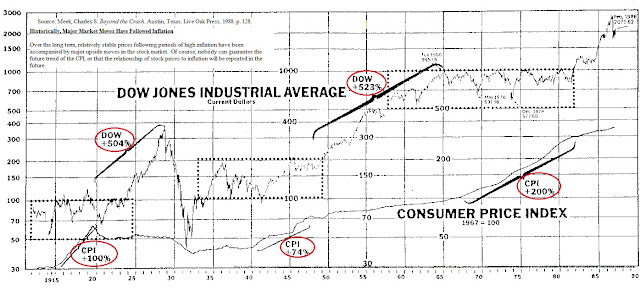

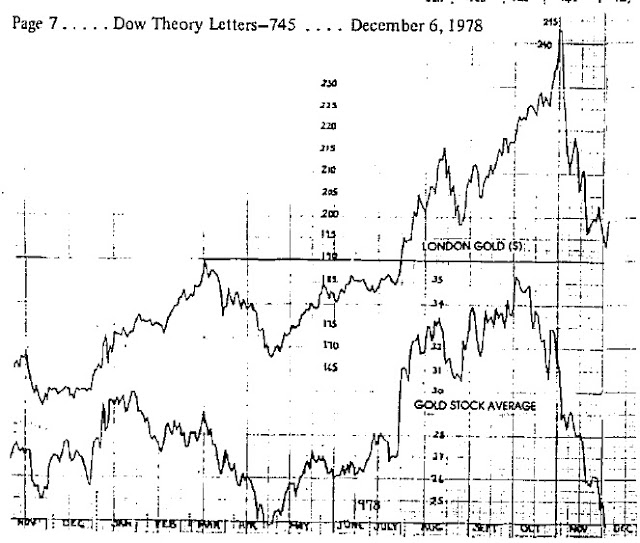

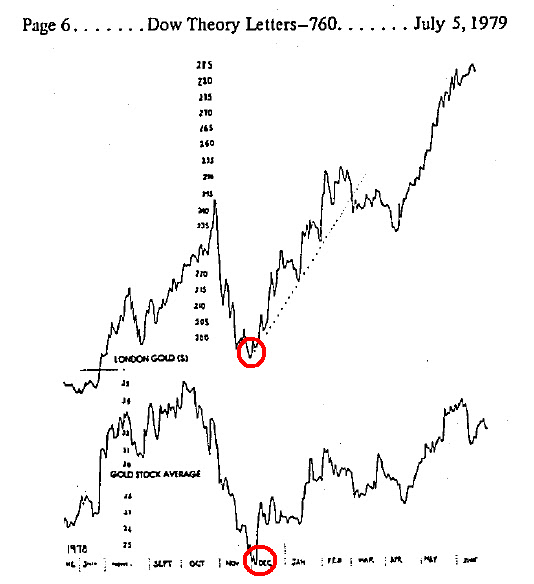

In order to better understand the relationship of precious metals and precious metal stocks it is critical that investors get familiar with the periods of peaks and troughs of the gold and silver markets. Without this knowledge hardened gold and silver investors will succumb to forces that will result in major losses of capital.

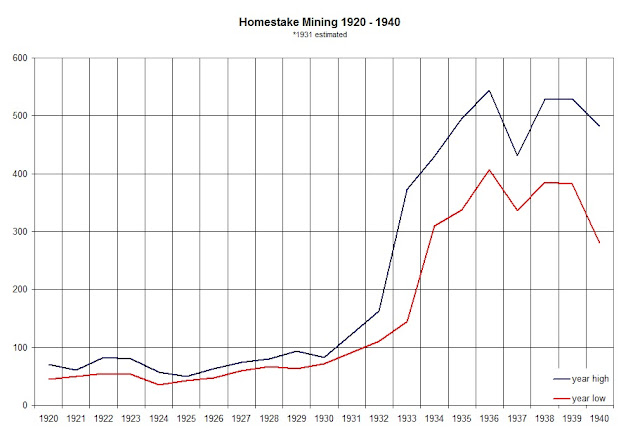

In a prior article on gold we gave an example of how gold stocks in general suffered their biggest percentage loss from 1924 to 1932. However, in that same period, one gold stock, Homestake Mining [HM], managed to not only defy the declining trend but increased in value beyond all expectation. In the period from 1891 to 1987, Homestake Mining increased in value from $9 over $5000 per share. Because it is our assertion that gold and gold stocks rise and fall with the general market (either leading or slightly lagging), we will demonstrate that Homestake Mining is the exception that proves the rule.

Homestake Stock Splits:

-

8 for 1 1937

-

2 for 1 1968

-

2 for 1 1974

-

3 for 2 1980

-

2 for 1 1983

-

2 for 1 1987

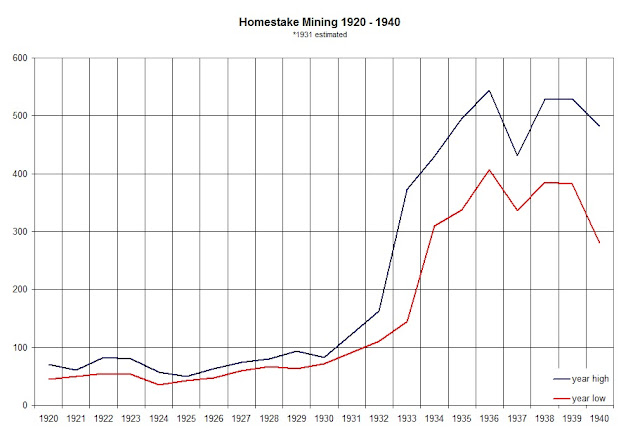

This article will address several specific reasons why Homestake Mining [HM] was able to increase in value from $71 to $528 in the period from 1920 to 1940. It is important to note that of the reasons that we provide, no one factor could answer for the rise of Homestake Mining. However, the extent of the combined characteristics far outweighed the concerns gold investors had about the alternative gold stocks during the same period, especially from 1924 to 1933.

There are two kinds of factors that affected the price of Homestake Mining [HM]. One set are those that Homestake Mining cannot control while the second set are those that can be controlled. Those matters not in the control of the management of Homestake Mining [HM] helped to provide a support for the price of the stock. At the same time, those actions taken by the management of Homestake helped to significantly boost the price of Homestake Mining. The combination of the two elements allowed Homestake to emerge as the best performing gold stock in the worst possible markets.

We’ll first address the issues that were not in the control of Homestake Mining [HM]. The most important matter not in the control of Homestake management was the fixing of the gold price. With the price of gold being fixed, the share price and earnings of gold stocks were considered to be stable. This was especially true when the price of other commodities were falling. Few gold bugs will take on the seemingly tabooed topic of the price of gold being fixed as the reason gold and gold stocks were a refuge to investors. However, this alone, being fixed, is the basis by which all myths of gold being a safe haven are built upon.

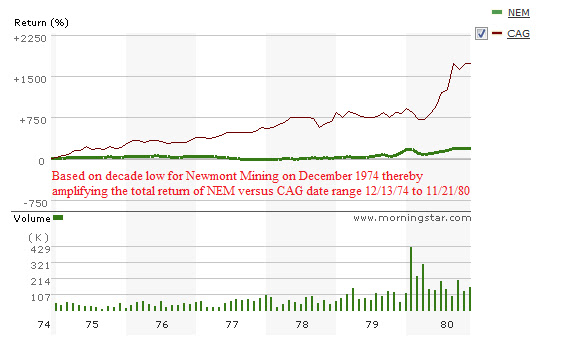

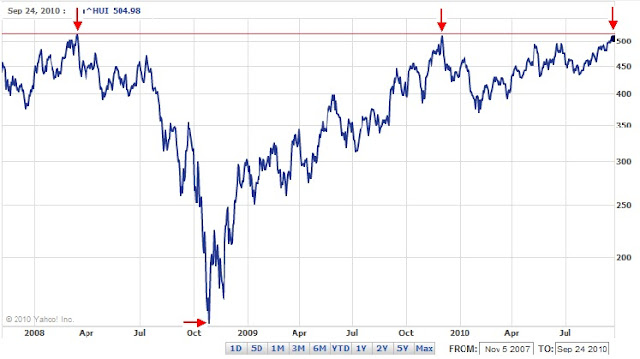

In more recent times, without a guaranteed price for gold, the commodity has fallen precipitously while gold stocks have been decimated. Some eternal gold bulls would say that during the market decline of 2007 to 2009 with the price of gold “only” falling 25%, in contrast to the Dow Industrials falling 40%, then it was an appropriate hedge. However, using the Philadelphia Gold and Silver Stock index (XAU), (a comparison of equity index to equity index) the decline was nearly 70% in a span of less than 1 year from March 2008 to November 2008. Gold was far from a source of stability during market panics of centuries past.

The next issue not in Homestake’s control was the limiting of the ability of the public to actually own (hoard) gold through the use of

Executive Order 6102 issued by Franklin D. Roosevelt on

April 5, 1933. This forced investors and savers in the U.S. to seek out the only alternative that existed which was gold equities. When markets seem to be falling apart, investors will seek out whatever happens to be the most stable option. Since owning gold wasn’t available the next best alternative was publicly traded gold stocks.

Also in 1933, President Franklin D. Roosevelt, through

Executive Order 6260, authorized the U.S. Treasury to purchase gold at the highest traded world price allowing gold mining companies to increase their earnings by almost 50%. The purpose of this was to incentivize domestic producers to increase their output to shore up the U.S. government’s large outflow of gold that took place from 1929 to 1933.

Factors that were in the control of the management of Homestake Mining [HM] were many and especially effective in getting the stock price to increase in value. The cornerstone of Homestake’s success was their dividend policy. 53 years of continuous dividend payments helped Homestake grow to become the default choice for gold stock investments. The only year that Homestake didn’t pay a dividend was in 1920 which was a reflection of the state of the market for that year.

During times of crisis or when it was felt that the monetary situation was weakening, the management of Homestake Mining would increase the dividend or they would pay an extra dividend. This kind of proactive behavior boosted demand for the stock from institutions and the public even when the dividend exceeded the actual earnings. As an example, after Great Britain abandoned the gold standard, Homestake increased the dividend from $6 to $7.80 in 1931.

On other occasions, Homestake would routinely declare an extra dividend of $1. This dividend would typically come each September, which was in addition to the previously declared payments. While not guaranteed, the $1 extra dividend was paid almost every year and sometimes two or three times within a single year.

Inevitably the payments of dividends would only go so far. Without a profitable business, Homestake would be broke. To resolve this issue, Homestake Mining management was aggressive at increasing efficiencies. In the span of a five-year period, Homestake management was able to nearly double the gold recovery from $3.77 in 1925 to $6.17 in 1930.

The final piece that was essential to the incredible increase of Homestake Mining was the fact that the stock was thinly traded. This critical element, along with the others mentioned before, ensured that a gold mine in the Dakota territory, initially started by George Hearst (father of William Randolph Hearst), Lloyd Tevis and J.B. Haggin, would increase from $9 in 1891 to well over $5000 (unadjusted) by 1987.

The lessons of Homestake Mining may simply be a matter of circumstance, unfair labor practices, below market wages and the acquisition of land in the most unscrupulous fashion. However, some lessons about how Homestake management operated are likely to prove useful to the understanding the reasons why Homestake’s stock price continued to go up in value when others didn’t but should have.

Source Citations:

- “Abreast of the Market.” Wall Street Journal. December 16, 1931. page 8.

- “Abreast of the Market.” Wall Street Journal. May 6, 1932. page 8.

- Rice, Claude T. “Premium Paid for Homestake.” Wall Street Journal. May 4, 1933. page 10.

- “Gold Ruling Adds to Miners’ Income.” Wall Street Journal. August 30, 1933. page 1.

- Poor’s High and Low Prices 1920-1930. Poor’s Publishing Company. 1931.

- Poor’s High and Low Prices 1924-1933. Poor’s Publishing Company. 1934.

- Poor’s High and Low Prices 1932-1940. Poor’s Publishing Company. 1941.