Review

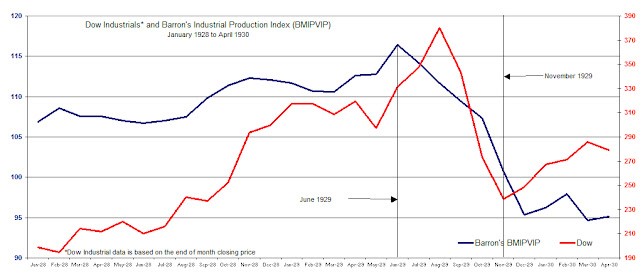

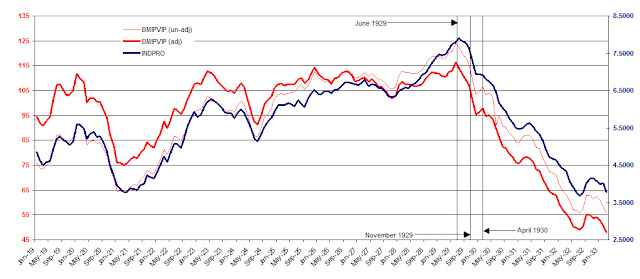

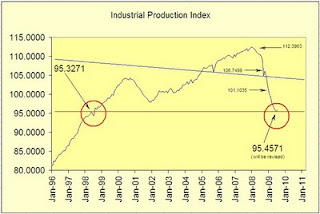

On August 23, 2009, using Dow Theory and the Industrial Production Index [IPI], we predicted that the National Bureau of Economic Research (NBER) was going to say that the recession ended in June 2009 (article here). We specifically said the following:

“Implicit in my discussion of the IPI [Industrial Production Index] is that we are at a turning point for the economy. Based on the combination of the Dow Theory confirmation of July 23, 2009 and the IPI turning up from the June low, I will have to guess that the National Bureau of Economic Research (NBER) is going to proclaim June 2009 as the official end to the recession. The end to this recession will be lackluster and questioned from all corners.”

As has been the case historically, the announcement that the recession had ended came 1-year and 3 months after the fact (NBER announcement found here.) Additionally, few have been satisfied with the definition of a recovery especially if it means that job growth and income increases have not been exceptional.

Now we are faced with what we believe could be the defining moment for a sustained stock market and economic decline worthy of being deemed (by NBER) a recession. The factors that go into this assessment are based on our interpretation of Dow Theory and the vacillations of the Industrial Production Index.

Dow Theory

Starting with Dow Theory, we have the following established indications:

-

On August 2, 2011, Dow Theory indicated that we were in the initial stages of a cyclical bear market (

article here). At the time, the Dow Jones Industrial Average (DIA) and the Dow Jones Transportation Average (IYT) fell below their respective June and March 2011 lows.

-

On August 9, 2011, we indicated that a bottom had been reached and that a bear market rally to prior highs was due, within the context of a cyclical bear market (

article here).

-

On March 16, 2012, we demonstrated that the divergence between the Dow Jones Industrial Average and the Dow Jones Transportation Average was

confirmation that we’re in a Dow Theory bear market rather than a renewed bull market (

article here).

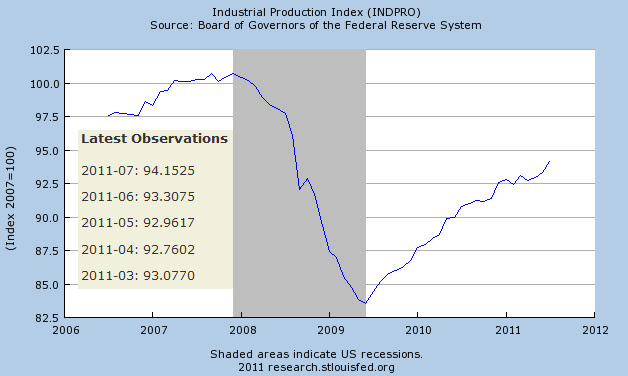

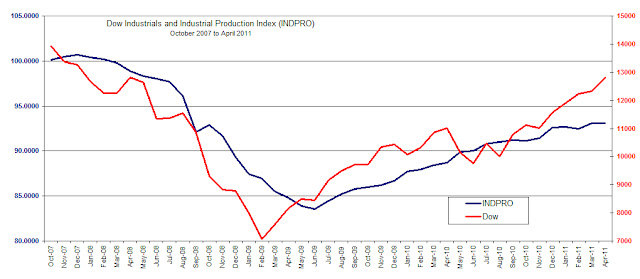

Generally speaking, Dow Theory acts as a leading indicator of the direction of the overall economy, with the Industrial Production Index following behind as confirmation. In this case, this is the first month that the Industrial Production Index (IPI) has declined after the Dow Theory bear market indication of August 2, 2011.

Industrial Production Index

Historically, the Industrial Production Index has “averaged” a decline of 1.44 consecutive months in periods of an economic growth period. This suggests that if the Industrial Production Index declines for two full months in a row, it would be enough to give us the all clear as to whether we can consider the economy as having reverted back into a recession after the rise from the June 2009 bottom. This interpretation relies on Dow Theory also having a bear market indication. In order for this to be the case, The Dow Industrials and Dow Transports would need to remain below their respective 2012/2011 peaks.

| Month |

IPI data |

| August 2011 |

94.1845 |

| September 2011 |

94.3800 |

| October 2011 |

94.9389 |

| November 2011 |

95.0939 |

| December 2011 |

95.9095 |

| January 2012 |

96.5705 |

| February 2012 |

96.5731 |

| March 2012 |

96.5685 |

| Source: |

St. Louis Fed |

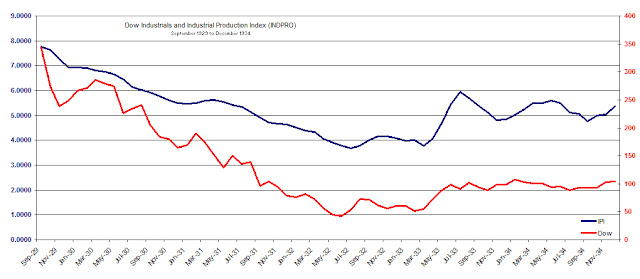

What would the Market Impact Be?

So far, we expect that the recessionary period would have at least four consecutive months of declines in the Industrial Production Index (IPI) and a total of at least 7 non-consecutive months of declines within the period considered a recession. This would be on par with the recession from July 1990 to March 1991. At the time of the 1990 to 1991 recession, the S&P 500 (SPY) declined -19.61% and the Nasdaq Composite Index declined –29.90%.

However, The stock market typically leads the call of a recession by topping out first. this suggests that potentially, the April 2, 2012 high for the Dow Industrials was the top and we're now in a declining trend at least until August/September 2012 to 10,611.59.

Again, our preliminary prediction is that if we see a second month of declines in the Industrial Production Index while the Dow Theory bear market indication is in place, we’ll have what will be considered a recession by the NBER which would be announced from 9 months to a year after the fact.

As a sidebar to the discussion of the possibility of a recession, the long-term gold stock positions that we've recently recommended which includes Agnico-Eagle (AEM), Gold Fields Ltd. (GFI) and Newmont Mining (NEM) will require reduced exposure or sold off since gold and silver stocks tend to perform worse than the general stock market during a recession.

Note: Industrial Production Index data is subject to constant revisions by the Federal Reserve Bank. We hope to reassess the Industrial Production Index based on the most updated information that is provided by the Federal Reserve.