In an effort to acquire political capital , Senator John McCain and Senator Maria Cantwell have

proposed to reinstate the Glass-Steagall Act which was overturned by the signing of the Graham-Leach-Bliley Act by former President Bill Clinton in 1999. The belief is that, by bringing back the Glass-Steagall Act, all future financial instability will be banished somehow.

It should be remembered that before the passage of the Graham-Leach-Bliley Act, we had the debacle of the Savings and Loan (S&L) crisis. You'd think that with Glass-Steagall on the books, something like the S&L crisis would not have occurred. After all, S&Ls didn't have direct ties to investment banks and brokerage houses. Additionally, S&L regulators knew of the existence of Glass-Steagall. However, Glass-Steagall or not, when a mortgage crisis "happens" the impact on the economy is always devastating. In fact, the off budget costs of the S&L crisis still hasn't been paid for.

Maybe we could say that the S&L crisis occurred because of the accounting change required by FIRREA. Or perhaps the crisis happened because of the lax regulation by the Federal Savings and Loan Insurance Corporation (FSLIC). No matter, the crisis occurred despite all the regulatory agencies and requirements in place to avoid a crisis.

I'd love to use Japan as an example of the impact that a mortgage crisis has on an economy. However, some would argue that the crossholding of shares in banking and brokerage stocks led to a domino effect when the stock market collapsed. Others would argue that the Japanese have an opaque financial system that is run on close ties to the government and that that couldn't possibly happen here in the United States. Wait, that's exactly what happened here in the good ol' USA. Darn!!! That idea is out the window.

For some reason, I distinctly remember that Senator McCain was a "reluctant" participant in what was known as the Keating Five. McCain was the lone Republican Senator among four Democratic senators who acted on behalf of the failed Lincoln Savings and Loan chairman Charles Keating Jr. In his defense, McCain was later cleared of corruption charges but was criticized for using "poor judgment" in his relationship with Keating and Lincoln S&L. Although I'm all for learning from past failures, it seems odd that McCain would be leading the charge to go back to Glass-Steagall given his vote for the law that overturned the 1933 law (later revised in 1934.)

Just so you don't think that I'm Republican bashing, please read my article titled Autopsy of the Glass-Steagall Act. My distrust of politicians cuts right down the middle. After seeing where we've been, let alone where we are, I can't say that I'm impressed with either side of the same coin.

So why is the reinstating of Glass-Steagall such a fool's errand? Well, in order to understand the reasons why, you need to do a cursory review of the history of farming and securitization. Yes, my answer lies in a distinct understanding of how farms and securitization, err, don't really work well together.

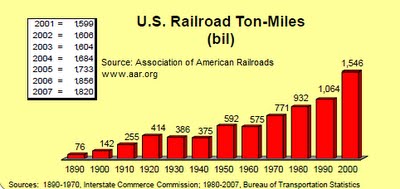

You see, financial markets are replete with financial panics in the last quarter of the year (especially October) for a very good reason. In order to commence the fall harvest, farmers need to get the financing necessary to buy the tools to harvest crops and then ship the goods to cities and towns across the nation. Unfortunately, when one farmer needs funding to harvest crops so does a massive number of other farmers. The excessive demand for financing to feed a nation becomes a matter of national security. For this reason, various governments have taken to subsidizing the needs of farmers when banks and financial markets couldn't, can't, or won't. One of the most popular arrangements was known as a farm loan system.

One of the earliest forms of farm loan programs was called Landschaften and was instituted by Frederick II of Prussia after 1750. In this program, the equivalent of corporate farmers banded together by merging their adjacent lands and then issuing a bond using the value of the land as collateral. Interest on the bonds would be paid based on the income generated on the sale of the commodity grown on the land. Financial panics would ensue if, for example, there was an unwilling market for the bonds being sold or if there was too much or too little of a crop being brought to market.

Later iterations of a government sponsored program intended to support farmers was Credit Foncier (English version of website is here). Established in 1852 by Napoleon III, Credit Foncier was specifically chartered to aid the financing of farmers and then needs. Foncier was known as a mortgage bond bank because it securitized the bonds based on the value of the farm land. As an organization that, although not part of the government, had the implicit backing of the government allowed for significant influence. Such influence allowed Credit Foncier to expand well beyond meeting the needs of farmers. After some time, Credit Foncier started to providing a majority of their loans to communes and homeowners in Paris.

In my research of Credit Foncier, I found the following quotes from the New York Times to be quite revealing:

"In 1848, when specie payments were suspended at the Bank of France, one of the pet inflationist projects was such a society as the Credit Foncier, whose obligations to the public should take the form of compulsory paper money."

"But although made a legal tender [money issued by Credit Foncier] in all payments, duties on imports and the public debt not excepted, being inconvertible into specie and issued without regard to quantity, they all become utterly worthless."

“The Credit Foncier of France.” New York Times. June 12, 1876.

In seems interesting to me that Credit Foncier was intended to help inflate the financial system through the guise of helping farmers, but later inflated into oblivion the very "legal tender" that they had control over.

Another type of farm lending institution was known as Credit Agricole. Credit Agricole was unique in that it was advanced money from the government of France to give loans to farmers. When Credit Agricole ran out of the money that was advanced, the government would require the Bank of France to issue new money to Credit Agricole without charging interest on the injection of funds. Credit Agricole would then reprice loans, that had already been issued, with higher interest rates. Inevitiably, the more loans that were made the greater the loss that was incurred. Despite the fact that Credit Agricole was a increasingly money losing operation, when considering the merits of the situation, the New York Times had this to say:

"However, the system of Credit Agricole should be discussed in America, not so much from the standpoint of its defects in France as from the standpoint of the advisability of the American Government furnishing a subsidy to the farmer. In view of the facts, it is realized by those who have studied the subject on the ground in Europe that the advantages to be brought to the American farmer will consist of the ability to get plenty of the greatest possible convenience and at fair and reasonable but not abnormally low rates."

"Some Land Banks". New York Times. October 6, 1912

Credit Agricole, Credit Foncier and the Landschaften system were the early models of financing mechanisms set up to keep farmers well capitalized when the financial markets were not very accommodating. These models would later set the stage for what was thought to be the saving grace for farmers in America.

Farmers and farming has had a hallowed tradition in the U.S. Our government will stop at nothing to help America's farmers. In the past, it was believed that all farmers were necessary and vital to the economy. Currently, corporate farms are showered with funds to "help" them compete with foreign agribusiness. This tends to be at the exclusion of small farms, implying that not all farmers are valued in the same way.

In 1912, legislators began contemplating farm financing systems as a means to smooth out the panics and crashes in financial markets. Among those that were actively considered were the Credit Foncier, Credit Agricole and the Landschaften systems. Each approach had their own merit in the eyes of the legislators, and in fact all approaches would be applied to the American financial system initially for farmers and then later for homeowners.

It is no coincidence that the Federal Reserve Bank came along in 1913. It was built with the stated goal of providing safety and stability in the banking system with the use of monetary policy. Additionally, the Federal Farm Loan System (FFLS) was set up in 1916 to provide loans to the farming industry. Again, I cannot emphasis enough the point that the whole purpose of these institutions were set up to treat the symptom of recurrent panics and crashes associated with farming.

Despite the existence of the Federal Reserve Bank and the Federal Farm Loan system we still had a monumental crash of financial markets from 1929 to 1932. The answer to this reality was the creation of Reconstruction Finance Corporation (RFC) to clean up the foreclosure mess that followed the crash of 1929. With creation of the RFC, banks that should have failed due to imprudent lending practices were given a pass, chief among them were National City Bank also known as Citigoup (C).

Later, as part of the New Deal laws that were passed in 1938 (not so new by then), the Federal National Mortgage Association (Fannie Mae) (FNM) was created based on the Federal Farm Loan System concept which in turn was based on the Credit Foncier, Credit Agricole and Landschaften models. Later iterations of the same flawed farm subsidies applied to homes were Freddie Mac, Ginnie Mae, FHA and a whole host of programs.

The problem with constructing a housing system based on failed farming finance programs is that it never worked without the subsidies. In the case of housing, prices would fall tremendously if it weren't for the fact that interest deductions are given and that Fannie, Freddie (FRE), GNMA, VA, and FHA will buy up or guarantee mortgages so that banks can keep lending. Additionally, first time homebuyer incentives are liberally offered and have always been offered as indicated by the state housing finance agencies website.

Basically, the government schemes that currently exist to incentivize housing, will only ensure that we continue to have financial panics and crashes with variable winners and guaranteed losers. Having Glass-Steagall in place only marginally affects the inevitable outcome. In fact, the fallout from subsidizing the housing market was going to happen anyway. It just happen to coincided with the fact that Glass-Steagall wasn't in place.

Parenthetically, although Glass-Steagall officially died in 1999 when signed into law by Clinton, it was dead on arrival when Swiss Bank announced that was going to buy investment bank Dillion, Reed & Company on May 15, 1997. The Clinton signing the Graham-Leach-Bliley Act was merely a formality as noted in my posting on March 30, 2009. -Touc

Related Articles:

Sources:

- Conant, Charles A. “Putting the Farmer in Command of Ready Money.” New York Times. September 8, 1912.

- “The Credit Foncier of England—Another Exposure.” New York Times. August 6, 1868.

- “The Credit Foncier of France.” New York Times. June 12, 1876.

- Some Land Banks. New York Times. October 6, 1912.