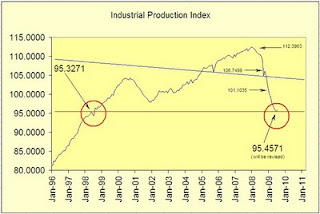

The Industrial Production Index (IPI) is an important lagging indicator that is part of Dow Theory as suggested in Robert Rhea’s book Dow Theory Applied to Business and Banking. Although seldom mentioned by modern Dow Theorists, the IPI is useful in confirming the validity of Dow Theory indications. This explains why a Dow Theory primary bull market was not announced by Robert Rhea in the period from November 1929 to April 1930. Although the stock market was rebounding from the “Great” Crash of 1929, the IPI was still in a declining trend, highlighted in the red bar as shown in the chart below.

In our last review of the Industrial Production Index on April 20, 2012, we had indicated that we’d need to see two consecutive months of decline in order for a confirmation of a recession while in a Dow Theory bear market. Since that piece, we have not seen two consecutive months of declines. However, as the data for the Industrial Production Index is continually updated, as much as six months into the past, we begin to see an emerging pattern.

Since January 2012, the Industrial Production Index has traded in a narrow range, based on the revised data. Already the Industrial Production Index is below the July 2012 high and approaching the April 2012 low of 96.4705. Falling below the April low could indicate that the recession had begun as early as January 2012. The Industrial Production Index has not been mired in such a range since the end if the recession was called in June of 2009. Additionally, the preliminary data suggests that the economic recovery has hit a snag and may be on the cusp of a full blown recession (as defined by the National Bureau of Economic Research).

As can be seen in the chart above, the Dow Jones Transportation Average and the Industrial Production Index seem to have experiences similar troubles at around the same point in time. True to form, the Dow Jones Transportation Index has gyrated widely to the downside with little ability to exceed the 2007 and 2011 highs.

From a historical standpoint, whenever the Industrial Production Index has peaked, 13 out of 17 times since 1920 (76.47%), the result was a recession call by the NBER. All that is left at this point is for the Industrial Production Index to rise, fall or get revised significantly outside of the established range. Rising or falling by a wide margin could definitively answer the question about whether we’re in a recession. The range could be revised out of existence through the process of updating the figures.

Our take is that there has to be a significant amount of economic growth through economic stimulus that dwarfs all prior efforts since 2007. Outside of such efforts by monetary and fiscal actions, we believe that a recession could be considered in effect from either January 2012 or July 2012.