Below are the Nasdaq 100 companies that are within 20% of the 52-week low. This list is strictly for the purpose of researching whether or not the companies have viable business models. These companies are deemed highly speculative unless otherwise noted.

|

Symbol

|

Name

|

Trade

|

P/E

|

EPS (ttm)

|

Yield

|

P/B

|

% from low

|

|

|

|

|

Akamai Technologies

|

31.62

|

33.46

|

0.95

|

N/A

|

2.66

|

0.13%

|

|

|

|

|

Cisco Systems, Inc.

|

15.94

|

12.44

|

1.28

|

1.60%

|

1.82

|

1.06%

|

|

|

|

|

Urban Outfitters, Inc.

|

28.88

|

18.92

|

1.53

|

N/A

|

3.42

|

3.27%

|

|

|

|

|

Staples, Inc.

|

15.94

|

12.94

|

1.23

|

2.60%

|

1.55

|

8.03%

|

|

|

|

|

Teva Pharmaceutical

|

48.9

|

13.15

|

3.72

|

1.70%

|

1.87

|

9.01%

|

|

|

|

|

Marvell Technology

|

15.16

|

12

|

1.26

|

N/A

|

1.84

|

9.30%

|

|

|

|

|

Qiagen N.V.

|

19.12

|

32.97

|

0.58

|

N/A

|

1.75

|

13.40%

|

|

|

|

|

Activision Blizzard, Inc

|

11.86

|

27.45

|

0.43

|

1.40%

|

1.32

|

14.92%

|

|

|

|

|

Microsoft Corporation

|

26.14

|

10.39

|

2.52

|

2.50%

|

4.1

|

15.00%

|

|

|

|

|

Broadcom Corporation

|

34.65

|

17.48

|

1.98

|

1.10%

|

3.13

|

15.89%

|

|

|

|

|

Infosys Limited

|

65.81

|

25.12

|

2.62

|

1.30%

|

6.09

|

16.01%

|

|

|

|

|

Amgen Inc.

|

58.35

|

12.13

|

4.81

|

N/A

|

2.18

|

16.10%

|

|

|

|

|

Yahoo! Inc.

|

15.38

|

18.07

|

0.85

|

N/A

|

1.53

|

18.86%

|

|

|

|

|

Google Inc.

|

517.65

|

20.1

|

25.75

|

N/A

|

3.34

|

19.38%

|

|

|

Watch List Summary

Micron Technology (MU)

On February 3, 2011 in Barron’s magazine (

article here), Doug Freedman of Gleacher & Co. upgraded his ratings of Micron Technology (MU) from Neutral to Buy. The justification for the ratings upgrade was that price-cutting within the respective industries for both companies was diminishing. At the time, Micron Technology was trading just short of the 52-week high at $10.89. Soon after the buy recommendation in early February, Micron Technology stock reached a peak of $11.61 by the middle of the month.

Fast-forward to June 24, 2011 in Barron’s magazine (

article here), Freedman reiterates his buy rating of Micron Technology (MU). The reiteration of the buy recommendation comes after Micron’s stock fell to $7.39 per share or –32% since his original buy recommendation on February 3, 2011. Apparently there is a story not worth repeating that Freedman is sticking to regardless of the reality that such a story is not applicable to Micron (MU). Freedman’s initial buy rating came when the stock was within striking distance of a 52-week high. The idea of transitioning from a neutral rating to a buy rating at the high seemed illogical since it was based on the premise that the previous trajectory would continue unabated.

Pre-Market Rules the Trading Day

On June 27, 2011, the stock market trading for the Nasdaq 100 was ruled by the pre-market. What do we mean by the pre-market ruling the day? Well, with all of the volume that is created during the regular hours of trading, the most impact to stock prices occurs during the pre-market. On average, the pre-market trading moved the shares of Nasdaq 100 stocks by 96.95%. The regular hours of trading only impacted market gains by 3.05%.

In addition, the volume of the pre-market is dwarfed by the regular hours however there is little to show for all of the activity during the regular trading day. As an example, Apple (AAPL) had pre-market volume of 125,033 shares and a gain of $5.96. At the close of regular trading, AAPL closed at $5.69, only a 4% difference from the pre-market close. This 4% difference from the pre-market close occurred on 12 million shares of volume. 32% of the companies on the Nasdaq 100 had no change in price after the pre-market closing price was established. Micron Technology, which had 34 million shares traded, was among those companies that didn’t budge from the pre-market closing price. This activity is not relegated to just the Nasdaq 100 on June 27th, we’ve examined this topic at great length in the past at the

following link.

Garmin (GRMN) Top Formation Complete

On

June 28, 2011, navigation device maker TomTom announced that expected earnings and sales would be cut for 2011. This resulted in a 26% decline in the share price of TomTom. Garmin (GRMN) was soon to follow the lead of TomTom falling by 3% in pre-market trading. Garmin was highlighted as one of the Nasdaq 100 stocks to watch when it was within 2% of the 52-week low on

August 15, 2010.

With a gain of 19% in 10 months and the prospect of retracing back to the $29 level, selling Garmin now, if you haven’t done so already, shouldn’t be out of the question.

Akamai (AKAM) in Lock Step

The price action of Akamai (AKAM) seems to be following in lock step the price movement from 2005 to 2008. In the period from 2005 to 2007 the stock of Akamai rose from $10 to as high as $59.15. The subsequent declining phase lasted from early 2007 to late 2008 and stopped at $9.29.

Where do we think that Akamai is in the current cycle of decline? The most recent high was registered at $54.12 on December 7, 2010. In the last cycle, the price of Akamai stock took a break from freefall by resting at the $25.88 level. If Akamai were to do exactly what occurred the last time around (on a percentage basis), then there should be a rebound to the Dow Theory 1/3 (red line) support line of $39.18.

In the last cycle, Akamai traded in a Dow Theory line formation two times as investors and traders decided which position held the strongest hand. The first time occurred in 2006. It only took investors four months to decide that the stronger hands were the accumulators of Akamai stock. The second time a Dow Theory line started was in mid-2007. After a year of struggle it was finally determined that the distributors of Akamai stock had the strongest hand.

If we’re lucky, with Akamai (AKAM) continuously falling to a new low, the recent reversal in the stock price could ignite a price rise back to the 1/3 (red line) Dow Theory resistance level of $39.18. Akamai’s stock price getting above $31.71 (yellow line) represents fair value, a significant marker in terms of Dow Theory since it indicates where a majority of investors, as opposed to speculators, have gains in their AKAM position instead of loses. This gives less incentive to the investors to sell their stock.

As in the last cycle for Akamai, the strongest resistance level is at the $39/$40 level. Dow Theory stipulates that an investor should only expect half of what is foreseeable down the road. Since $39.18 (red line) is the foreseeable prospect for AKAM, if the price is now $35, then a fair profit could only be 5.97% or a gain of $2.09. Trite as this may seem, it is the only reasonable expectation for the stock in the short term.

The downside target for Akamai (AKAM), according to Dow Theory, is $24.24 (green line). In the past, AKAM has shown the ability to break through this support levels on downside moves in resounding fashion. Those interested in taking new positions should be willing to accept the downside risks beforehand.

First Solar (FSLR)

It was reported on

June 30, 2011 that First Solar (FSLR) received $4.49 billion in conditional loan guarantees from the Department of Energy. This news pushed the price of FSLR up 6% in after hours trading.

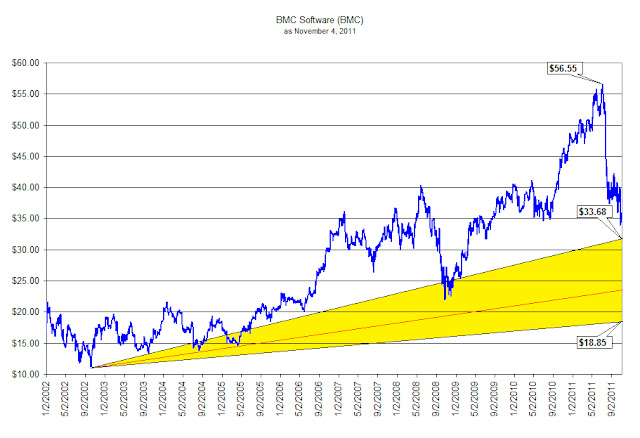

As the above chart indicates, First Solar (FSLR) appeared on our watch list several times at opportune prices. On

February 26, 2010, FSLR appeared on our watch list when the stock price was within 7% of a new low. After a brief rise in the price of FSLR low in February, the stock re-appeared on our

May 22, 2010 watch list falling within 16% of the 52-week low. More recently, FSLR showed up on our watch list when the stock came within 7% of the new low on

June 17, 2011.

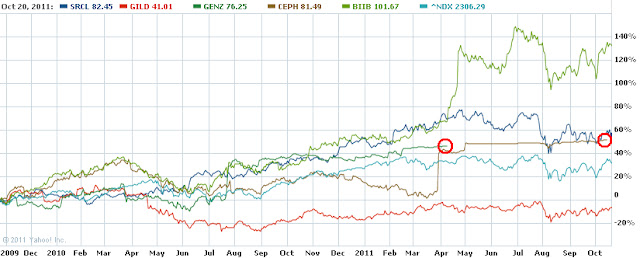

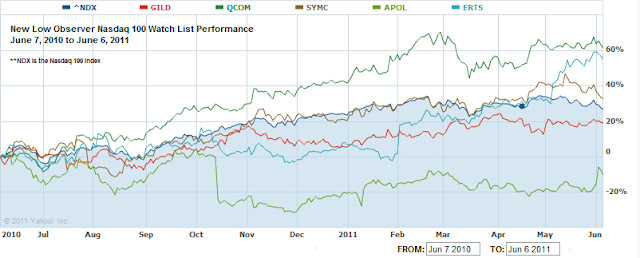

Watch List Performance Review

In our ongoing review of the Nasdaq 100 Watch List, we have taken the top five stocks on our list from July 2, 2010 and have check their performance one year later.

| Symbol |

Company |

2010 |

2011 |

% change

|

|

|

|

| APOL |

Apollo Group, Inc. |

41.86 |

46.6 |

11.32%

|

|

|

|

| RIMM |

Research In Motion |

48.14 |

28.83 |

-40.11%

|

|

|

|

| DELL |

Dell Inc. |

12.03 |

16.95 |

40.90%

|

|

|

|

| YHOO |

Yahoo! Inc. |

14.07 |

15.44 |

9.74%

|

|

|

|

| QCOM |

QUALCOMM |

32.37 |

57.81 |

78.59%

|

|

|

|

| - |

- |

- |

Average |

20.09%

|

|

|

|

|

|

|

| NDX |

Nasdaq 100 |

1734.41 |

2362.25 |

36.20%

|

|

Only two companies, Dell (DELL) and Qualcomm (QCOM), from our July 2010 watch list were able to beat the Nasdaq 100. The average gain for the top 5 companies was 20.09% which was far below the 36.20% gain for the Nasdaq 100. Apollo Group (APOL) provided a surprising gain of 11.32% in an extremely challenging environment for companies in the for-profit education business. Research In Motion (RIMM) not only was at a new low last year, it fell another -40%. It seems that RIMM is going in a death spiral since few companies on our watch lists are near their two consecutive years in a row, let alone falling an additional -40%. Despite the plummeting of the shares of RIMM, it should be noted that the stock rose 40% by March 2011 after showing up on our list last year.

Disclaimer:

On our current list, we excluded companies that have no earnings. Stocks that appear on our watch lists are not recommendations to buy. Instead, they are the starting point for doing your research and determining the best company to buy. Ideally, a stock that is purchased from this list is done after a considerable decline in the price and extensive due diligence. We suggest that readers use the March 2009 low (or the companies' most distressed level in the last 2 years) as the downside projection for investing. Our view is to embrace the worse case scenario prior to investing. A minimum of 50% decline or the November 2008 to March 2009 low, whichever is lower, would fit that description. It is important to place these companies on your own watch list so that when the opportunity arises, you can purchase them with a greater margin of safety. It is our expectation that, at the most, only 1/3 of the companies that are part of our list will outperform the market over a one-year period.

.

Please consider donating to the New Low Observer. Thank you.