-

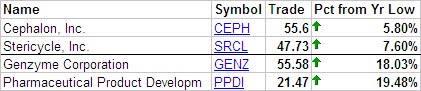

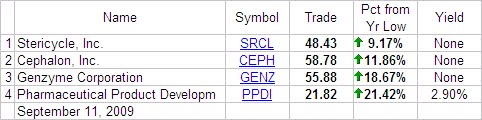

Cephalon Inc. (CEPH) at 3.56% above their 52-week low.

-

Gilead Sciences (GILD) at 17.27% above their 52-week low.

-

Stericycle (SRCL) at 17.76% above their 52-week low.

-

Genzyme Corp. (GENZ) at 18.79% above their 52-week low.

Cephalon (CEPH), according to Valueline, normally trades at 12 times cashflow. The cashflow for CEPH in 2007 was $5.41 per share (Mergent’s, was $5.78 for 2007.) Using the smaller figure, we get a price of $64.92 as the average price that the stock has typically reverted to. As the number of shares for CEPH have increased by 11% since 2007, I have adjusted lower the cash flow per share by 11% as a rough gauge of what the historical average price would be at 12x cash flow. The figure that I come up with is $57.72. This is 5.71% above the current price of $54.42. Valueline sees the negative cashflow figures persisting until the foreseeable future. (I have intentionally left out the negative cashflow figures for 2008 because the economy was in recession for the whole year.)

Gilead Sciences (GILD), according to Valueline, should be trading at 20x cashflow. With a cashflow of $2.32 in 2008, GILD averages a price of $46.40. Although Mergent’s has a cashflow figure that is higher, I will go with the most conservative figure that I can find. At the current price of $46.17, GILD is trading at the historical cashflow. Maybe this is a fading star but GILD has never traded below 20x cashflow for an extend period of time.

Based on 2008 cashflow figures from Valueline, Stericycle (SRCL) would trade around the $38.18 range. The 2008 cashflow for SRCL was $2.19 per share. This is significantly above the mean, which makes these share less inviting even though they are within 18% of the 52-week low.

Finally we have Genzyme Corp. (GENZ) at $55.94. This stock has historically traded at 19 times cashflow. The 2008 cashflow for this GENZ was $2.82, according to Mergent’s (Valueline had the higher figure.) GENZ, although selling 19% above the 52-week low, is a far superior value proposition. The shares outstanding have grown by 2.7% from 2006 to 2008 while the long-term debt has fallen by 85% over the same time frame.

Additional analysis will be provided on these companies as long as they stay within 20% of the 1-year low. Touc.

Disclosure: Long CEPH