As long-term investors in precious metals, we have featured several articles that warned about the pitfalls of gold and silver investing rather than highlighting the redeeming attributes in the sector. One reason for this is the one-sided analysis that permeates throughout the gold and silver investment community.

Too often there are voices clamoring for attention about reasons to invest in gold and silver and very few of those same voices willing to say “dump the junk.” Some analysts in the gold sector will defy logic by recommending gold stocks in an obvious declining trend rendering their analysis moot since anyone can use the rationale “we’re in a bull market” to justify their claims.

One sure sign that we’re in a gold bull market is when gold and silver mining companies start paying ever increasing dividends. In a 2009 article titled “Why Silver Beats Gold As a Precious Metals Play,” we said, “be mindful of the coming competitive dividend war between precious metal companies.” Apparently, precious metal stocks have not disappointed in sharing the wealth in the current gold bull market. According to Morningstar.com, in the last five years the top ten dividend increasing companies in the precious metal sector has averaged +29.61%. We don’t expect this trend to reverse in the near term.

| Symbol | Company | 5-year dividend growth rate |

| AEM | Agnico-Eagle | 84.42% |

| AUY | Yamana Gold | 50.61% |

| IAG | IamGold | 29.87% |

| DRD | DRDGold | 26.08% |

| NEM | Newmont Mining | 20.11% |

| GG | Goldcorp | 19.26% |

| ABX | Barrick Gold | 18.31% |

| BVN | Buenaventura | 17.97% |

| RGLD | Royal Gold | 17.50% |

| GFI | Gold Fields | 11.98% |

| Average dividend growth rate | 29.61% | |

| Source: Morningstar.com accessed August 15, 2012 | ||

Also, in the same 2009 article and later reiterated in our 2011 article titled “The Coming Precious Metals Dividend War,” we said the following, “one gold or silver company is going to ‘jump the shark’ and make the dividend payments in the actual metal. When that time comes, it will be fair warning to protect your positions, though this may be indistinguishable to ebullient gold bugs at the time.” When we published our October 13, 2011 article titled “Gold Resource: Gold Dividend Means Sell” we felt that precious metal investors had been given fair warning that “…it may be an indication of a cyclical or short-term top in the gold market.”

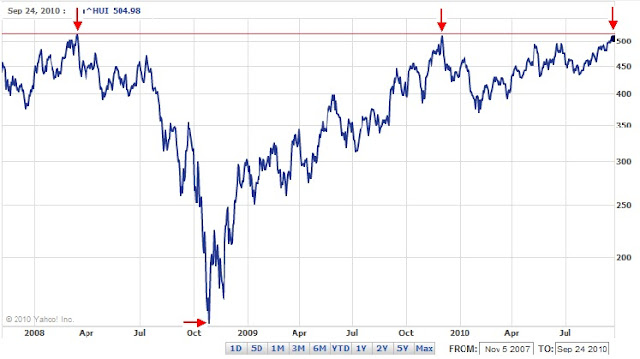

The announcement by Gold Resource (GORO) that the option for an “in-kind” dividend in the form of gold was on August 17, 2011 (PDF found here). Three trading days later, the price of the SPDR Gold Shares (GLD), according to Yahoo!Finance, peaked at $184.59. Twelve trading days after GORO’s announcement, according to Kitco.com, the London PM fix for gold closed at the peak price of $1,895. At the same time, the long established Philadelphia Gold and Silver Stock Index (XAU) declined as much as –33% by May, 15, 2012 and has settled at a loss of -26.80%.

As the precious metals dividend war heats up, the timing, nature of the dividend, and the quality of the company will provide for some perspective as to whether we are at a short/long-term peak in the precious metal market.

However, as we’ve said in the past, companies that pay dividends in gold have historically had difficulty in retaining such a policy. Those companies that currently have a policy of offering dividend payments in gold should be expected to discontinue such distributions at some point down the road. When that change in policy arrives, the news could push the respective gold and silver stock prices well below known “undervalued” levels.

If you must invest in precious metal stocks, we’d opt for those that are part of the XAU Index or the HUI Gold Bug Index and pay their dividends only in the form of cash.