A reader writes:

"Without the Obama stimulus and intervention from the FED it would already be below 5000. The existing position is totally artificial, unsustainable and downright ephemeral. Any one that claims that this synthetic bull market is sustainable is full of it.

"It is interesting to note how much you can derive from the historical shape of a line with zero analysis of why it was that shape. You have not even quoted a single example of a similar pattern resulting in a similar outcome to your predictions. In other words, this is not a scientific approach. It not even a logical approach. I can only conclude that the sole purpose of such analysis is to influence the market in a desired direction. In other words it is a propaganda approach."

Our Response:

Manipulation is a factor of the market in the day-to-day movement. However, the long-term trend of the market cannot be manipulated as demonstrated from the writings of William Peter Hamilton, former editor of the Wall Street Journal.

Using Dow Theory, Hamilton called the top in the stock market on October 25, 1929 in a WSJ editorial titled “A Turn in the Tide.” It should be noted that the comments on manipulation made by William Peter Hamilton were done when it was well known who and when manipulation took place prior to the institution of the SEC.

In his book The Stock Market Barometer, Hamilton outlines many methods of manipulations as they took place and its relevance to the overall market. In his book, Hamilton says of manipulation:

-

“The market is always under more or less manipulation.” page 37.

-

“Even with manipulation, embracing not one but several leading stocks, the market is saying the same thing, and is bigger than the manipulation” page 42.

-

“Major Movements Are Unmanipulated-One of the greatest of misconceptions, that which has militated most against the usefulness of the stock market barometer, is the belief that manipulation can falsify stock market movements otherwise authoritative and instructive” page 49.

-

“These discussions [of manipulation] have been made in vain if they have failed to show that all the primary bull markets and every primary bear market have been vindicated, in the course of their development and before their close, by the facts of general business, however much over speculation or over-liquidation may have tended to excess, as they always do, in the last stage of the primary swing” page 50.

-

“It has been shown that, for all practical purposes, manipulation has, and can have, no real effect in the main or primary movement of the stock market, as reflected in the averages. In a primary bull or bear market the actuating forces are above and beyond manipulation. But in the other movements of Dow's theory, a secondary reaction in a bull market or the corresponding secondary rally in a bear market, or in the third movement (the daily fluctuation) which goes on all the time, there is room for manipulation, but only in individual stocks, or in small groups, with a well-recognized leading issue” page 73.

Hamilton, William Peter, The Stock Market Barometer, Wiley & Sons, New York, 1922.

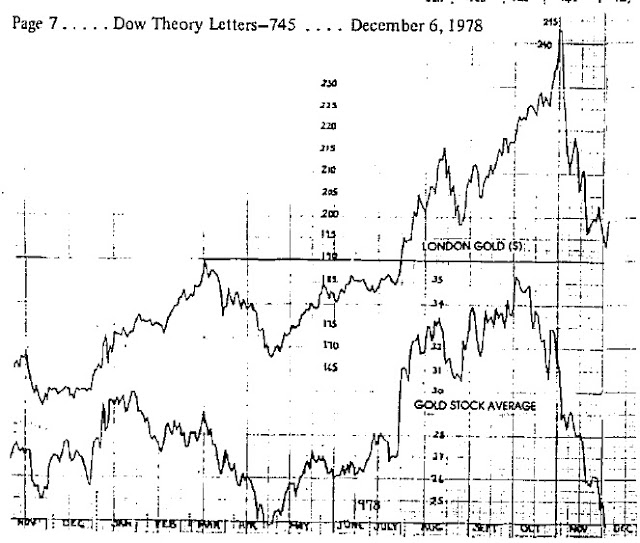

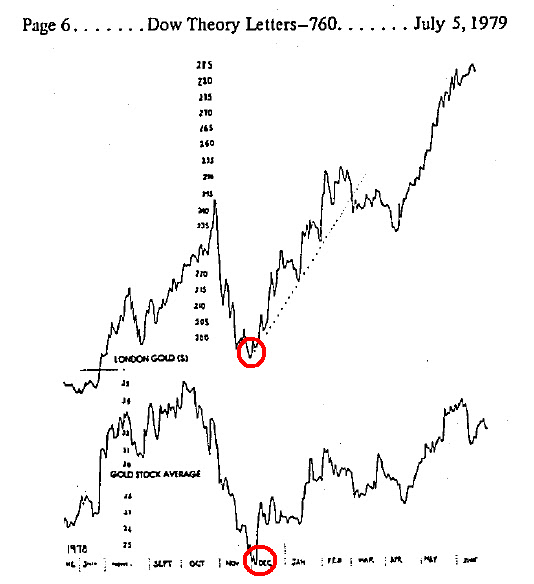

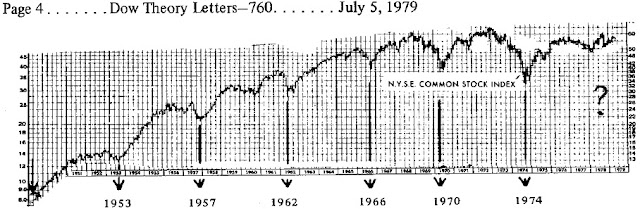

Another great Dow Theorist, Richard Russell, editor of the

Dow Theory Letter which has been published consistently since 1958, called the market bottom in October 1974 and called the top in November 2007 (

read Barron's article here). The extensive history of reasonably accurate and well-documented calls of market direction make examining Dow Theory worthwhile. The purpose of showing Russell’s remarks on the topic of manipulation is to demonstrate that, although there is a distinct difference between the pre-1934 SEC market of Hamilton era and today, the rules, according to Dow Theory, remain the same.

In The Dow Theory Letters, Richard Russell reiterates the fact that:

“One of the most difficult concepts to get across to subscribers is the concept of primary trend of the market. This may be old hat to my veteran subscribers of 10 or 20 years, but the whole idea of the primary trend bears repeating now.

“There are three trends in the market, all working with each other simultaneously. There is the great primary trend, lasting usually a few years up to 15 years or even longer. There is the secondary trend lasting usually a few months up to a year. And there is the minor or daily trend lasting a few days to a few weeks or so.

“The minor trend of the market is open to manipulation. This shortest of trends may reflect a news event, a sudden scare, a sunny word from the president or any of a thousand other possibilities.

“The secondary trend often reflects a short-lived expansion or recession that the economy or some very major news event. The secondary trend is also open to manipulation, usually on the part of the Fed in that the Fed can make money tight or loose (the Fed can even bring on a recession by restricting credit or the Fed can see a boom by opening the money spigots wide).

“The primary trend is the great tidal trend of the market. When the tide is coming in we term it a bull market. When it is going out we call it a bear market. One of the basic tenets of Dow theory is that the primary trend of the market cannot be manipulated. That’s a point that every investor must understand. The primary trend is more powerful than the power of the Federal Reserve, Congress, and the president combined. When the primary trend of the market turns down (as it did early 1973) stocks will decline until the market discounts the worst that can be seen ahead. When the primary trend turns up (as they did in late 1974) the market will rise until the best that can be seen ahead is fully discounted in the price structure.

“But the point I want to get across to subscribers is that once the direction of the primary trend is set, the market will fully express itself in the primary direction. The primary trend may be held back for a while, secondary reactions may interrupt the primary trend, but ultimately the trend will run to conclusion, it will express itself fully.”

Russell, Richard, Dow Theory Letters, January 24, 1990, Letter 1035, 2

Keep in mind that Dow theory isn’t a cure all for investment success. As aptly stated by yet another great Dow Theorist Robert Rhea in his book “The Dow Theory," he states:

“The Dow theory is not an infallible system for beating the market. Its successful use as an aid in speculation requires serious study, and the summing up of evidence must be impartial. The wish must never be allowed to father the thought.”

Rhea, Robert, The Dow Theory, 1932, Barron’s Publishing, 26

Rhea is known for having called the market bottom in 1932 with the publishing of the book The Dow Theory as well as in his newsletter Dow Theory Comment. Despite the clarity in the fact that Dow Theory is not “infallible” the point is made that the use of Dow Theory has the significant value of synthesizing all current and foreseeable economic, political, and social information. Rhea quotes Hamilton with the following thoughts:

“The Averages Discount Everything -- The fluctuations of the daily closing prices of the Dow-Jones rail and industrial averages afford a composite of all the hopes, disappointments, and knowledge of everyone who knows anything of financial matters, and for that reason the effects of coming events (excluding acts of God) are always properly anticipated in their movements.”

Rhea, Robert, The Dow Theory, 1932, Barron’s Publishing, 19

For the fact that Dow Theory is supposed to include all information, there is little reason for me to speculate on the reasons why and how the market will do what I interpret the averages to be saying. Furthermore, the idea that Dow theory is about a bunch of lines is an unfair assessment at best. Suffice to say, Dow Theory is founded primarily on values then market sentiment and finally explained in a technical fashion (using lines.) Those wishing to understand the value component of the theory can find it throughout the

New Low Observer website. However, keep reading for more insight on how value plays a role in your investment strategy.