gold Stocks?

No Sophisticated Investors

Dollar down, Gold up?

Problems with Market Share

Aim for Annualized Returns

Anatomy of Bear Market Trade

Don’t Use Stop Orders

How to Value Earnings

Low Yields, Big Gains

Set Limits, Gain More

Ex-Dividend Dates -

-

Historical Data

1290-1950: Price Index

1670-2012: Inflation Rate

1790-1947: Wholesale Price Cycle

1795-1973: Real Estate Cycle

1800-1965: U.S. Yields

1834-1928: U.S. Stock Index

1835-2019: Booms and Busts

1846-1895: Gold/Silver Value

1853-2019: Recession/Depression Index

1860-1907: Most Active Stock Average

1870-2033: Real Estate Cycles

1871-2020: Market Dividend Yield

1875-1940: St. Louis Rents

1876-1934: Credit-New Dwellings

1896-1925: Inflation-Stocks

1897-2019: Sentiment Index

1900-1903: Dow Theory

1900-1923: Cigars and Cigarettes

1900-2019: Silver/Dow Ratio

1901-2019: YoY DJIA

1903-1907: Dow Theory

1906-1932: Barron's Averages

1907-1910: Dow Theory

1910-1913: Dow Theory

1910-1936: U.S. Real Estate

1910-2016: Union Pacific Corp.

1914-2012: Fed/GDP Ratio

1919-1934: Barron's Industrial Production

1920-1940: Homestake Mining

1921-1939: US Realty

1922-1930: Discount Rate

1924-2001: Gold/Silver Stocks

1927-1937: Borden Co.

1927-1937: National Dairy Products

1927-1937: Union Carbide

1928-1943: Discount Rate

1929-1937: Monsanto Co.

1937-1969: Intelligent Investor

1939-1965: Utility Stocks v. Interest Rates

1941-1967: Texas Pacific Land

1947-1970: Inventory-Sales Ratio

1948-2019: Profits v. DJIA

1949-1970: Dow 600? SRL

1958-1976: Gold Expert

1963-1977: Farmland Values

1971-2018: Nasdaq v. Gold

1971-1974: REIT Crash

1972-1979: REIT Index Crash

1986-2018: Hang Seng Index Cycles

1986-2019: Crude Oil Cycles

1999-2017: Cell Phone Market Share

2008: Transaction History

2010-2021: Bitcoin Cycles -

Interesting Read

Inside a Moneymaking Machine Like No Other

The Fuzzy, Insane Math That's Creating So Many Billion-Dollar Tech Companies

Berkshire Hathaway Shareholder Letters

Forex Investors May Face $1 Billion Loss as Trade Site Vanishes

Why the oil price is falling

How a $600 Million Hedge Fund Disappeared

Hedge Fund Manager Who Remembers 1998 Rout Says Prepare for Pain

Swiss National Bank Starts Negative

Tice: Crash is Coming...Although

More on Edson Gould (PDF)

Schiller's CAPE ratio is wrong

Double-Digit Inflation in the 1970s (PDF)

401k Crisis

Quick Link Archive

Category Archives: GENZ

Illumina Shines After Appearing on Watch List

New Low Team Nails it on Genzyme Deal

"Finally we have Genzyme Corp. (GENZ) at $55.94. This stock has historically traded at 19 times cashflow. The 2008 cashflow for this GENZ was $2.82, according to Mergent’s (Valueline had the higher figure.) GENZ, although selling 19% above the 52-week low, is a far superior value proposition. The shares outstanding have grown by 2.7% from 2006 to 2008 while the long-term debt has fallen by 85% over the same time frame."

We hope that the work we have done on this site is evidence of the soundness of our strategy. Tomorrow we will outline another stock from our Nasdaq 100 Watch List that has made the Genzyme deal look like peanuts in comparison.

Flash Crash Follies

"...the folly of human laws too often encumbers its operations." Adam Smith

Apple (AAPL), Research In Motion (RIMM), IBM (IBM), Dell (DELL), General Electric (GE), Oracle (ORCL), Microsoft (MSFT), Hewlett-Packard (HPQ)

Stocks of the above noted companies took a dive at the same time on September 28, 2010. The exchanges didn't provide commentary on the actions taken as a result of the instantaneous decline and rise in value. many have attributed specific declines to "newsworthy" issues related to the specific companies. However, no one has stepped forward to explain the statistical anomally of so many companies experiencing the same issue at exactly the same time.

July 29, 2010 (date contains article link from third party source)

Cisco Corp. (CSCO)

At 10:41am EST, Cisco (CSCO) shares spiked by 11% due to an order imbalanced triggered by 100 shares. CSCO rose from $23.37 to $26 which triggered circuit breakers prompting Jamie Selway, managing director at broker White Cap Trading LLC in New York, “We’re stopping trading in incomparably liquid products because of dumb mistakes...” In this instance, the NYSE-owned AMEX which handles very few trades in CSCO could not fulfill orders placed on their exchange even through there were plenty of shares being trades on alternative exchanges. Ultimately, CSCO was trading with the liquidity of a penny stock. Soon enough, firms with intimate knowledge of where they place their trade can play the illiquidity to their advantage. The AMEX and other small exchanges will be under attack.

July 23, 2010 (date contains article link from third party source)

Genzyme Corp. (GENZ)

At 1:18pm EST and 1:25pm EST, Genzyme Corp. (GENZ) triggered circuit breakers when the stock attempted to rise by more than 10% on two separate occasions within the same day due to rumors about a takeover. Nasdaq OMX spokesman Robert Madden gave no justification for the halt in trading. However, traders and money managers expressed the sentiment that “at some point, you need to let efficient market theory rule how stocks trade.” In this case, Genzyme wasn't allowed to rise as much as speculators were willing to bid the price up.

Nasdaq 100 Watch List

Watch List Summary

Performance Review

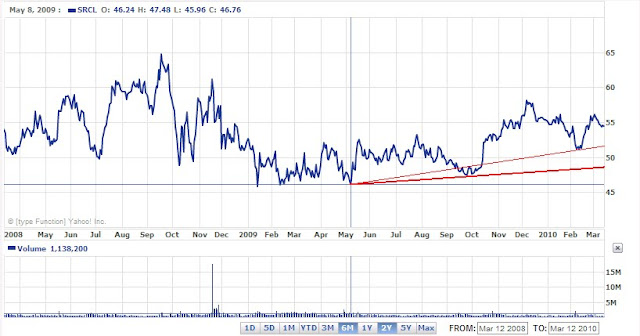

- Stericycle (SRCL) up 44.48%

- Genzyme (GENZ) up 25.54%

- Pharmaceutical Product Development (PPDI) up 20%

- Cephalon (CEPH) up 5.92%

|

| *chart does not reflect dividend reinvestment for PPDI |

Nasdaq 100 Watch List

| Symbol | Name | Price | P/E | EPS | Yield | P/B | % from Low |

| PAYX | Paychex, Inc. | 25.95 | 19.67 | 1.32 | 4.80% | 6.67 | 5.27% |

| INTC | Intel Corporation | 18.81 | 11.26 | 1.67 | 3.40% | 2.3 | 6.87% |

| AMAT | Applied Materials, Inc. | 11.02 | 24.44 | 0.45 | 2.50% | 2.03 | 7.33% |

| YHOO | Yahoo! Inc. | 13.89 | 22.77 | 0.61 | N/A | 1.59 | 7.34% |

| MXIM | Maxim Integrated Products, Inc. | 16.91 | 41.86 | 0.4 | 5.00% | 2.15 | 7.91% |

| GILD | Gilead Sciences, Inc. | 34.56 | 10.47 | 3.3 | N/A | 4.58 | 8.93% |

| ATVI | Activision Blizzard, Inc | 10.82 | 41.94 | 0.26 | 1.30% | 1.21 | 8.96% |

| DELL | Dell Inc. | 12.45 | 15.74 | 0.79 | N/A | 3.92 | 9.80% |

| RIMM | Research In Motion Limited | 46.72 | 10.24 | 4.56 | N/A | 3.2 | 9.85% |

| AMGN | Amgen Inc. | 55.22 | 11.73 | 4.71 | N/A | 2.28 | 9.87% |

| DISH | DISH Network Corporation | 18.77 | 11.26 | 1.67 | N/A | N/A | 10.02% |

| CSCO | Cisco Systems, Inc. | 21.86 | 16.46 | 1.33 | N/A | 2.82 | 10.31% |

| XRAY | DENTSPLY International Inc. | 30.66 | 16.55 | 1.85 | 0.70% | 2.6 | 10.45% |

| MSFT | Microsoft Corporation | 25.22 | 12 | 2.1 | 2.10% | 4.76 | 10.95% |

| SPLS | Staples, Inc. | 19.49 | 17.26 | 1.13 | 1.80% | 2.2 | 11.69% |

| PDCO | Patterson Companies Inc. | 27.15 | 14.67 | 1.85 | 1.50% | 2.3 | 12.52% |

| SHLD | Sears Holdings Corporation | 66.83 | 27.38 | 2.44 | N/A | 0.9 | 12.87% |

| GOOG | Google Inc. | 490.15 | 21.29 | 23.03 | N/A | 3.77 | 13.03% |

| LIFE | Life Technologies Corporation | 46.51 | 29.91 | 1.56 | N/A | 1.97 | 13.16% |

| STX | Seagate Technology. | 11.16 | 3.55 | 3.14 | N/A | 1.95 | 13.41% |

| FLIR | FLIR Systems, Inc. | 27.24 | 18.52 | 1.47 | N/A | 3.25 | 13.50% |

| GRMN | Garmin Ltd. | 29.64 | 8.95 | 3.31 | 5.10% | 2.21 | 13.52% |

| TEVA | Teva Pharmaceutical Industries | 53.48 | 19 | 2.82 | 1.20% | 2.48 | 13.81% |

| FLEX | Flextronics International Ltd. | 5.55 | 15.72 | 0.35 | N/A | 2.26 | 14.20% |

| COST | Costco Wholesale Corporation | 61.29 | 21.93 | 2.8 | 1.30% | 2.43 | 14.75% |

| HSIC | Henry Schein, Inc. | 56.35 | 15.82 | 3.56 | N/A | 2.31 | 14.77% |

| CERN | Cerner Corporation | 79.18 | 31.31 | 2.53 | N/A | 3.83 | 14.85% |

| CELG | Celgene Corporation | 55.25 | 29.99 | 1.84 | N/A | 5.11 | 15.06% |

| CA | CA Inc. | 20.44 | 13.43 | 1.52 | 0.80% | 2.02 | 15.48% |

| ERTS | Electronic Arts Inc. | 16.26 | N/A | -1.06 | N/A | 1.96 | 15.63% |

| VRTX | Vertex Pharmaceuticals Incorpor | 36.25 | N/A | -3.53 | N/A | 9.01 | 16.00% |

| KLAC | KLA-Tencor Corporation | 31.05 | 25.31 | 1.23 | 3.30% | 2.32 | 16.34% |

| STLD | Steel Dynamics, Inc. | 15.01 | 15.73 | 0.95 | 2.00% | 1.58 | 16.45% |

| WCRX | Warner Chilcott plc | 22.75 | 11.2 | 2.03 | N/A | 2.82 | 16.55% |

| LOGI | Logitech International S.A. | 15.39 | 22.57 | 0.68 | N/A | 2.68 | 16.86% |

| CEPH | Cephalon, Inc. | 62.26 | 12.48 | 4.99 | N/A | 2.09 | 17.36% |

| URBN | Urban Outfitters, Inc. | 34.11 | 22.19 | 1.54 | N/A | 4.26 | 18.85% |

| FWLT | Foster Wheeler AG. | 24.19 | 10.8 | 2.24 | N/A | 3.46 | 18.99% |

| FISV | Fiserv, Inc. | 53.56 | 17.16 | 3.12 | N/A | 2.57 | 19.55% |

| JBHT | J.B. Hunt Transport Services, I | 35.26 | 26.73 | 1.32 | 1.40% | 7.56 | 19.73% |

| CTAS | Cintas Corporation | 27.71 | 19.64 | 1.41 | 1.70% | 1.67 | 19.96% |

Genzyme Corp: Value is Finally Being Recognized

Odds and Ends

“The recent non-confirmation by the Transports may have served as an entry spot for bold speculators, but I doubt if the 2007 highs in the Averages will be approached or bettered. Nevertheless, we may see a brief period of better markets, a "breather" in the long life of the bear. I believe this primary bear market will extend into 2016.

A near-term marker or target is to see whether the Dow and the Transports can better their recent June highs. Those highs were 10450.64 for Industrials and 4467.25 for Transports. Write those figures down. I'm betting that the two D-J Averages will not be able to better the June highs. Let's wait and see.”

All I can say is, at least he indicated an upside target that matches the one we came up with yesterday. Can't understand how he was so bullish on Friday and is now sounding so skeptical today.

Nasdaq 100 Watch List

Below are the Nasdaq 100 companies that are within 20% of their respective 52-week low. Stocks that appear on our watch lists are not recommendations to buy. Instead, they are the starting point for doing your research and determining the best company to buy. Ideally, a stock that is purchased from this list is done after a considerable decline in the price and considerable due diligence.

| Name | Price | P/E | EPS | Yield | P/B | Pct from Yr Low | |

| Gilead Sciences, Inc. (GILD) | $38.37 | 12.31 | 3.12 | 0.00% | 4.71 | 0.95% | |

| Apollo Group, Inc. (APOL) | $54.41 | 13.61 | 4.00 | 0.00% | 6.23 | 3.07% | |

| QUALCOMM (QCOM) | $36.50 | 19.47 | 1.88 | 2.10% | 2.90 | 3.60% | |

| Ryanair Holdings plc (RYAAY) | $24.60 | 0.00 | 0.00 | 0.00% | 0.00 | 3.89% | |

| Activision (ATVI) | $10.56 | 124.24 | 0.09 | 1.40% | 1.22 | 6.34% | |

| Yahoo! Inc. (YHOO) | $15.29 | 27.40 | 0.56 | 0.00% | 1.81 | 9.45% | |

| Genzyme (GENZ) | $51.77 | 125.66 | 0.41 | 0.00% | 1.84 | 9.94% | |

| Symantec (SYMC) | $15.62 | 40.57 | 0.39 | 0.00% | 3.02 | 11.82% | |

| Electronic Arts (ERTS) | $17.63 | 0.00 | 0.00 | 0.00% | 2.29 | 12.29% | |

| Cephalon, Inc. (CEPH) | $59.38 | 11.84 | 5.01 | 0.00% | 1.90 | 13.00% | |

| Logitech (LOGI) | $14.63 | 40.41 | 0.36 | 0.00% | 2.65 | 14.03% | |

| Staples (SPLS) | $21.66 | 21.17 | 1.02 | 1.60% | 2.35 | 15.71% | |

| Amgen Inc. (AMGN) | $54.46 | 11.56 | 4.71 | 0.00% | 2.37 | 17.22% | |

| RIMM (RIMM) | $64.92 | 0.00 | 0.00 | 0.00% | 0.00 | 19.56% | |

| Cintas (CTAS) | $25.54 | 23.87 | 1.07 | 1.80% | 1.61 | 19.91% |

Watch List Summary

| Company | Change from Last Week |

| Gilead Sciences, Inc. (GILD) | -3.49% |

| Apollo Group, Inc. (APOL) | -5.51% |

| QUALCOMM (QCOM) | -5.97% |

| Ryanair Holdings plc (RYAAY) | -14.47% |

| Activision (ATVI) | -4.92% |

| Yahoo! Inc. (YHOO) | -8.11% |

| Genzyme (GENZ) | -2.80% |

| Symantec (SYMC) | -7.36% |

In all, the Nasdaq 100 Watch List of last week lost -6.58% as compared to the Nasdaq 100 index which lost a total of -7.56%. As with our Dividend Achiever Watch List, the smaller losses and larger gains make the Watch Lists a good place to start investigating your next investment opportunities. Naturally, we expect that all investment decisions should be done with an eye for selectivity and a willingness to harbor a lot of patience.

Nasdaq 100 Watch List

| Symbol | Name | Price | P/E | EPS | Yield | P/B | % from low |

| GILD | Gilead | 39.71 | 12.74 | 3.12 | 0 | 4.86 | 0.40% |

| APOL | Apollo | 57.41 | 14.36 | 4 | 0 | 6.53 | 8.75% |

| QCOM | QUALCOMM | 38.68 | 20.63 | 1.88 | 2.00% | 3.09 | 9.08% |

| ATVI | Activision | 11.08 | 130.35 | 0.09 | 1.40% | 1.31 | 11.58% |

| GENZ | Genzyme | 53.22 | 129.17 | 0.41 | 0 | 1.91 | 13.02% |

| RYAAY | Ryanair | 28.16 | 0 | 0 | 0 | 0 | 13.46% |

| YHOO | Yahoo! Inc. | 16.53 | 29.62 | 0.56 | 0 | 1.93 | 18.84% |

| SYMC | Symantec | 16.77 | 43.56 | 0.39 | 0 | 3.13 | 20.04% |

Nasdaq 100 Watch List

Below are the Nasdaq 100 companies that are within 21% of the 52-week low.

| Symbol | Name | Price | P/E | EPS | Yield | P/B | % from Low |

| GILD | Gilead Sciences | 41.67 | 14.77 | 2.82 | 0 | 5.74 | 4.44% |

| QCOM | QUALCOMM | 38.25 | 30.7 | 1.25 | 1.90% | 3.08 | 7.87% |

| GENZ | Genzyme Corporation | 53.93 | 35 | 1.54 | 0 | 1.85 | 14.53% |

| ATVI | Activision Blizzard | 11.6 | 136.47 | 0.09 | 1.30% | 1.35 | 16.82% |

| RYAAY | Ryanair Holdings | 29.19 | N/A | - | 0 | 0 | 17.61% |

| APOL | Apollo Group, Inc. | 63.53 | 15.89 | 4 | 0 | 7.34 | 20.34% |

Nasdaq 100 Watch List

| Symbol | Name | Price | P/E | EPS | Yield | P/B | % from Low |

| GILD | Gilead | 45.7 | 16.19 | 2.82 | 0 | 6.4 | 10.63% |

| GENZ | Genzyme | 53.64 | 34.81 | 1.54 | 0 | 1.82 | 13.91% |

| RYAAY | Ryanair | 29.23 | 0 | 0 | 0 | 0 | 17.77% |

| ATVI | Activision | 11.79 | 138.71 | 0.09 | 1.30% | 1.36 | 19.33% |

| SYMC | Symantec | 16.68 | 43.32 | 0.39 | 0 | 3.1 | 19.40% |

This list is strictly for the purpose of researching whether or not the companies have viable business models or are about to go out of business. These companies are deemed highly speculative unless otherwise noted.

Nasdaq 100 Watch List

| Symbol | Name | Trade | P/E | EPS (ttm) | Yield | P/B | % from Low |

| GILD | Gilead | 45.7975 | 16.2 | 2.822 | 0 | 6.48 | 10.86% |

| GENZ | Genzyme | 52.8 | 34.3 | 1.54 | 0 | 1.81 | 12.13% |

| SRCL | Stericycle | 54.58 | 27 | 2.03 | 0 | 5.44 | 18.76% |

| QCOM | QUALCOMM | 42.17 | 33.8 | 1.25 | 1.60% | 3.32 | 18.92% |

| APOL | Apollo Group | 63.14 | 15.8 | 4 | 0 | 7.13 | 19.61% |

| RYAAY | Ryanair | 29.75 | N/A | - | 0 | N/A | 19.86% |

Nasdaq 100 Watch List

Below are the Nasdaq 100 companies that are within 20% of the 52-week low.

| Symbol | Name | Price | P/E | EPS (ttm) | Yield | P/B | % from Yr Low |

| GILD | Gilead Sciences | 45.34 | 16.1 | 2.82 | 0 | 6.5 | 9.76% |

| GENZ | Genzyme Corp. | 53 | 34.4 | 1.54 | 0 | 1.8 | 12.55% |

| APOL | Apollo Group | 61.28 | 14.7 | 4.16 | 0 | 6.7 | 16.08% |

| QCOM | QUALCOMM | 41.83 | 33.6 | 1.246 | 1.60% | 3.3 | 17.96% |

| FSLR | First Solar, Inc. | 116.5 | 15.5 | 7.53 | 0 | 3.6 | 18.02% |

| SRCL | Stericycle, Inc. | 54.5 | 26.9 | 2.03 | 0 | 5.5 | 18.58% |

Nasdaq 100 Watch List

| Symbol | Name | Trade | P/E | EPS | Yield | P/B | Pct from Yr Low |

| QCOM | QUALCOMM | 38.95 | 31.3 | 1.25 | 1.70% | 3.1 | 9.84% |

| ERTS | Electronic Arts Inc. | 17.77 | N/A | -2.3 | N/A | 2.3 | 13.18% |

| GILD | Gilead Sciences, Inc. | 47.42 | 16.8 | 2.82 | N/A | 6.7 | 14.79% |

| FSLR | First Solar, Inc. | 115.5 | 15.4 | 7.53 | N/A | 3.6 | 17.04% |

| SRCL | Stericycle, Inc. | 54.49 | 26.9 | 2.03 | N/A | 5.5 | 18.56% |

| APOL | Apollo Group, Inc. | 63.02 | 15.2 | 4.16 | N/A | 6.8 | 19.38% |

| GENZ | Genzyme | 56.91 | 36.9 | 1.54 | N/A | 2 | 20.85% |

Watch List Summary

Nasdaq 100 Watch List

Below are the Nasdaq 100 companies that are within 21% of the 52-week low. This list is strictly for the purpose of researching whether or not the companies have viable business models or are about to go out of business. These companies are deemed highly speculative unless otherwise noted (view all.)

-Touc

| Symbol | Name | Trade | P/E | EPS | Yield | P/B | % from Low |

|---|---|---|---|---|---|---|---|

|

Apollo Group

|

56.92

|

13.70

|

4.16

|

N/A

|

6.56

|

7.82%

|

|

|

Electronic Arts

|

16.75

|

N/A

|

-2.31

|

N/A

|

2.09

|

13.56%

|

|

|

First Solar

|

116.00

|

15.46

|

7.50

|

N/A

|

4.37

|

14.97%

|

|

|

Activision

|

10.79

|

125.47

|

0.09

|

1.39%

|

1.28

|

16.65%

|

|

|

Pharma Prod.

|

21.20

|

15.81

|

1.34

|

2.83%

|

1.87

|

17.97%

|

|

|

Stericycle

|

54.30

|

26.81

|

2.03

|

N/A

|

5.36

|

18.15%

|

|

|

Genzyme

|

55.97

|

31.91

|

1.75

|

N/A

|

1.94

|

18.86%

|

|

|

Gilead

|

48.84

|

17.31

|

2.82

|

N/A

|

6.84

|

20.24%

|

Nasdaq 100 Watch List

| Symbol | Name | Trade | P/E | EPS (ttm) | Yield | P/B | % from Low |

|---|---|---|---|---|---|---|---|

|

Electronic Arts

|

16.06

|

N/A

|

-4.06

|

N/A

|

1.97

|

8.88%

|

|

|

Apollo Grp

|

59.22

|

14.25

|

4.16

|

N/A

|

6.23

|

12.18%

|

|

|

First Solar

|

115.10

|

15.34

|

7.50

|

N/A

|

3.94

|

14.07%

|

|

|

Stericycle

|

51.36

|

25.36

|

2.03

|

N/A

|

5.17

|

15.18%

|

|

|

Gilead Sci.

|

47.01

|

16.66

|

2.82

|

N/A

|

6.47

|

15.73%

|

|

|

Genzyme Corp.

|

55.73

|

31.77

|

1.75

|

N/A

|

1.93

|

18.35%

|

|

|

QUALCOMM

|

38.84

|

31.17

|

1.25

|

1.80%

|

2.98

|

19.00%

|

|

|

Pharma Product

|

21.65

|

13.70

|

1.58

|

2.80%

|

1.92

|

20.48%

|

|

|

Activision

|

11.11

|

45.35

|

0.25

|

1.40%

|

1.24

|

20.63%

|

-Touc