Below are the Nasdaq 100 companies that are within 20% of their respective 52-week lows. Stocks that appear on our watch lists are not recommendations to buy. Instead, they are the starting point for doing your research and determining the best company to buy. Ideally, a stock that is purchased from this list is done after a considerable decline in the price and rigorous due diligence.

| Symbol |

Name |

Price |

P/E |

EPS |

Yield |

Price/Book |

Div/Share |

% Chg from Low |

| FSLR |

First Solar, Inc. |

25.05 |

|

-0.46 |

|

0.6 |

|

2.24% |

| EA |

Electronic Arts Inc. |

16.49 |

|

-0.52 |

|

2.42 |

|

2.71% |

| CTRP |

Ctrip.com International Ltd. |

21.64 |

19.29 |

1.12 |

|

2.74 |

|

3.00% |

| APOL |

Apollo Group Inc. |

38.64 |

8.41 |

4.6 |

|

4.34 |

|

4.21% |

| CHRW |

CH Robinson Worldwide Inc. |

65.49 |

25 |

2.62 |

2.00% |

8.48 |

1.32 |

5.12% |

| VOD |

Vodafone Group plc |

27.67 |

12.75 |

2.17 |

3.40% |

1.07 |

0.95 |

13.82% |

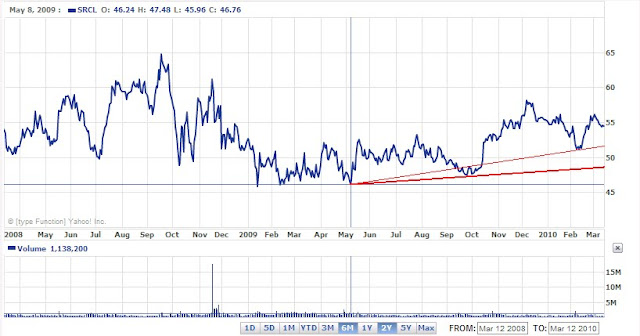

| SRCL |

Stericycle, Inc. |

83.64 |

31.09 |

2.69 |

|

5.95 |

|

14.50% |

| ORCL |

Oracle Corporation |

29.16 |

15.28 |

1.91 |

0.80% |

3.4 |

0.24 |

17.96% |

| RIMM |

Research In Motion Limited |

14.7 |

3.46 |

4.25 |

|

0.69 |

|

18.07% |

| GMCR |

Green Mountain Coffee Roasters Inc. |

46.84 |

24.11 |

1.94 |

|

3.67 |

|

18.82% |

Watch List Summary*

Update: December 16, 2011 Summary Stocks

Today we’re going to review the price action of the Nasdaq 100 stocks profiled in the summary section of our December 16, 2011 watch list. First on the list was BMC Software (BMC), we indicated the following about BMC:

-

“If BMC were to replicate the percentage decline from the May 2008 top to the October 2008 low, the stock would decline to a price of $31.11.”

-

“The $40 level seems reasonable within the next year for BMC even though it is 20% above the current price.”

BMC declined from the December 16th price of $33.17 down to the low $31.62 on January 10, 2012. The actual low of $31.62 was within 1.64% of the projected downside target. Additionally, BMC managed to close above the $40 level starting on March 26, 2012.

Virgin Media (VMED) was the second stock listed in our summary section. We projected an initial downside target of $18.29. This never materialized as the stock reversed its decline at $20.52, we said the following regarding the VMED’s upside target:

From December 19, 2011 to February 7, 2012 VMED rose as high as $24.49 but struggled to move any higher. On February 8, 2012, VMED jumped to $25.27 and managed to close as high as $25.93 on February 14, 2012. This was a gain of +23.77% in a month and a half.

Ctrip.com (CTRP) was the last stock that we reviewed. At the time, we said the following about CTRP:

-

“…on a pace to replicate the performance from the high in April 2008 to the low of January 2009 which equaled a loss of -72%. A similar decline in CTRP from the high of $50.57 would bring the price down to $14.16.”

-

“CTRP sits one penny below the 2nd Dow Theory support level of $23.11. Any further deviation below the current price almost ensures that the stock is destined for the $10 range.”

On March 28, 2012, CTRP declined significantly enough below the $22.44 level for us to believe that the stock would fall first to the $14.16 level and possibly to the $10 range.

*Stocks that are in our Watch List Summary section are those that we find the most compelling among all the stocks that appear in the watch list above.