Below are the top Nasdaq 100 companies that are within 20% of the 52-week low. This list is strictly for the purpose of researching whether or not the companies have viable business models. These companies are deemed highly speculative unless otherwise noted.

| Symbol |

Name |

Price |

P/E |

EPS |

Yield |

P/B |

% from Low |

| ISRG |

Intuitive Surgical |

$267.40 |

31.8 |

$8.40 |

- |

5.26 |

8.68% |

| CEPH |

Cephalon, Inc. |

$60.32 |

11.3 |

$5.35 |

- |

1.81 |

9.67% |

| CSCO |

Cisco Systems |

$20.97 |

15.4 |

$1.36 |

- |

2.62 |

10.37% |

| APOL |

Apollo Group, Inc. |

$37.98 |

10.5 |

$3.62 |

- |

4.30 |

12.54% |

| AMGN |

Amgen Inc. |

$56.98 |

12.3 |

$4.63 |

- |

2.24 |

13.37% |

| ERTS |

Electronic Arts |

$16.05 |

- |

-$0.48 |

- |

2.04 |

14.17% |

| QGEN |

Qiagen N.V. |

$19.32 |

30.4 |

$0.64 |

- |

1.89 |

14.59% |

| TEVA |

Teva Pharma. |

$54.01 |

16.6 |

$3.25 |

1.30% |

2.22 |

14.94% |

| VRTX |

Vertex Pharma. |

$36.16 |

- |

-$3.73 |

- |

11.31 |

15.71% |

| GRMN |

Garmin Ltd. |

$30.53 |

8.3 |

$3.66 |

4.80% |

2.10 |

16.93% |

| INTC |

Intel Corporation |

$20.66 |

11.2 |

$1.85 |

3.00% |

2.43 |

17.39% |

| GILD |

Gilead Sciences |

$37.50 |

11.0 |

$3.42 |

- |

5.36 |

18.18% |

| SHLD |

Sears Holdings |

$70.18 |

41.9 |

$1.68 |

- |

0.94 |

18.53% |

|

|

|

|

|

|

|

| ^NDX |

Nasdaq 100 |

2,276.70 |

|

|

|

|

|

***

Read our Chapter 2 review of Seth Klarman's book Margin of Safety here***

Watch List Summary

From the current watchlist we are considering the prospects for Intuitive Surgical (ISRG), Intel (INTC) and Garmin (GRMN). Garmin is interesting simply for the fact that the moving feast known as their dividend should be announced in the coming months. We're curious if Garmin will eliminate, raise, lower or keep the dividend the same. As has been the case in the last four years, Garmin has paid their dividend all at once. This will be very interesting considering the 4.80% payment.

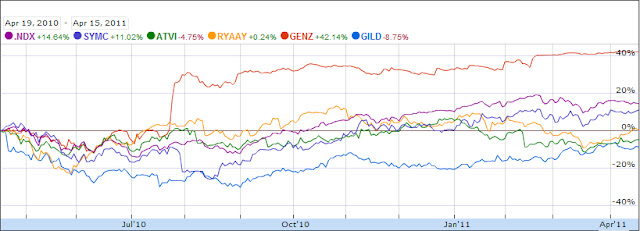

In the Nasdaq 100 Watch List of 15 companies from

December 12, 2010 to the closing price January 7, 2011, the average return from all of the companies was +3.65%. This is compared to the NDX (Nasdaq 100 Index) which had a gain of +2.77%.

Dish Network (DISH) registered the largest gain of +12.45%. Adobe Systems (ADBE) rose 11.60% since December 12th. Cisco (CSCO) came in third on the list with a gain of 6.45%.

Watch List Performance Review

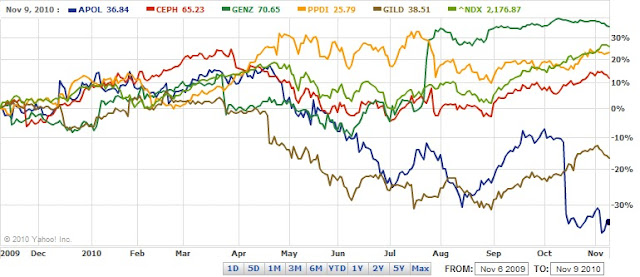

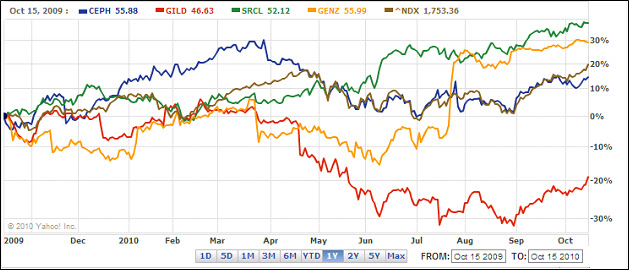

In our ongoing review of the Nasdaq 100 Watch List, we have taken the top four stocks on our list from the closing price of

January 7, 2010 and have checked their performance one year later. The top four companies on that list are provided below with the closing price for January 7, 2010 and January 7, 2011.

| Symbol |

Name |

2010 |

2011 |

% change |

| GILD |

Gilead Sciences |

44.54 |

37.50 |

-15.81% |

| CEPH |

Cephalon, Inc. |

63.01 |

60.32 |

-4.27% |

| GENZ |

Genzyme Corp |

53.81 |

71.39 |

32.67% |

| APOL |

Apollo Group |

60.50 |

37.98 |

-37.22% |

|

|

|

Average |

-6.16% |

|

|

|

|

|

|

|

|

| ^NDX |

Nasdaq 100 |

1892.59 |

2276.70 |

20.30% |

Only one stock, Genzyme (GENZ), was able to to show a positive return. This was of little consolation as the three other stocks on our watchlist fell, on average, -19%. The Nasdaq 100 outperformed the watchlist with a gain of 20% in the last year.

Disclaimer

Stocks that appear on our watch lists are not recommendations to buy. Instead, they are the starting point for doing your research and determining the best company to buy. Ideally, a stock that is purchased from this list is done after a considerable decline in the price and extensive due diligence. We suggest that readers use the March 2009 low (or the companies' most distressed level in the last 2 years) as the downside projection for investing. Our view is to embrace the worse case scenario prior to investing. A minimum of 50% decline or the November 2008 to March 2009 low, whichever is lower, would fit that description. It is important to place these companies on your own watch list so that when the opportunity arises, you can purchase them with a greater margin of safety. It is our expectation that, at the most, only 1/3 of the companies that are part of our list will outperform the market over a one-year period.