Members

-

Topics

Archives

-

-

Recent Posts

-

-

-

Investor Education

Market Return After Exceptional Years

Dollar Cost Averaging Tool

Dow Theory: The Formation of a Line

Dividend Capture Strategy Analysis

Golden Cross – How Golden Is It?

Debunked – Death Cross

Work Smart, Not Hard

Charles H. Dow, Father of Value Investing

It's All About the Dividends

Dow Theory: Buying in Scales

How to Avoid Losses

When Dividends are Canceled

Cyclical and Secular Markets

Inflation Proof Myth

What is Fair Value?

Issues with P-E Ratios

Beware of Gold Dividends

Gold Standard Myth

Lagging Gold Stocks?

No Sophisticated Investors

Dollar down, Gold up?

Problems with Market Share

Aim for Annualized Returns

Anatomy of Bear Market Trade

Don’t Use Stop Orders

How to Value Earnings

Low Yields, Big Gains

Set Limits, Gain More

Ex-Dividend Dates -

-

Historical Data

1290-1950: Price Index

1670-2012: Inflation Rate

1790-1947: Wholesale Price Cycle

1795-1973: Real Estate Cycle

1800-1965: U.S. Yields

1834-1928: U.S. Stock Index

1835-2019: Booms and Busts

1846-1895: Gold/Silver Value

1853-2019: Recession/Depression Index

1860-1907: Most Active Stock Average

1870-2033: Real Estate Cycles

1871-2020: Market Dividend Yield

1875-1940: St. Louis Rents

1876-1934: Credit-New Dwellings

1896-1925: Inflation-Stocks

1897-2019: Sentiment Index

1900-1903: Dow Theory

1900-1923: Cigars and Cigarettes

1900-2019: Silver/Dow Ratio

1901-2019: YoY DJIA

1903-1907: Dow Theory

1906-1932: Barron's Averages

1907-1910: Dow Theory

1910-1913: Dow Theory

1910-1936: U.S. Real Estate

1910-2016: Union Pacific Corp.

1914-2012: Fed/GDP Ratio

1919-1934: Barron's Industrial Production

1920-1940: Homestake Mining

1921-1939: US Realty

1922-1930: Discount Rate

1924-2001: Gold/Silver Stocks

1927-1937: Borden Co.

1927-1937: National Dairy Products

1927-1937: Union Carbide

1928-1943: Discount Rate

1929-1937: Monsanto Co.

1937-1969: Intelligent Investor

1939-1965: Utility Stocks v. Interest Rates

1941-1967: Texas Pacific Land

1947-1970: Inventory-Sales Ratio

1948-2019: Profits v. DJIA

1949-1970: Dow 600? SRL

1958-1976: Gold Expert

1963-1977: Farmland Values

1971-2018: Nasdaq v. Gold

1971-1974: REIT Crash

1972-1979: REIT Index Crash

1986-2018: Hang Seng Index Cycles

1986-2019: Crude Oil Cycles

1999-2017: Cell Phone Market Share

2008: Transaction History

2010-2021: Bitcoin Cycles -

Interesting Read

Inside a Moneymaking Machine Like No Other

The Fuzzy, Insane Math That's Creating So Many Billion-Dollar Tech Companies

Berkshire Hathaway Shareholder Letters

Forex Investors May Face $1 Billion Loss as Trade Site Vanishes

Why the oil price is falling

How a $600 Million Hedge Fund Disappeared

Hedge Fund Manager Who Remembers 1998 Rout Says Prepare for Pain

Swiss National Bank Starts Negative

Tice: Crash is Coming...Although

More on Edson Gould (PDF)

Schiller's CAPE ratio is wrong

Double-Digit Inflation in the 1970s (PDF)

401k Crisis

Quick Link Archive

Category Archives: Wesco Financial

Munger, Buffett, and Dow Theory

Posted in BRK-A, Charlie Munger, Dow Theory, Warren Buffett, Wesco Financial, wsc

Tagged members

Should Berkshire Hathaway Be Trading at 1995 Prices?

No, this isn’t an article about the prospect of Berkshire Hathaway falling from the current price of $121,950 to $32,100. Instead, this is what Edson Gould’s Altimeter suggests that Berkshire Hathaway’s (BRK-A) stock price is currently trading at.

Edson Gould’s Altimeter compares the current stock price relative to the dividend that is paid by a company. As we all know, Berkshire Hathaway does not pay a dividend. So, how did we arrive at a dividend for Berkshire Hathaway? We borrowed the dividend policy of Charlie Munger’s Wesco Financial (WSC). We thought that there would be no better corporate dividend policy to replicate other than that of Warren Buffett’s right hand man.

Exactly what portion of Munger’s dividend policy did we replicate? First, we took WSC’s average dividend payout ratio of 13% from 1999-2010 and applied it to Berkshire Hathaway’s 1977 reported operating earnings of $22.54 per share. This resulted in a dividend of $2.93.

Next, we compared the compound annual growth rate [CAGR] of the dividend for Wesco Financial which was slightly more than the book value from 1999-2010, at 3.37% and 3.01%, respectively. Additionally, we took into consideration the fact that by 2010 Wesco Financial had a 38-year history of consecutive dividend increases. Because Berkshire Hathaway has a 19.8% CAGR of their book value (2011 annual report), we opted to cut that figure in half and assign a dividend growth rate of 9.9%. Our decision to cut the CAGR of the book value in half was in deference to Buffett’s desire to better deploy the capital in other investment opportunities and the possible diminished impact of the succession team upon Buffett’s “retirement.”

After borrowing the dividend policy from Buffett’s primary business partner and creating a hypothetical dividend and a compounded annual dividend growth rate, assuming regular dividend increases for the last 35 years, we believe that we have constructed a reasonable approximation of an Altimeter which is represented in the chart below.

Based on the Altimeter, our best guess is that the period from 1996 to 2008 provided consistent indications of when to add to your positions of Berkshire Hathaway (at or below green line). The period from 2008 to 2009 provided exceptional opportunities for new investors to buy Berkshire Hathaway as the markets, economy and insurance industry were in crisis mode at the exact same time.

Once the recovery in stocks started it was off to the races for most investors. Even Berkshire Hathaway was able to participate in the run-up from the 2009 low. However, on a relative basis, Berkshire’s share price was not increasing to a level that was reflective of its true value, this is in spite of getting within 10% of the 2007 high in late February 2010. Based on the Altimeter, Berkshire is currently undervalued by at least 66% and below the 2007 peak by almost 95%.

Those considering the acquisition of Berkshire Hathaway have the following upside targets to consider in the coming 2-3 years, all things being equal:

-

$175,280

-

$197,190

-

$219,100

The following are the possible downside targets:

-

$120,767

-

$105,606

After constructing a fairly conservative dividend policy, the Altimeter clearly outlines the reasons why Warren Buffett would suggest that Berkshire Hathaway will “very aggressively” buy back shares even though the stock is well within striking distance of the all time high.

Who is Edson Gould?

"Edson Gould spent over 60 years working in and studying financial markets. Gould studied the arts at Princeton, engineering at Lehigh (from where he graduated in 1922), and finance at New York University. In 1922, after working for a short time at Western Electric, he joined Moody's Investor Service as an analyst and later was editor of Moody's Stock Survey, Bond Survey, and Advisory Reports. In 1948, he began at Arthur Wiesenberger & Company, where he developed and edited the well-known Wiesenberger Investment Report and became a senior partner. He also was Research Director at E. B. Smith (which later became Smith Barney), and worked for Nuveen."

(source: Market Technicians Association. Gould, Edson Beers, Knowledge Base. Accessed April 26, 2012. link MTA reference.)

"Market technician Edson Gould always laughed at the idea of having a significant influence on the stock market, but his predictions were the most precise around. He pinpointed major bull markets and prophesied bottom-out markets as if he had his own peephole into the future. But in place of a crystal ball and wacky off-the-cuff schemes, his were smart, intensely researched and time-tested theories that made him a legend in the investment community."

(source: Fisher, Kenneth L.. 100 Minds That Made the Market. Business Classics, Woodside, CA. 1993. page 320.)

Posted in Altimeter, BRK-A, Charlie Munger, Edson Gould, Warren Buffett, Wesco Financial, wsc

Investment Policy Q&A

“What we should have done is wait one full year after the cut, or lack of an increase, to determine the viability of the company. Keep in mind that a cut in the dividend isn’t a death sentence. In fact, cutting the dividend might be the best management move to make. However, current shareholders of the company might abandon the stock if they have a policy to hold stocks with a steady dividend (as we advise investors to do.)”

Posted in Northern Trust, NTRS, Transatlantic Holdings, TRH, Wesco Financial, wsc

Tagged members

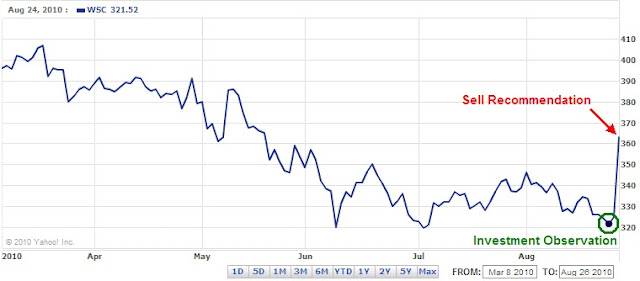

Sell Wesco Financial (WSC) at the Market

Investment Observation: Wesco Financial Corp. (WSC) at $321.24

“Business and human quality in place at Wesco continues to be not nearly as good, all factors considered, as that in place at Berkshire Hathaway. Wesco is not an equally-good but smaller version of Berkshire Hathaway, better because its small size makes growth easier. Instead, each dollar of book value at Wesco continues plainly to provide much less intrinsic value than a similar dollar of book value at Berkshire Hathaway. Moreover, the 7 quality disparity in book value’s intrinsic merits has, in recent years, continued to widen in favor of Berkshire Hathaway. All that said, we make no attempt to appraise relative attractiveness for investment of Wesco versus Berkshire Hathaway stock at present stock-market quotations.”Munger, Charles T. Wesco Financial Corporation, Letter to Shareholders. February 25, 2009. Page 7. http://www.wescofinancial.com/cm2008.pdf (PDF). Accessed August 23, 2010.

Posted in BRK-A, investment observation, Wesco Financial, wsc