Watch List Performance Review

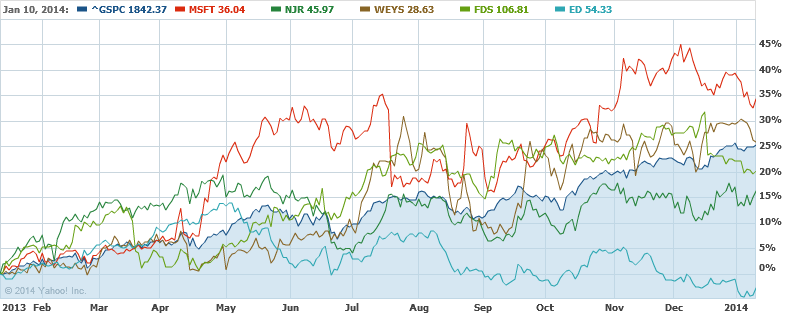

In our ongoing review of the NLO Dividend Watch List, we have taken the top five stocks on our list from February 1, 2013 and have checked their performance one year later. The top five companies on that list can be seen in the table below.

| Symbol | Name | 2013 Price | 2014 Price | % change |

| FDO | Family Dollar Stores | 56.09 | 61.82 | 10.2% |

| WEYS | Weyco Group | 23.20 | 26.42 | 13.9% |

| LKFN | Lakeland Financial Corp. | 24.74 | 36.63 | 48.1% |

| SO | Southern Company | 44.01 | 41.24 | -6.3% |

| MSFT | Microsoft Corporation | 27.93 | 37.84 | 35.5% |

| Average | 20.3% | |||

| DJI | Dow Jones Industrial | 14,054.50 | 15,698.85 | 11.7% |

| SPX | S&P 500 | 1,514.68 | 1,782.59 | 17.7% |

In our review, we informed our readers that we’ve taken position in Dollar Tree (DLTR) instead of Family Dollar (FDO) which coincidently turned out to be a better purchase. Year-to-date, Dollar Tree yielded a return of +26% and has risen as much as +50% in less than one year. Family Dollar rose as far as +30% and has settled at a +10% gain one year later. Our readers may recall that we had taken profits in Dollar Tree at 15% as its our strategy of seeking fair profits.

U.S. Dividend Watch List: January 31, 2014

The market volatility continued this week with the S&P 500 trading as low as 1,772 and as high as 1,798 which is a 1.5% swing. By the end of the week, the market was down -0.5% and provided us with an additional 10 companies we could consider.

Below are 43 companies on our U.S. Dividend Watch List that are on our radar.